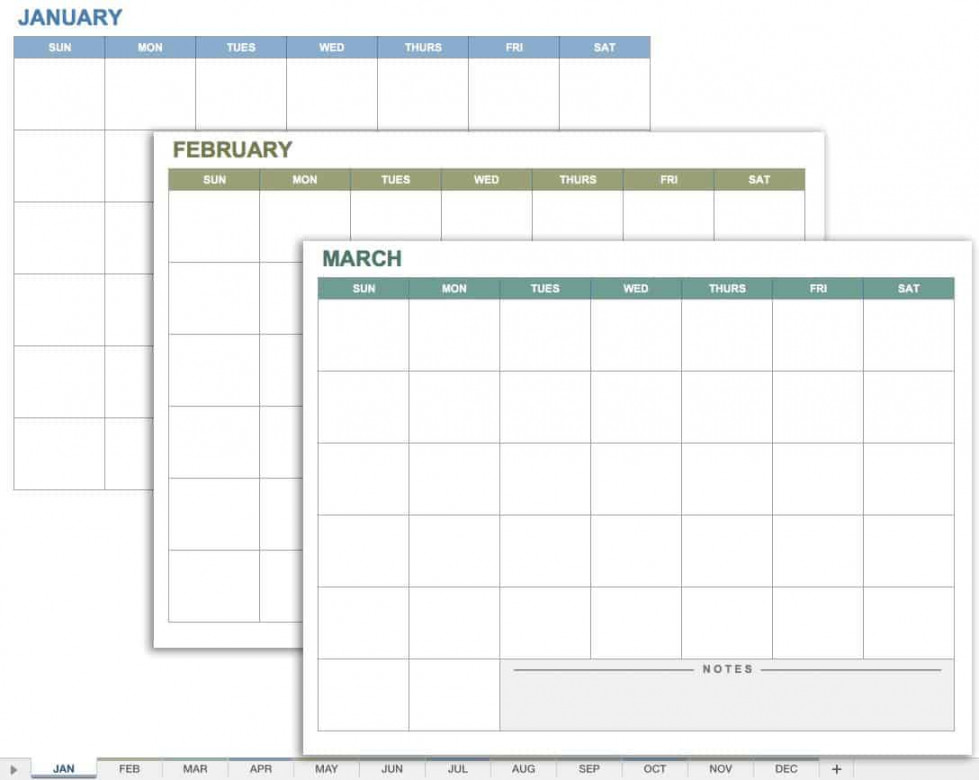

12 Month Blank Calendar

Fiscal Year: What It Is and Advantages Over Calendar Year What Is a Fiscal Year (FY)?

A fiscal year is a one-year period that companies and governments use for financial reporting and budgeting. It is most commonly used for accounting purposes to prepare financial statements. Although a fiscal year can start on Jan. 1 and end on Dec. 31, not all fiscal years correspond with the calendar year. For example, universities often begin and end their fiscal years according to the school year.

Key Takeaways A fiscal year is a 12-month period chosen by a company to report its financial information.Financial reports, external audits, and federal tax filings are based on a company’s fiscal year.Companies may choose to report their financial information on a non-calendar fiscal year based on the specific nature and revenue cycle of their business.

Investopedia / Julie Bang

Understanding Fiscal Years

A fiscal year is a period of time lasting one year but not necessarily starting at the beginning of the calendar year. Countries, companies, and organizations can start and end their fiscal years differently, depending on their accounting and external audit practices.

Knowing a company’s fiscal year is important to corporations and their investors because it allows them to accurately measure revenue and earnings year-over-year. The Internal Revenue Service (IRS) allows companies to be either calendar year or fiscal year taxpayers.

The U.S. federal government’s fiscal year runs from Oct. 1 to Sept. 30. Fiscal years that vary from a calendar year are typically chosen due to the specific nature of the business. For example, nonprofit organizations often align their fiscal years with the timing of grant awards.

Fiscal years are referenced by their end date or end year. For example, to reference a nonprofit organization’s fiscal year, you may say, “FY 2024” or “fiscal year ending June 30, 2024.” Similarly, if you referred to government spending that occurred on Nov. 15, 2022, you would label that as an expenditure for FY 2023.

According to the IRS, a fiscal year consists of 12 consecutive months ending on the last day of any month except December. Alternatively, instead of observing a 12-month fiscal year, U.S. taxpayers may observe a 52- to 53-week fiscal year. In this case, the fiscal year would end on the same day of the week each year, whichever is the closest to a certain date–such as the nearest Saturday to Dec. 31. This system automatically results in some 52-week fiscal years and some 53-week fiscal years.

Fiscal years are commonly referred to when discussing budgets and are a convenient time period to reference and review a company’s or government’s financial performance.

IRS Requirements for Fiscal Years

The default IRS system is based on the calendar year, so fiscal-year taxpayers have to make some adjustments to the deadlines for filing certain forms and making payments. While most taxpayers must file by April 15 following the year for which they are filing, fiscal-year taxpayers must file by the 15th day of the fourth month following the end of their fiscal year. For example, a business observing a fiscal year from June 1 to May 31 must submit its tax return by Sept. 15.

In the United States, eligible businesses can adopt a fiscal year for tax reporting purposes simply by submitting their first income tax return observing that fiscal tax year. At any time, these businesses may elect to change to a calendar year. However, companies that want to change from a calendar year to a fiscal year must get special permission from the IRS or meet one of the criteria outlined on Form 1128, Application to Adopt, Change, or Retain a Tax Year.

Examples of Fiscal Years for Corporations

Investors might ask, “What fiscal year is it?” and it can vary from company to company. Below are 10-K reports from popular companies with fiscal years that don’t follow the calendar. A 10-K is an annual report of financial performance that is filed with the Securities and Exchange Commission (SEC).

Apple Inc. (AAPL) ends its fiscal year on the last Saturday of September.

Apple Fiscal Year Example.

Microsoft Corporation (MSFT) ends its fiscal year on the last day of June every year.

Microsoft Fiscal Year Example.

Macy’s Inc. (M) ends its fiscal year on the fifth Saturday of the new calendar year. Many retailers generate a large chunk of their earnings around the holidays, which could explain why Macy’s chooses this end date.

Macy’s Fiscal Year Example. Is a Fiscal Year the Same As a Calendar Year?

Not necessarily. A fiscal year spans 12 months and corresponds with a company’s financial reporting periods. Sometimes, a fiscal year may differ from a calendar year. Fiscal years are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and financial statements.

What Is an Example of a Fiscal Year?

Consider the fiscal year for the U.S. government, which begins on Oct. 1 and ends on Sept. 30. Companies that rely on contracts from the government also may structure their fiscal years to end in late September. Conversely, many tech companies experience strong sales volumes during the early months of the year, which can explain why in many cases, their fiscal years will end in late June.

Why Use a Fiscal Year Instead of a Calendar Year?

For companies that operate on a seasonal basis, using a fiscal year may be beneficial. This is because it may provide a more accurate reflection of the company’s operations, allowing for revenues and expenses to better align. For instance, it is common for retail companies to end their fiscal year on Jan. 31, after the holiday season has ended. Walmart and Target are two primary examples of companies that use this fiscal year.

The Bottom Line

A fiscal year is one-year period used by some businesses, governments, and nonprofits that ends on a date other than Dec. 31. Reasons vary for why some entities might want a fiscal year different than the calendar year. Retail businesses, for example, might want to avoid closing out their fiscal year in the middle of the busy holiday season, while schools might want their fiscal years to more closely match their school years. In circumstances, a fiscal year might end on a specified day—such as the last Saturday of a particular month—as opposed to the last day of a month. In these cases, it is possible for a fiscal year to sometimes be 53 weeks long. Entities that use a fiscal year file their taxes on the 15th day of the fourth month following the conclusion of their fiscal year.