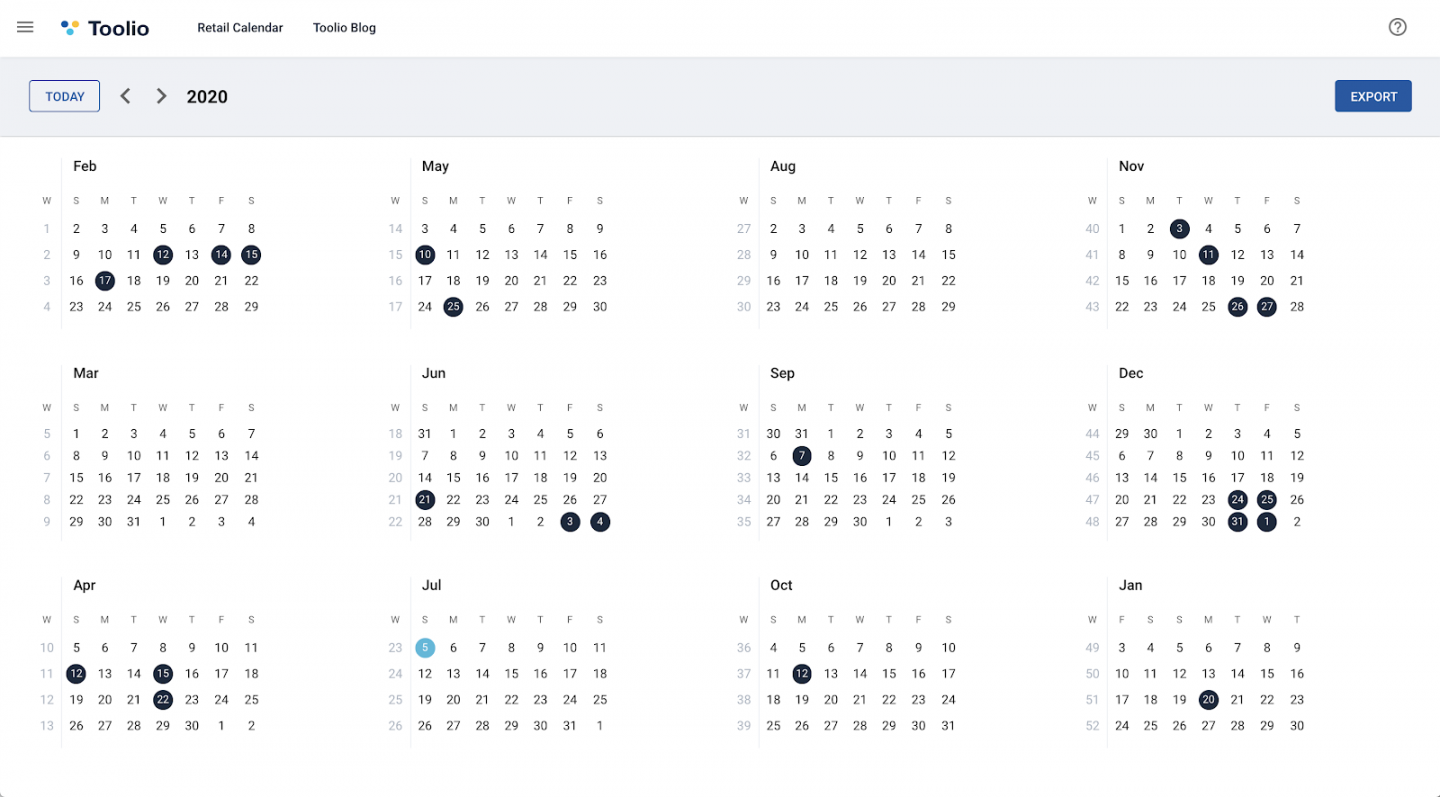

454 Retail Calendar 2019

Increased cost-of-living is erasing vehicle sales recovery

In the world of international business, forex transactions are the lifeblood that keep the global economy alive with an estimated daily volume of $7.6tn as of April this year. The South African portion of that amounts to over $19.1bn.

Local businesses rely on these transactions to navigate the complex world of international trade. However, a recent survey conducted by South African fintech disruptor Future Forex reveals a startling truth – many of these entities partaking in international money transfers are unknowingly taking a significant knock on their bottom-line due to non-transparent forex fees.

The Future Forex survey, compiled from more than 250 company responses across various industries, exposed a concerning lack of transparency and fairness in pricing when it comes to forex transactions.

It found that 92.8% of respondents were either in the dark about how their banks or forex providers were charging them for each transaction, or were being significantly overcharged on their transactions.

The lack of transparency by banks and other forex providers was particularly alarming, with more than 75% of respondents being unaware of what they’re being charged each time they perform a cross-border transaction.

This murkiness extends to the exchange-rate margin, with 34% of participants not knowing about this critical aspect of forex dealings, which is the lion’s share of the fees charged by a provider.

“Exchange-rate margin, often referred to as the spread, is the gap between the rate at which a forex service provider buys a currency and the rate at which it sells it,” says Future Forex chief executive officer Harry Scherzer. “This seemingly innocuous detail can actually have profound financial implications for businesses that in turn are likely to be facing higher costs of which they may not have been fully aware.”

“As an example,” Scherzer says, “if you plan to send R1m to the USA and convert that amount to dollars, using a spot rate (current exchange rate) of R19 to $1, a bank might charge you R19.38 for each dollar bought. Therefore, the spread in this case would be R0.38 per dollar, or 2% of the transaction value. You will incur a cost to the sum of approximately R20,000 for this transaction – excluding processing and admin fees.”

Exporters and importers, the backbone of South Africa’s international trade, bear the brunt of these hidden costs. A small discrepancy or hidden cost in each transaction, when multiplied by sheer volume, can result in significant, and often unjustified, fees.

The survey also highlights a growing dissatisfaction among businesses with their existing forex providers. Key grievances include pricing, transparency, levels of service, and usability. Evidently, there is a thirst for change in the market, and businesses are eager to embrace innovative forex providers that prioritise their needs.

“Future Forex is poised to fill this gap, leading the charge for transparent, client-centric forex services,” says Scherzer. “We are committed to leveraging automation, technology, and exceptional support to offer South African businesses the best possible forex rates. The aim is to do so while fostering transparency and ease of international money movement – a beacon of hope for businesses tired of navigating murky waters.”

The results of the Future Forex survey shed light on a pervasive issue that affects the very core of South African businesses engaged in international trade. It’s a wake-up call for companies to become more discerning when it comes to their forex dealings, demanding transparency and fair pricing, notes Scherzer.

“South African businesses can no longer afford to be in the dark about the true costs of forex transactions,” Scherzer concludes. “Whether sending or receiving funds from abroad, pure transparency and fair charges should be the new status quo. Future Forex is leading the pack with its innovative forex services that places a renewed focus on being client-centric through high levels of service, low pricing and full transparency.”