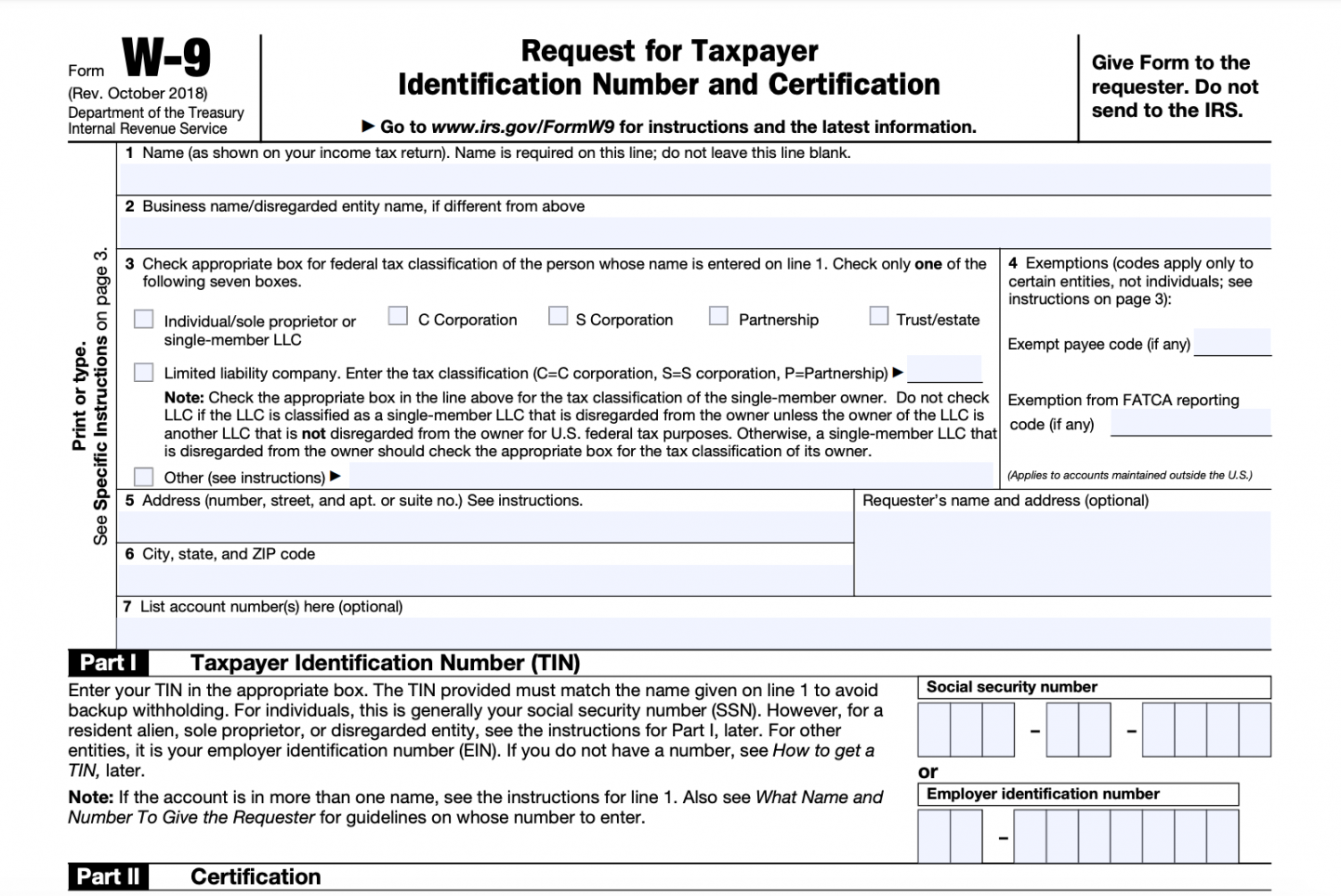

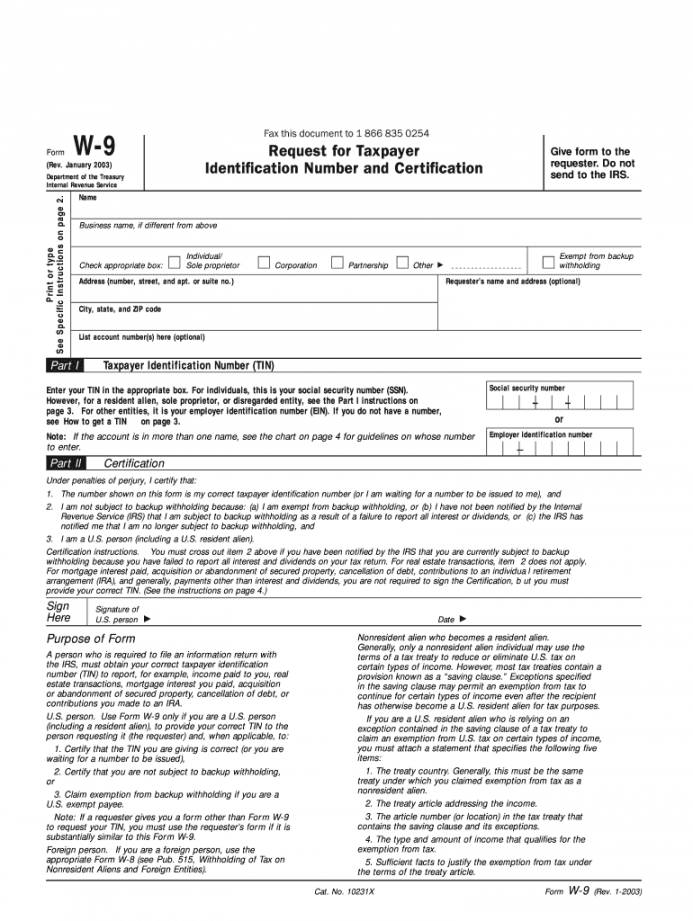

Online Fillable W 9 Form

9 Best Payroll Services For Small Business (2023)

The best payroll services offer core capabilities, ample software integrations and other key features that may or may not match your company’s current size and payroll needs.

Essential Features

These features make payroll tools a step up from running payroll manually with a spreadsheet.

Variety of payment methods: Payroll software should provide a range of ways to pay your employees, whether through paper checks, direct deposit or via prepaid debit card. Payroll tax filing and payment: Payroll software and services should automatically prepare, file and pay taxes based on where your employees live. This feature is all the more important for companies that hire employees in multiple U.S. states and in other countries. Unlimited payroll runs: If you have employees and contractors that get paid on different schedules, you’ll want a payroll solution that allows unlimited payroll runs for flexibility. Self-service: An advantage of payroll software and services is that they provide an online portal for HR staff, payroll administrators and employees to view and sometimes make changes to payroll-related data. Basic reports: Payroll software runs a variety of reports on company-wide or individual levels for metrics such as total compensation, deductions or taxes paid in a given quarter or tax year. Automatic compliance updates: Payroll software and services stay up to date with the latest payroll and tax regulations, so you don’t have to. Mobile access: HR staff, payroll administrators and employees should be able to access payroll tools on the go. Employees especially should have access to their pay history and pay stubs through the mobile app. Software Integrations

The payroll software you use should integrate with QuickBooks or whichever accounting software you use to keep an accurate record of payroll history in the event of an audit. Payroll software should also integrate with benefits administration software for accurate deductions and with time tracking software.

Other Important Considerations

To further evaluate your payroll needs, answer these ten questions about your business and its payroll system.

What Is the Size of My Business?

Christine Stolpe, CPP, president and CEO of Wages Creek Consulting, notes this as a key factor that small businesses must consider when choosing a payroll platform so that they don’t outgrow the system too quickly. When considering outsourcing payroll, you don’t need to think about the size of your business in terms of its turnover or number of customers. You need to take into account just two things: how many employees do you have currently and how many more are you likely to add in the near one to two years?

What Types of Employees Do I Have?

You can have both regular employees and independent contractors on your payroll. Additionally, you might pay your employees a fixed monthly salary, hourly wages or a base wage plus commissions or tips.

Payment structure and taxation requirements for each of them differ and you need to know these numbers to evaluate your payroll needs. If you have only independent contractors, you might be able to meet your needs using an online payroll system, which is usually cheaper.

How Do I Pay My Employees?

Do you need to make direct deposits or handle check payments? Do you need to make international payments via platforms like Stripe and PayPal? Think about how you will get money from your bank account to your employees and make it as painless as possible.

How Often Do I Pay My Employees?

Do you pay all your employees at one time, or do you have different schedules for different categories? For instance, you might be paying them weekly or biweekly. In the case of independent contractors, you might be paying them anytime they invoice you.

The payroll system should be able to handle these payouts in addition to off-cycle payments like expense reimbursements, bonuses, commissions, etc.

Are All Employees Based Out of the Same Location?

If you have employees spread across different states or around the globe, you will need to meet more regulations. With hybrid and remote work becoming commonplace as a result of the pandemic, you must consider if you might have people working from different locations in the future.

Who Is Responsible for Processing Payroll?

If you have a dedicated person or team for processing payroll, you will likely be able to manage with a DIY payroll solution, which could be cheaper. Otherwise, you should consider investing in an outsourced payroll service even if it is more expensive. This will help ensure that payments are processed accurately and on time.

What Are My Local/State Payroll Laws?

The payroll laws depend upon the locality, state and countries where your employees reside. You must know what city, state, federal or international payroll laws you need to comply with. If you’re not sure, contact a payroll professional in your area to get some guidance.

How Do I Want Payroll Taxes Handled?

Payroll taxes can get complex and tedious as your business grows. You need to decide if you want the new payroll solution to handle taxes or not. If the answer is yes, look closely at the cost for year-end calculations because that usually comes with an extra price tag. If you don’t, make sure to hire a reliable tax professional to handle this process for you.

What Deductions Do I Need To Plan For?

Before disbursing payments, you need to withhold deductions for taxes, such as income tax and Social Security tax; wage garnishments, such as unpaid loans, alimony, and child support; and benefits, such as health insurance.

What Is My Budget?

Cost is an important factor when choosing a payroll company. You must have an estimate in mind that you are willing to pay monthly or annually to meet your payroll needs. This will help ensure that you don’t overextend yourself when you are tempted to pay extra for à la carte features.

Get an expert to help you manage employee payment, taxes, government compliances and other payroll-related activities. Get a quote from ADP.