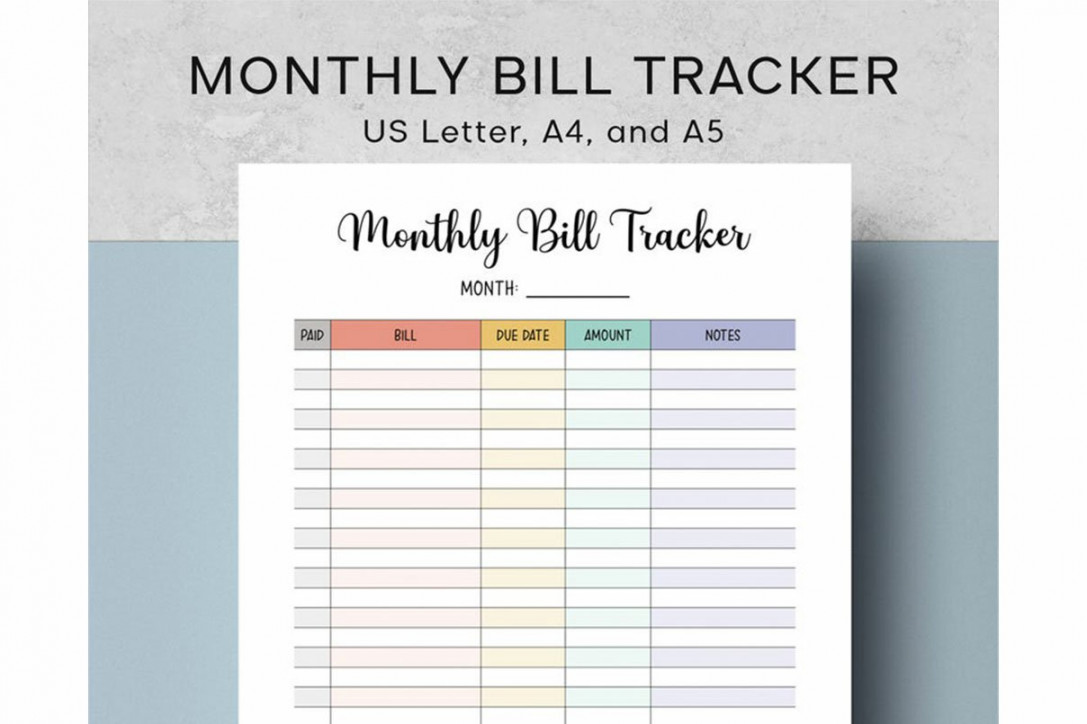

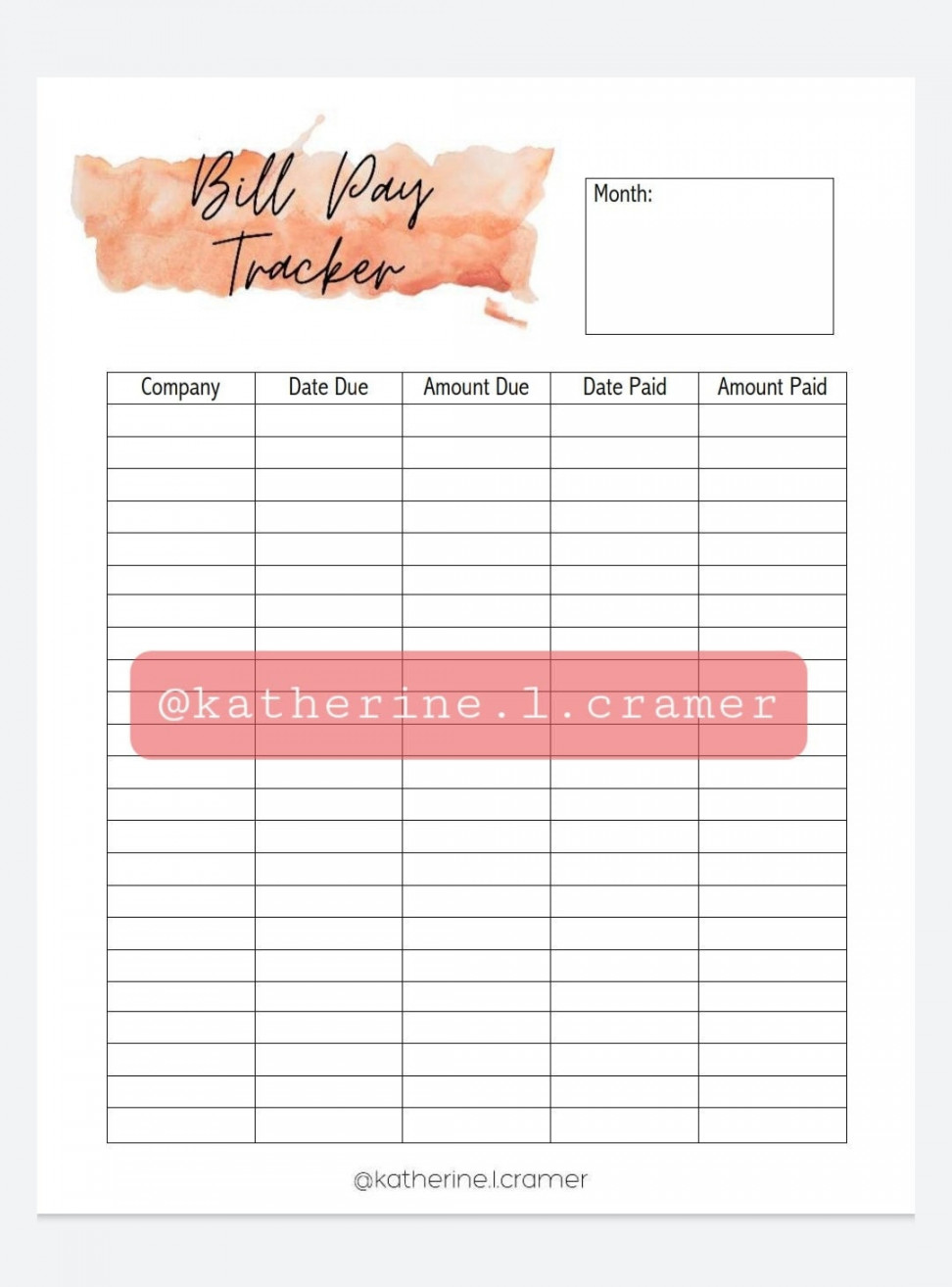

Free Printable Monthly Bill Payment Template

What is bill pay? How it works, plus all the pros and cons

Before the internet became ubiquitous, consumers typically sat down at the table and wrote checks each month to pay credit card, utility, and other bills. It’s become much simpler to pay monthly bills these days because many banking institutions now offer bill pay services. These services are both widely available and convenient.

If you’re thinking about using a bill pay service, here’s how it typically works, how to set it up, and where it’s offered.

How does bill pay work?

Online bill pay services let you schedule one-time or recurring payments to utility, cellphone, and healthcare providers. Your banking institution will then disburse the payment amount at the interval and date you’ve specified.

For instance, you might set up recurring payments for your $81 electric bill each month on the 15th. Your bank would then disburse your regular $81 payment amount from your bank account to the electric company monthly on the 15th.

Bill pay pros & consPros:Simpler than paying by check.Automatic payments mean you won’t forget to pay regular bills.Can easily track pending and past payments.Online payments are generally processed more quickly than check payments.Cons:Can make it trickier to balance your checkbook.Could overdraft your account if funds aren’t available.May incur low balance fees if your balance drops below a certain amount.Easy to lose track of payment amounts and dates if you don’t log in frequently.How to set up online bill pay

To set up online bill pay, you’ll need to log into your online checking account and add the information of the service provider or credit card issuer you’d like to pay, including the company name, address, and phone number. You’ll also need to include your account number with that provider, so be sure to have your credit card or a monthly statement readily available.

Once you’ve entered the company information and your account number, you can select how you’d like to pay your bills. You can choose to make a single payment, or schedule recurring payments if you have regular monthly bills, or an ongoing service contract in place with a provider. Once you’ve determined the ideal payment frequency, you can specify a bill pay date.

While bill pay services may work slightly differently depending on your bank, these services often let you review pending and past payments, track future payments, adjust monthly payment dates, and more. You can also update account and payee information through your banking dashboard if anything changes.

Who offers bill pay?

Many traditional banks, online banks, and credit unions offer online bill pay with checking accounts. If you have an existing account, talk with your bank or log into your online dashboard to determine if online bill pay is available to you. If you’re looking for a new account with online bill pay, research account features online or speak with a customer service representative at prospective banks to ask about this service.

Frequently asked questions (FAQs) Is online bill pay safe?

While online bill pay is generally a safe service, it depends on the security measures that your bank or credit union uses. Each banking institution has its own security measures in place, so ensure you learn more about how your bank keeps your information secure if you’re shopping around for a new account.

Is bill pay the same as check?

Online bill pay is similar to, but not the same as check payments. As with check payments, the payment amount you send through online bill pay will be deducted from your checking account. But with bill pay, you won’t need to send a paper check to your credit card company or service provider to make payments–you can simply schedule your payments online through your banking dashboard.

Can I deposit a bill pay check?

You generally can’t pay an individual through an online bill pay service. Instead, you’ll likely need to use a person-to-person payment service like Venmo, Zelle, or PayPal to pay family or friends. If you do receive a paper bill pay check, you can deposit it into an existing bank account, add it to a prepaid debit card, or cash it through a check cashing service.

Is online bill pay better than checks?

Whether online bill pay is better than checks depends on your individual situation. For many people, the convenience and predictability of online bill pay makes it a better solution than paper checks. But some may prefer paper checks because automatic payments may be more difficult to keep track of, especially if you don’t log into your online account frequently.

This story was written by NJ Personal Finance, a partner of NJ.com. The information presented here is created independently from the NJ.com editorial staff, and purchases made through links in this article may result in NJ.com earning a commission.