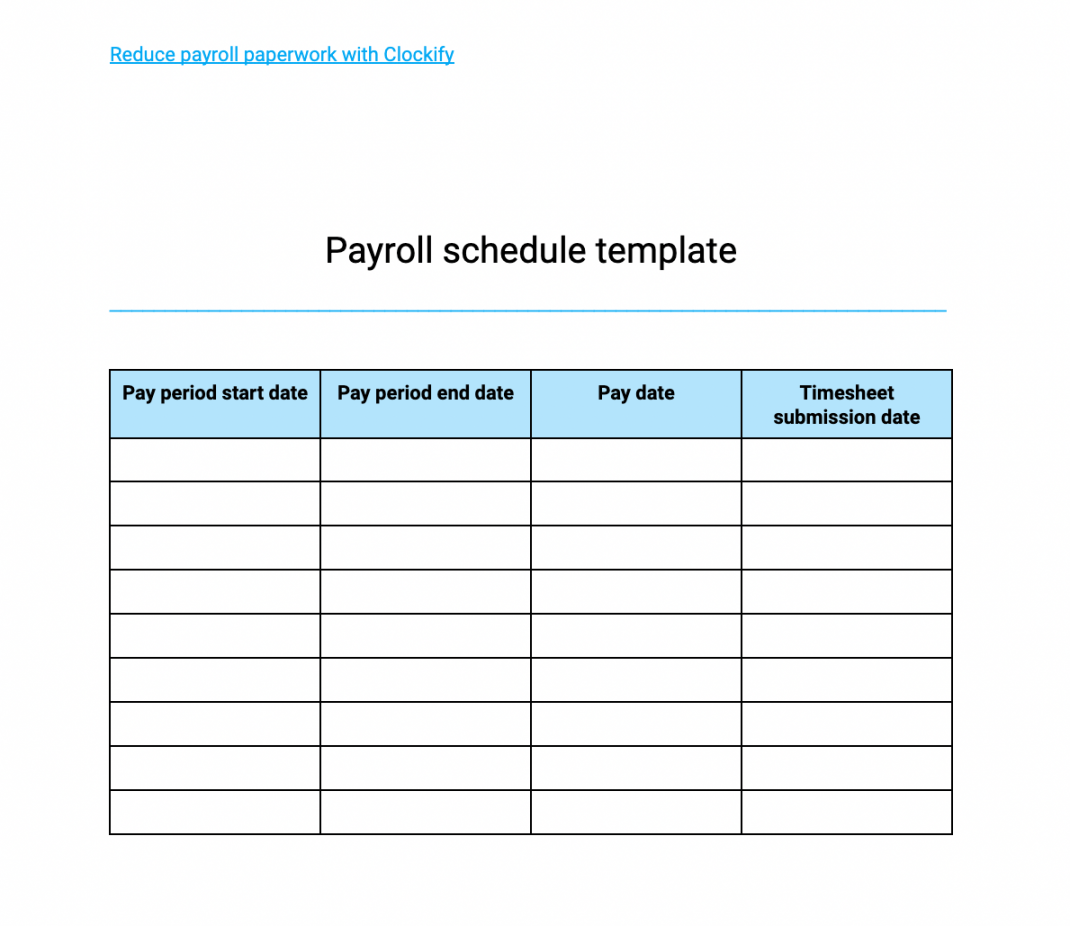

Pay Period Schedule Template

How Many Pay Periods Are in a Year?

While pay rates and benefits are major factors in ensuring employees are satisfied with their compensation, it’s also important to consider how often you pay your workers. Some pay schedules benefit employees more than employers, and vice versa, so make sure you understand the pros and cons of each pay schedule before you decide how often you pay your employees.

What are pay periods?

A pay period (or pay cycle) is the recurring amount of time during which an employee’s wages are calculated for payment; this period could span a week, two weeks or some other length of time.

As a small business owner and employer, you have some leeway in how long your company’s pay periods will be. The only related federal guideline exists in the Fair Labor Standards Act, which requires wages to be paid on an employee’s “regular payday for the pay period covered.”

While this may sound vague, states are often more specific about their payday requirements. For example, Nebraska allows employers to choose when employees get paid, while Maine requires employers to pay employees at regular intervals that are 16 days or less. Vermont requires written notice from employers before they can implement a biweekly or semimonthly pay cycle. When in doubt, check your state’s guidelines.

Is there a difference between a pay period and a payday?

Two terms related to employee compensation may cause a little confusion: pay period and payday.

As stated previously, a pay period is the recurring amount of time during which an employee’s wages are calculated for payment. A payday, by contrast, is the exact calendar date on which an employee receives their paycheck.

“If ABC company pays employees on the 1st and the 15th of every month, each is a pay date,” said Ruhal Dooley, an HR knowledge advisor at the Society for Human Resource Management. “The corresponding pay periods could cover the 1st through the 15th, and the 16th through the last day of the month.”

When considering your payroll frequency, you should understand how payroll works. Paying employees accurately and on time is critical to keeping them happy, so understanding the payroll process should be a top priority for business owners.

How many pay periods are in a year?

The number of pay periods in a year depends on the pay schedule you use, and there are several options. Keep in mind that the best schedule for employees might not be the most beneficial for your company. You’ll have to weigh the pros and cons of each pay schedule to make the right decision.

“Some small employers pay monthly because it is administratively easier to pay once a month when all other bills are being paid, [but] employees don’t usually prefer that,” Dooley said. “The checks are bigger, but that’s a long time to wait for another paycheck. Small employers may not pay more frequently because payroll takes up too much time and because cash flow may not permit such frequency.”

Types of payroll schedules

Here are the four most common employee payroll schedules, according to the U.S. Bureau of Labor Statistics (BLS):

Weekly. A weekly pay schedule is the second-most-common pay schedule, with 34% of employers using it. With this pay schedule, you’ll pay your employees the most frequently – generally, 52 times a year. Keep in mind, however, that leap year could add an extra pay period because it could lead to a 53rd week.

Weekly payroll schedules are the most time-consuming and costly payroll option. If you handle payroll on your own, it could chew up a lot of your time. And if you use an online payroll service, you may have to pay extra if your provider charges you each time you run payroll. However, some payroll services charge a flat rate for unlimited payroll runs. If you are using a weekly pay period schedule, we recommend finding a payroll provider that offers this option. Here are our picks for the best online payroll services.

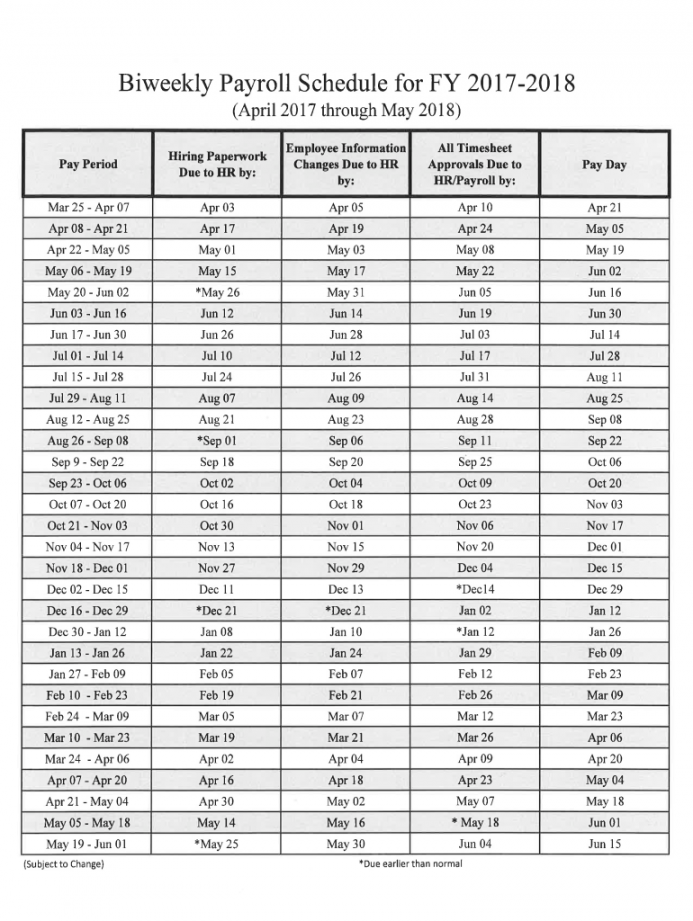

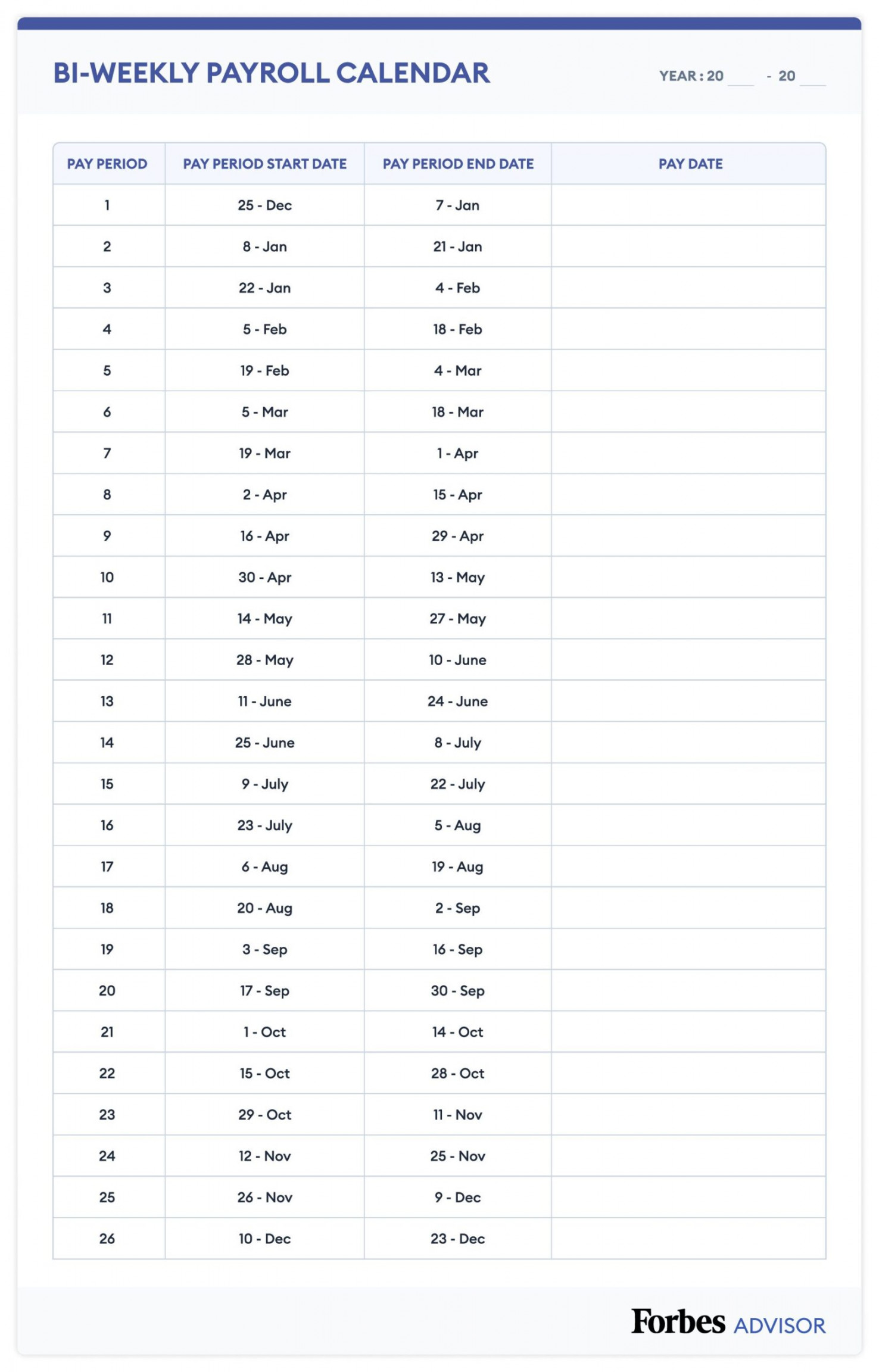

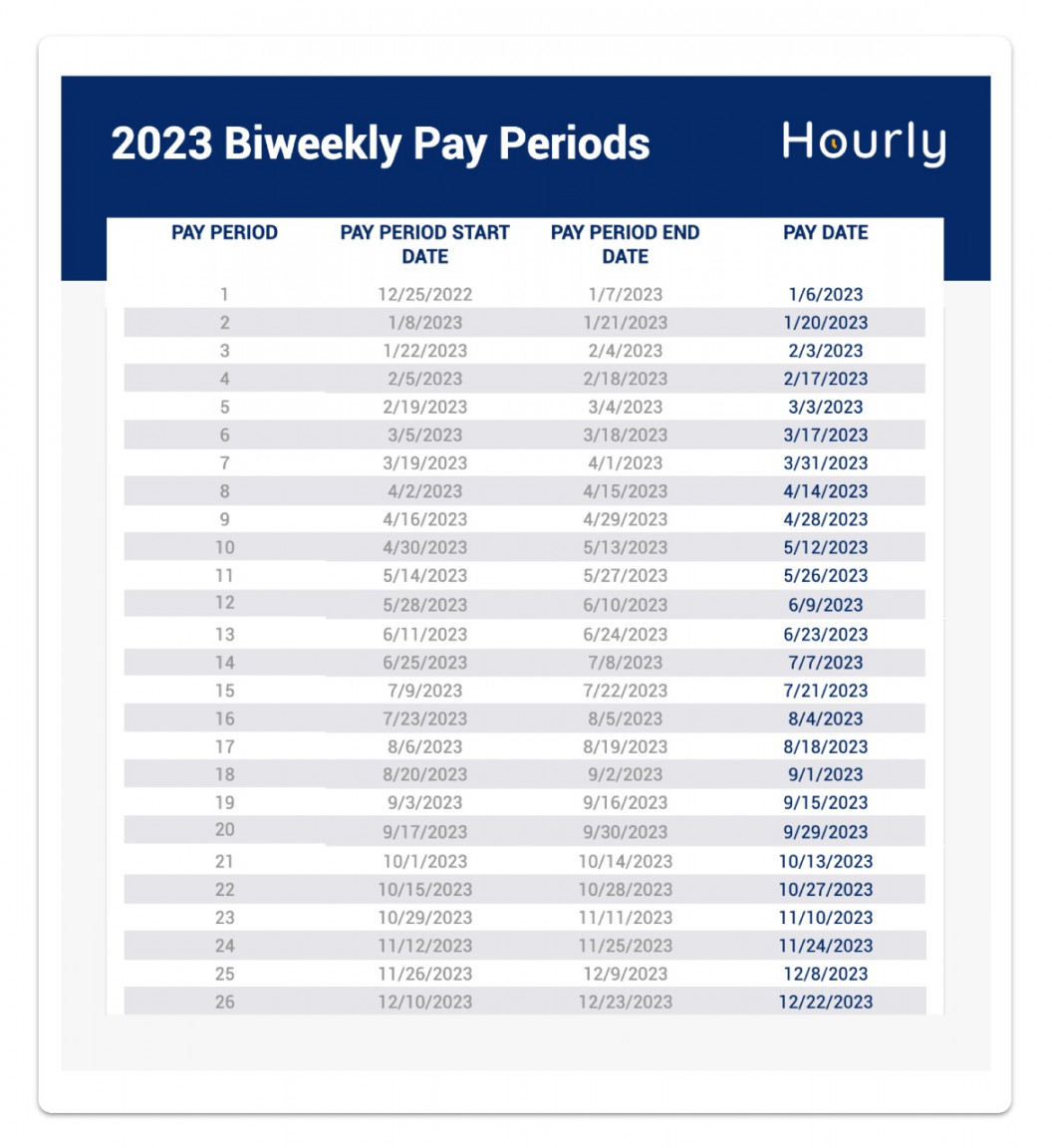

Biweekly. A biweekly schedule means you pay employees every other week. According to the BLS, this is the most popular pay schedule, with 42% of U.S. employers using this model. Through this pay schedule, employees can expect to receive 26 paychecks in a year. However, because the year doesn’t evenly divide into seven-day weeks, an extra paycheck could still occur, resulting in 27 pay periods in one year.

Semimonthly. With a semimonthly pay schedule, employers pay their workers twice per month – typically, on the first and 15th of the month or the 15th and last day of the month – resulting in 24 paychecks per year. This method gives employees set dates when they will be paid, though you will have to make decisions such as how to handle payments if the 15th lands on a weekend and how you will pay overtime if your pay period is not based strictly on a 40-hour workweek.

Monthly. If more frequent pay periods are too costly and difficult for you to handle, you can choose a monthly pay schedule. This pay schedule is less common than the others, with just 5% of U.S. workplaces using this method, according to the BLS. This is largely because employees find it difficult to carefully plan out their budgets for an entire month.

If you decide to go with a more frequent pay schedule, you may find moving to a paperless payroll system beneficial. The more times you run payroll means the more paperwork you will have. Digitizing the process can help ensure nothing gets lost or misfiled.

Editor’s note: Looking for the right online payroll software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Can a specific pay schedule be considered a perk?

Sometimes, how and when you pay your employees can be considered a perk. By understanding how your industry functions and how employees in that industry like to be paid, you can tailor your pay schedule to fit those preferences, said Sean Manning, CEO of Payroll Vault.

“Employees might prefer to get paid sooner rather than later, so a weekly pay period might be preferred, or they may prefer a biweekly over semimonthly,” he said.

Depending on the type of work your employees do and what their financial needs are, your payment schedule could enrich their current situations. Take harvesters, for example; the idea that they are paid in cash at the end of a day or week works best for them but would be terrible in other industries, Dooley said.

“Cash is good because no trips have to be made to a bank, and the amounts are not usually so vast that there’s fear among employees in handling those sums,” he said. “In other industries, cash would be an unusual way to pay employees, because administratively and as a transaction, it is too nuanced and detailed and altogether difficult and potentially even dangerous.”

Ultimately, it’s all about understanding your employees’ preferences and needs and comparing them with how you want your company’s cash flow to operate.

One factor that can throw your payroll schedule off, at least for some employees, is of they ask for a payroll advance. Have a policy in place with how best to handle those situations so it doesn’t totally disrupt your schedule.

How to choose the best pay schedule for your company

By keeping the above points in mind, you should be able to determine which pay schedule will work best for your company and your employees. Manning said it’s important not to rush the decision.

You’re going to need a “reasonable amount of time to collect information, process payroll accurately and distribute paychecks to employees,” he said. “But it’s often more beneficial to select an efficient and reliable system first, a process or system that a small business owner can rely on and trust.”

Make sure to be careful with your decision making, discuss your company’s financial situation with a professional and consider what workers in your industry expect of you, Dooley said.

“When strategizing payroll, employers should consider their cash flow and their other financial obligations and when they’re due,” he said. “Employers should consider the expectations and preferences of their staffs and should do what is administratively most beneficial.”

When deciding how often to pay employees, carefully consider the norms in your industry, employees’ preferences and your cash flow needs.