Bill Paying Calendar Template Free

6 Bills You Shouldn’t Put on Autopay, According to Financial Experts

Putting your bills on autopay can be a simple and seamless way to budget each month. But beware: There are a few bills you shouldn’t streamline.

Paying your bills online has many benefits, like avoiding late fees so you can save more money, reducing paper bills and adding security, but what about putting your bills in the queue using autopay?

What is autopay?

“Autopay is an automated payment system that allows companies to automatically withdraw money from your bank account or charge your credit card on a set schedule to pay bills and expenses,” says Rikin Shah, financial advisor and CEO of GetSure. “It’s designed to make paying recurring bills more convenient.”

It’s a great tool in your financial toolbox to streamline bill paying each month, but there are multiple factors to take into account when deciding which bills to autopay. For starters, use automatic payments to pay your monthly bills only if you’re confident you can afford to pay in full. “Otherwise, you may build up a balance that will charge you interest—and that could undermine your efforts to stay on top of your bills,” says Dana Marineau, Credit Karma’s former VP of Communications and Brand. “If you aren’t confident you can pay in full, avoid autopay.”

In particular, you might want to avoid paying the following bills on autopay.

1. Annual subscriptions

You shouldn’t have an annual magazine subscription or a monthly streaming service subscription like Netflix or Hulu on autopay because you may forget they’re active and continue paying regularly even if you no longer want or need them, says Shah. In fact, a recent survey by C&R Research found that 42% of consumers have continued paying for a subscription they no longer use. The same survey found that consumers underestimate how much they spend on subscriptions by a whopping $133 on average—2.5 times more than they thought they were paying. Plus, it’s important to pay attention to how many subscription services you’re using; having an excessive amount is one of the spending habits personal finance experts caution against.

2. Utility bills

Don’t use autopay for bills where the total varies from month to month. “Usage and rates for utilities fluctuate, so you want to review the bills and adjust your usage if needed,” says Shah, especially in the winter and summer months, when heat and air conditioning can spike your electricity or gas usage. Also, billing errors in utility bills are not uncommon, says Shah, so it’s important to get into the habit of reviewing your bill instead of setting an autopayment and forgetting about it. You should also avoid paying certain bills with cash—including utility bills.

3. Broadband and internet

While broadband and internet bills appear to be a set price each month and therefore safe for autopay, proceed with caution. Because broadband pricing isn’t regulated by the government, companies are free to hike prices whenever they want to. It’s financially savvy to check your bill each month and make sure you’re not paying more than you anticipated. This is especially true if you signed up for promotional pricing, says Shah. “[Those rates] often expire after 12 months, so reviewing bills allows you to renegotiate rates or find better deals,” he says.

4. Credit card bills

Credit card bills can present challenges when it comes to autopay because you’ll want to cover at least the minimum amount due, and you may or may not have enough money to pay more every month. Smart credit card management is a must for healthy personal finance, so make sure you know the purchases you definitely should and definitely should not use a credit card for.

5. Auto insurance premiums

Auto insurance premiums are often due in intervals of once or twice a year, which can make for a hefty bill. If one of those payments hits your bank account when your balance is low, you may end up overdrawing and get hit with a fee. Also, your rates and coverage needs can change frequently, so you want to make sure you’re reviewing the details every renewal period, rather than having it on autopilot and not considering your options. “Data shows that drivers could get a lower rate by shopping around at renewal rather than auto-renewing,” says Shah.

6. Memberships

Last, any charges like gym memberships, the big-box store you joined or your family membership to the zoo should not be on autopay. Many memberships come with auto-renewal, and before you know it, you’re signed up for another year, even if you don’t want it or plan to use it.

What to know before using autopay

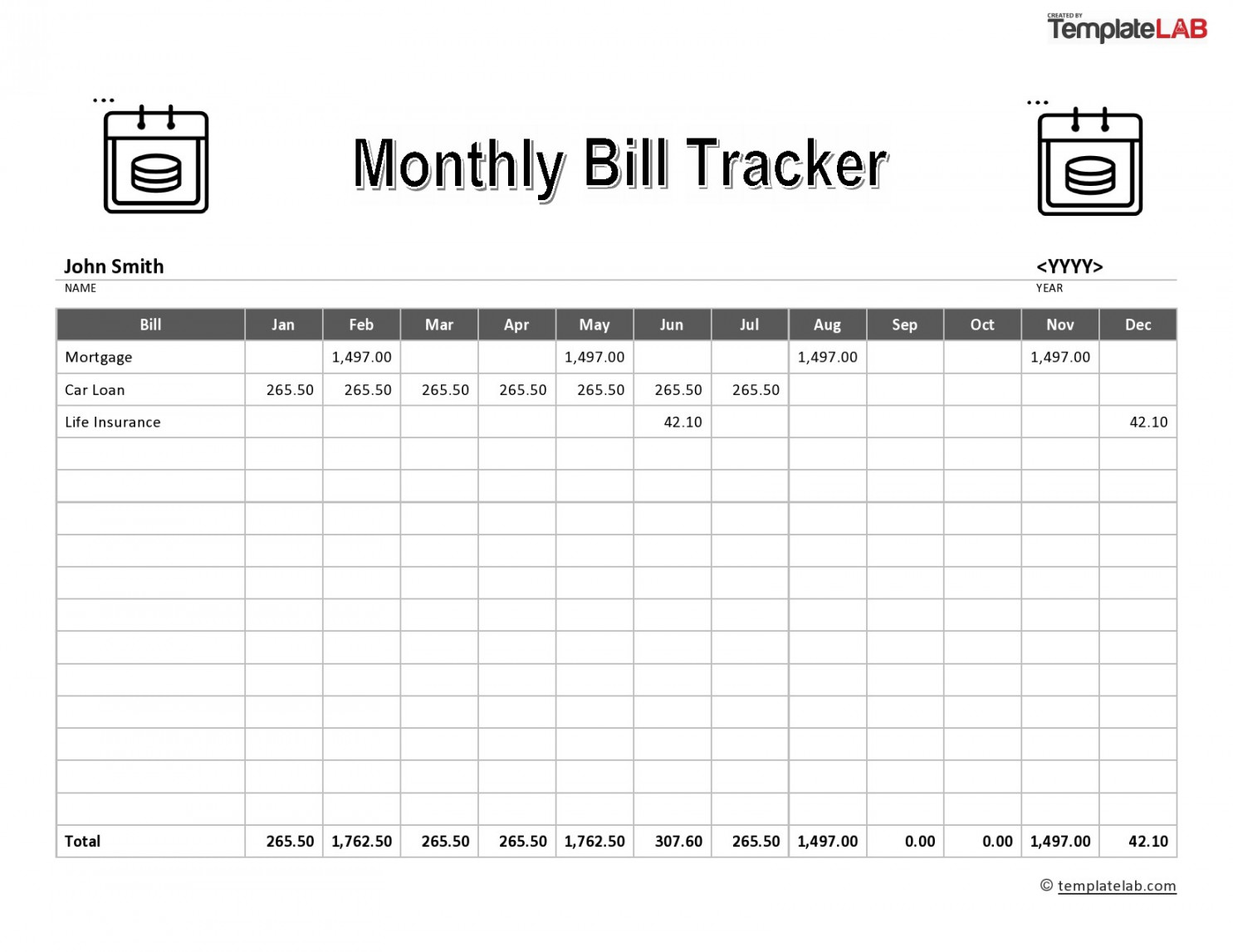

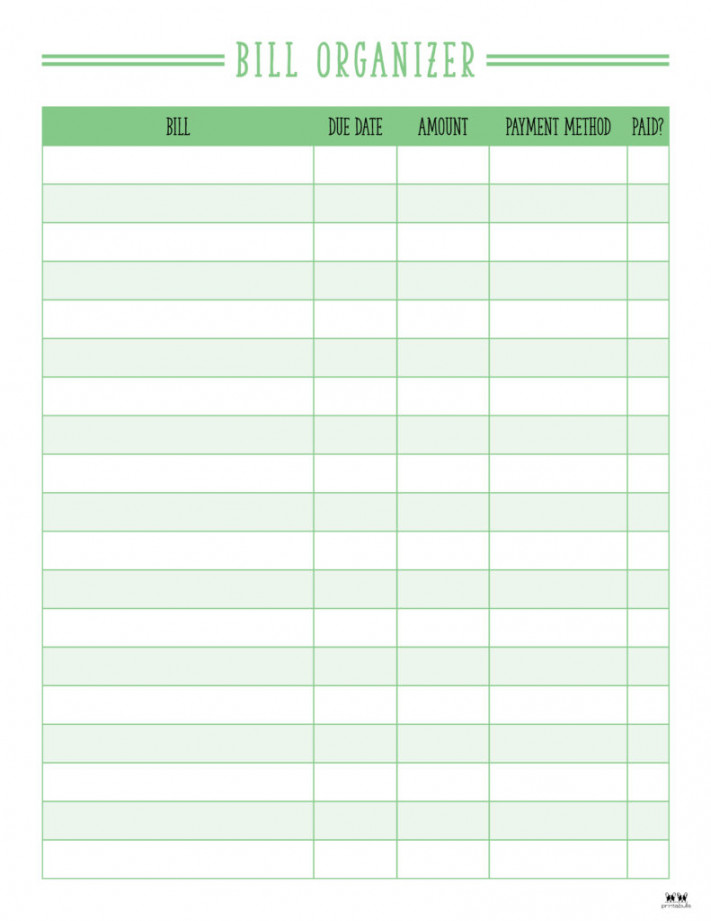

While autopay can be a convenient way to streamline your bills, it’s best to only set up auto payment for bills with fixed amounts that don’t change, like mortgage and car payments. “This avoids situations where an unexpected increase leads to overdrafts,” says Shah. In addition, you’ll want to follow these tips:

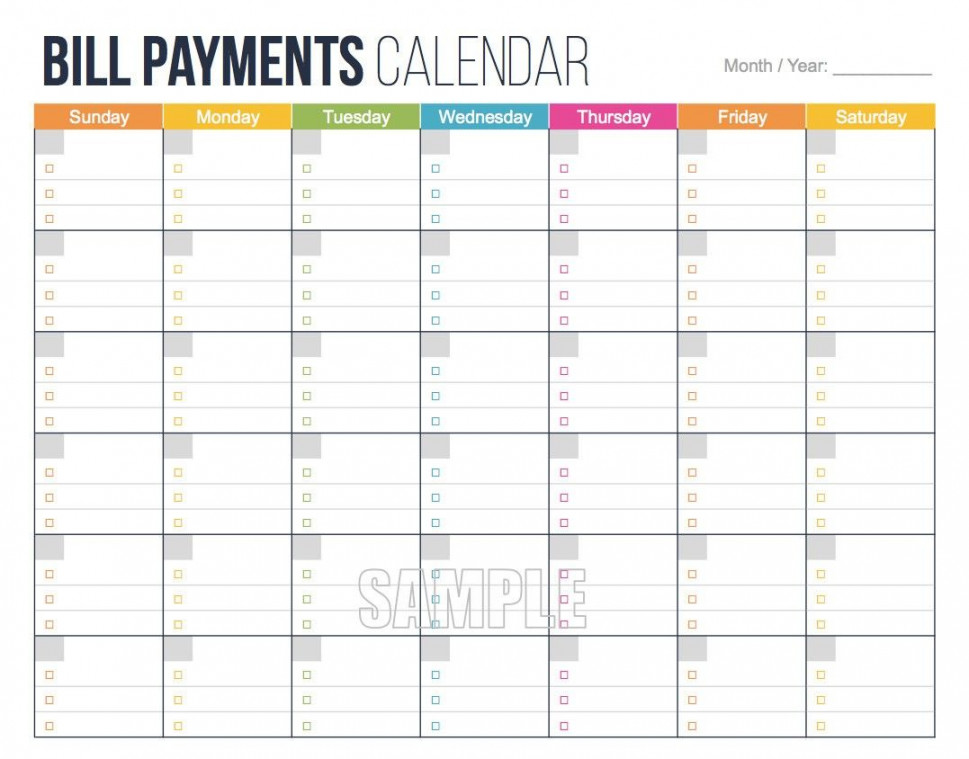

Use a credit card for autopay instead of a debit card. “This gives you more flexibility if you need to dispute a charge before it comes out of your checking account,” says Shah. Review your statements regularly to make sure the auto-paid amounts are correct. “It’s good practice to check your accounts at least once a month for any discrepancies or fraudulent charges,” says Shah. Set calendar reminders to check your account balances before autopay dates, so you can add funds if needed and avoid overdraft fees. For bills that are not on autopay, set aside a regular, recurring time to pay your bills. Schedule a block of time on your calendar, and try to make it part of your routine, says Marineau.

Additional reporting by Stacey Marcus.

About the experts Rikin Shah is the CEO of GetSure and a financial services advisor. He has more than 20 years of experience in financial services, including roles in investment banking at J.P. Morgan, in private equity investing at Stone Point Capital and as Head of Business Operations for Earnest, a student loan refinancing startup. Dana Marineau is the CMO at Rakuten and the former VP of Communications and Brand at Credit Karma.

Sources:

C+R Research: “Subscription Service Statistics and Costs”