Printable Monthly Calendar Templates Bills

Household budget calculator: Work out income, spending and bills

Our household budget calculator lets you track what you have coming in and where your moneygoes every month.

Getting a grip on your incomings and outgoings is the essential first step in fixing your finances.

Once you know the details you can think about where you can cut back, how much money you can afford to save or invest, and start to plan for a better financial future.

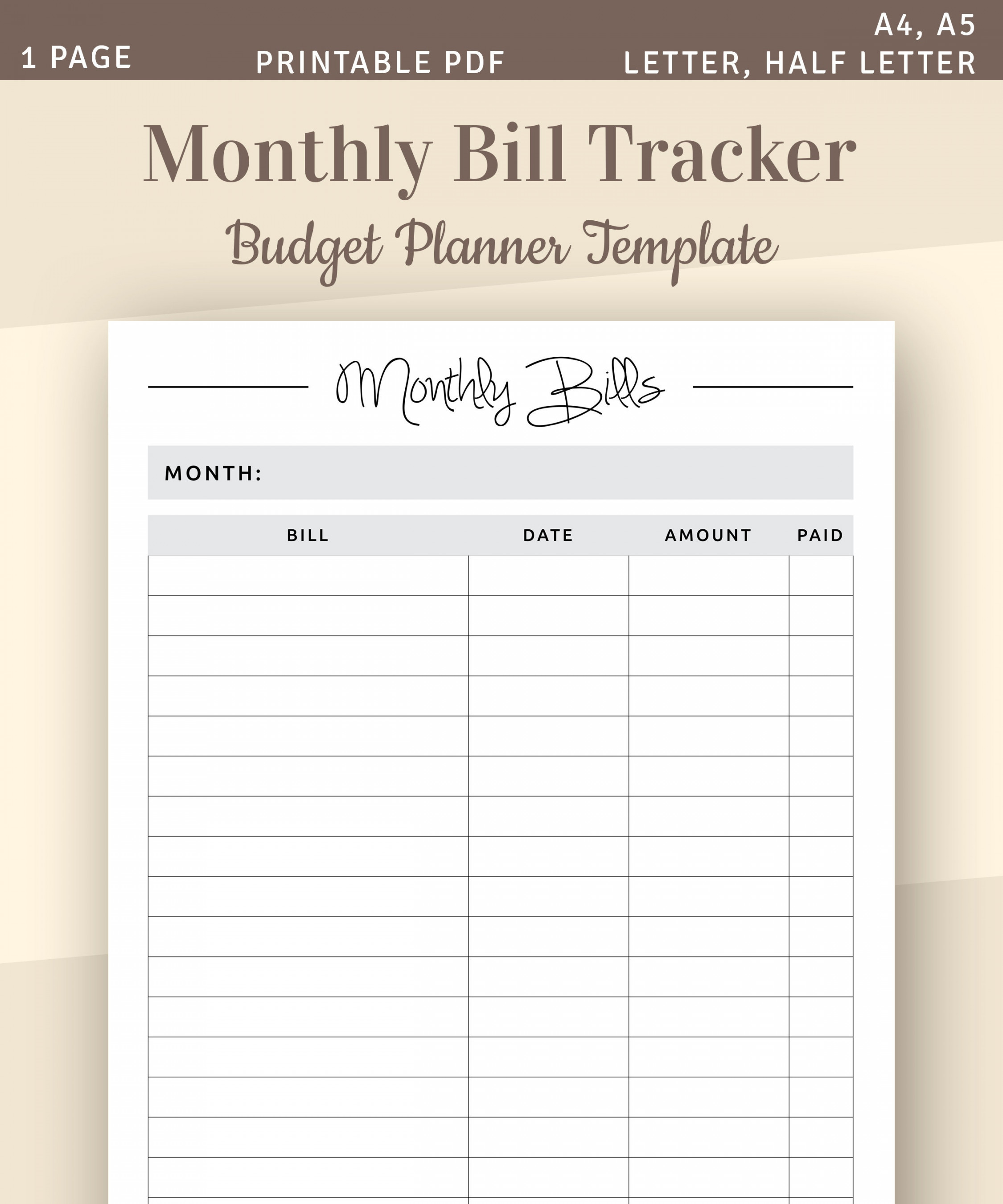

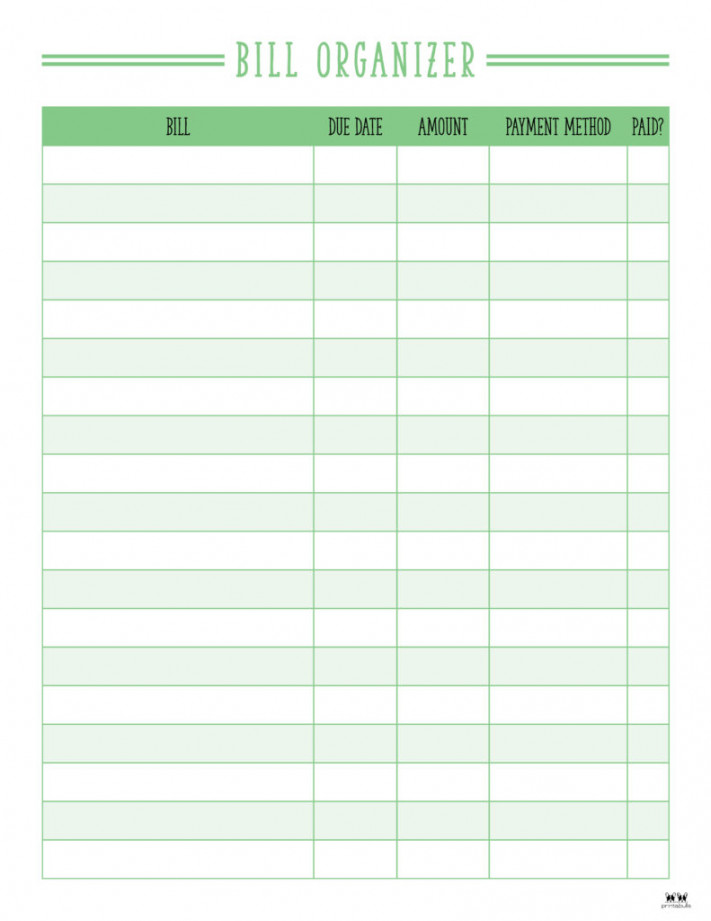

Before you use this however, it makes sense to spend some time gathering together the pieces of paper you will need, such as pay slips, council tax bills, insurance policies and credit card bills.

For help on how to get started read our guide: How to start budgeting and some tips for success

This calculator only works on the desktop and tablet version of This is Money.

Household Budget Calculator

Our household budget calculator lets you track exactly where the money goes every month – the first step to cutting back. Before you use this however, it makes sense to spend some time gathering together the pieces of paper you will need, such as pay slips, council tax bills, insurance policies and credit card bills

Why you need to budget

Budgeting at its simplest level is about checking your incomings and outgoings.

If you’re using up your savings and accumulating debt, you’re probably overspending. Given that everything is getting increasingly expensive, that is not a situation you want to be in.

If you get a handle on your budget, you can work out where you are spending too much, areas where you might be able to cut back, opportunities to save on your bills, and where you might be able to set money aside to enjoy yourself.

A budget also lets you understand how much you might be able to save or invest each month to build your wealth.

How to working out your incomings and outgoings

Budgeting is easier than it used to be, as the information is much more readily available thanks to internet and mobile banking.

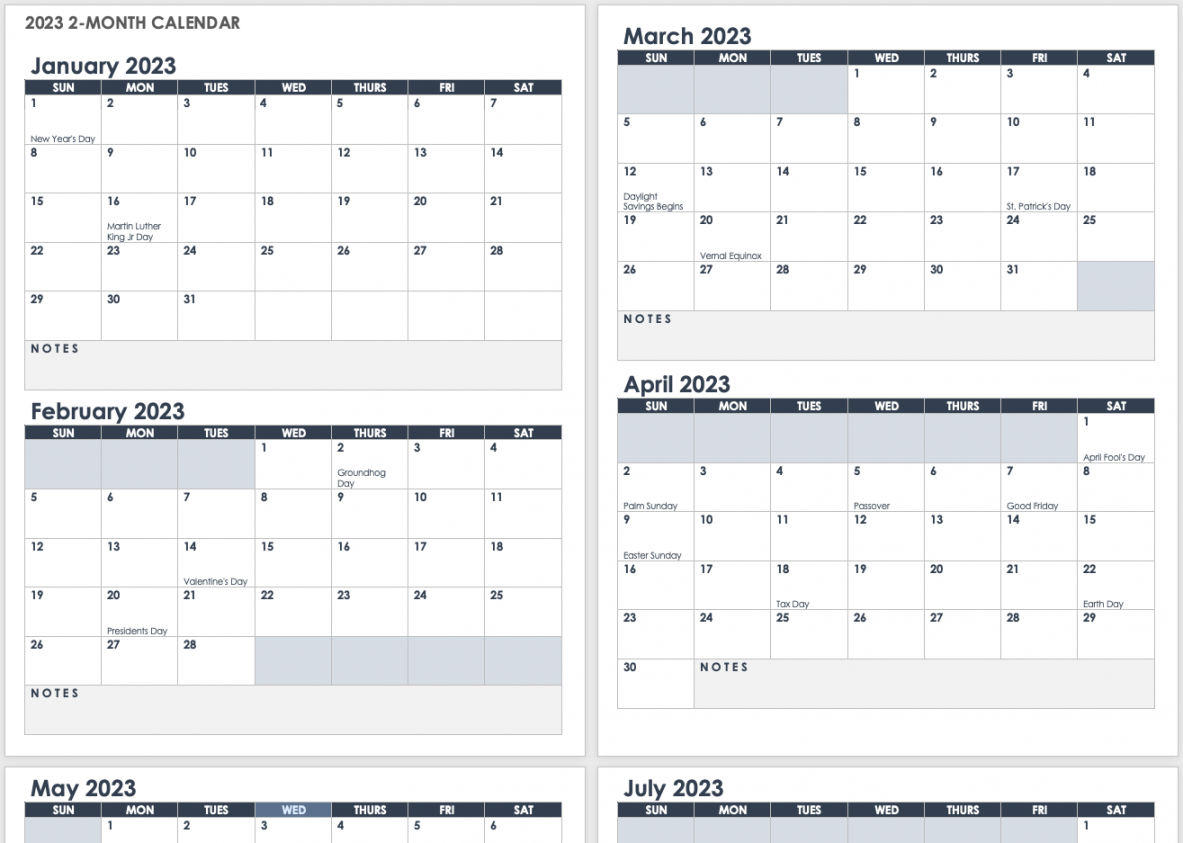

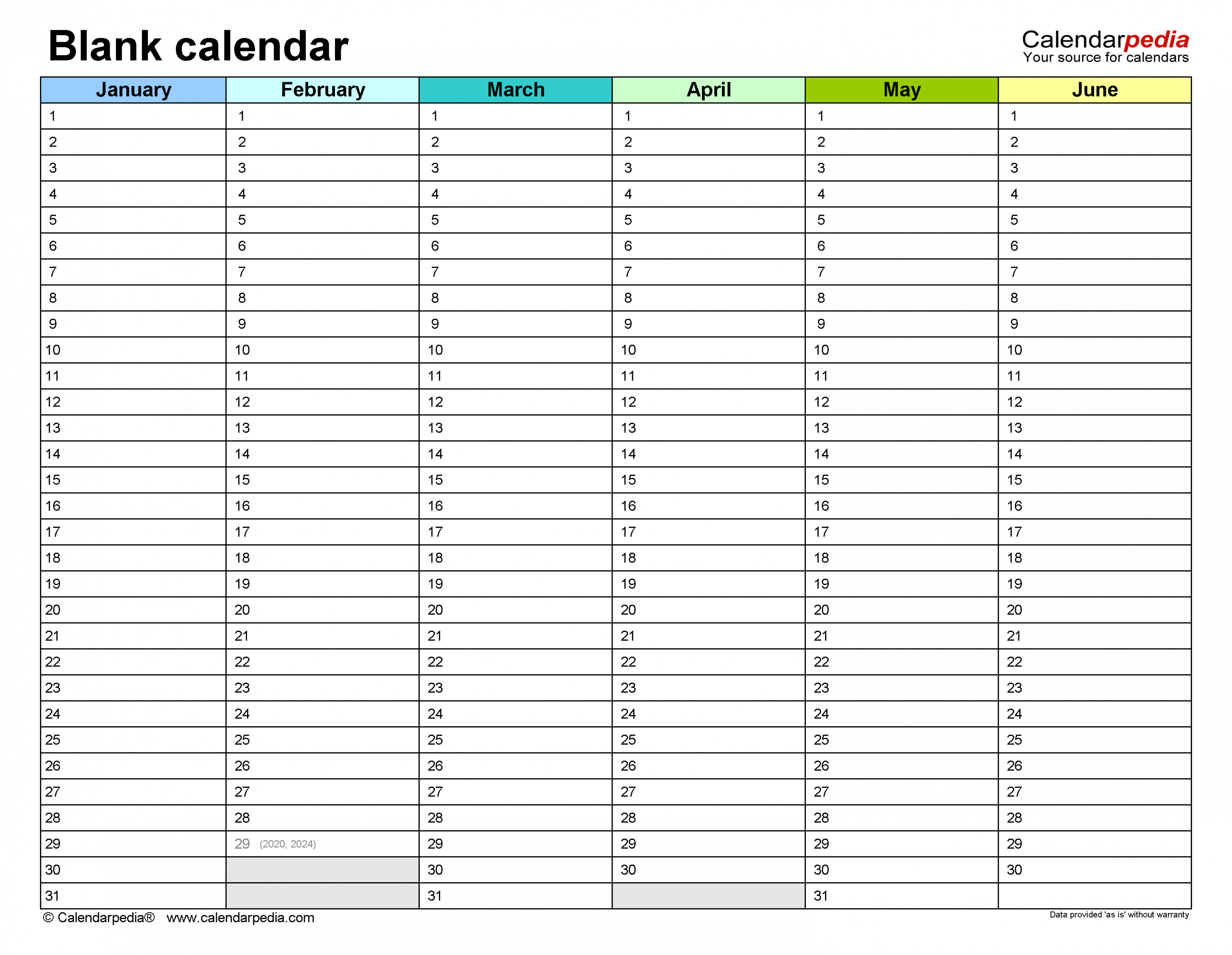

You can access your bank statements online, and export them to an excel spreadsheet, you can sign up for one of the many budgeting apps, you can get a pen and paper out, or you can use our household budget calculator above.

However, you do it, just do it.

Ideally, to start the budgeting process you will want a good few months’ worth of statements – probably at least six – so you are averaging out spending and income to remove any anomalies, spikes, or out of the ordinary stuff.

Go through and categorise your spending, working out what goes on monthly bills, essentials, shopping, travel, children, socialising etc.

You will also need to gather information on non-regular but important spending, such as annual car or home insurance paid in full, and what you spend on holidays each year.

Essential vs discretionary spending

Understanding essential and discretionary spending is key to working out where and how you might be able to save money.

Essential spending is anything that can’t be cut out: the mortgage or rent, utility bills, groceries, and any medication for example.

There are also essentials that you may only pay once a year, such as home insurance and car insurance.

Even if an expense is essential, customers can still potentially save money by switching suppliers and getting a better deal. For example, while that’s not possible with energy bills during the current crunch, it may be possible with car or home insurance or broadband.

Discretionary spending on the other hand, is anything you can live without. This might include a gym subscription, Netflix account, a daily cup of takeaway coffee or food deliveries.

While budgeting doesn’t mean cutting out anything that isn’t a ‘must have,’ dividing up spending in this way can help people to identify anything they would be prepared to reduce or cut out completely.

The 50/30/20 rule

The 50/30/20 rule is a commonly used budgeting tool, coined by the American politician, Elizabeth Warren in her book ‘All Your Worth: The Ultimate Lifetime Money Plan.’

It suggests people should spend up to 50 per cent of their after-tax income on their ‘needs’.

These are the bills and costs that are a necessity, including mortgage, rent, insurance and utilities.

After that, the method suggests that 30 per cent of post-tax income should be allocated towards the person’s ‘wants’.

These are non-essentials that might include dinners out, clothes shopping, holidays or a new sofa.

The remaining 20 per cent, according to Warren, of your income should be put aside for the future, via savings and investments.

Building a rainy day pot as a buffer

Something to build into your budgeting is having a rainy day fund – easily accessible money which acts as a financial cushion to deal with unforeseen events.

For example, you should have a rainy day pot in case you lose your job, or if you’re self-employed, in case business dries up.

You also need a rainy day pot so that you are financially prepared for any large unforeseen costs such as your boiler breaking down and needing to be replaced.

Some personal finance experts believe that a rainy day pot should cover between three to six months worth of basic living expenses. Others suggest you keep the equivalent of at least three months of your take home salary.

If you do not have a rainy day fund, which many people don’t, do not be disheartened but try to start slowly building one up with some regular savings.

Check out our full range of financial calculators – from credit cards to mortgages, savings and inflation – work out how to save and make money

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.