Printable W 9 Form

Tax Compliance

The Tax Compliance Office is part of Finance and operates on behalf of William & Mary (hereafter “W&M”) and the Virginia Institute of Marine Science (hereafter “VIMS”).

Mission

Our primary mission is to ensure compliance with various tax laws and regulations promulgated by the United States federal government, the Commonwealth of Virginia and any local government jurisdictions and develop (and enforce) appropriate policies and procedures in order to meet compliance requirements and protect the tax-exempt status of W&M and VIMS.

Disclaimer

The tax services offered by the Tax Compliance Office are informational and procedural in nature. We cannot provide individual income tax advice or consulting to employees, students or parents and will not advise on any personal income tax requirements or issues. Use of any information from this site, or any other website referred to, is for general information only and does not represent personal tax advice either expressed or implied. You are encouraged to seek professional tax advice for personal income tax questions and assistance.

Frequently Requested Information A single column, collapsible list of frequently requested information Federal Tax ID (EIN) W&M: 54-6001718 VIMS: 54-6001802 Federal EXEMPT Tax Determination

W&M is NOT a 501(c)(3) organization. W&M is an exempt organization due to our relationship with the Commonwealth of Virginia as a State Agency. Here is the IRS Determination Letter.

VIMS (Virginia Institute of Marine Science) is an affiliated agency and is NOT a 501(c)(3) organization. VIMS is an exempt organization due to our relationship with the Commonwealth of Virginia as a State Agency. Here is the IRS Determination Letter.

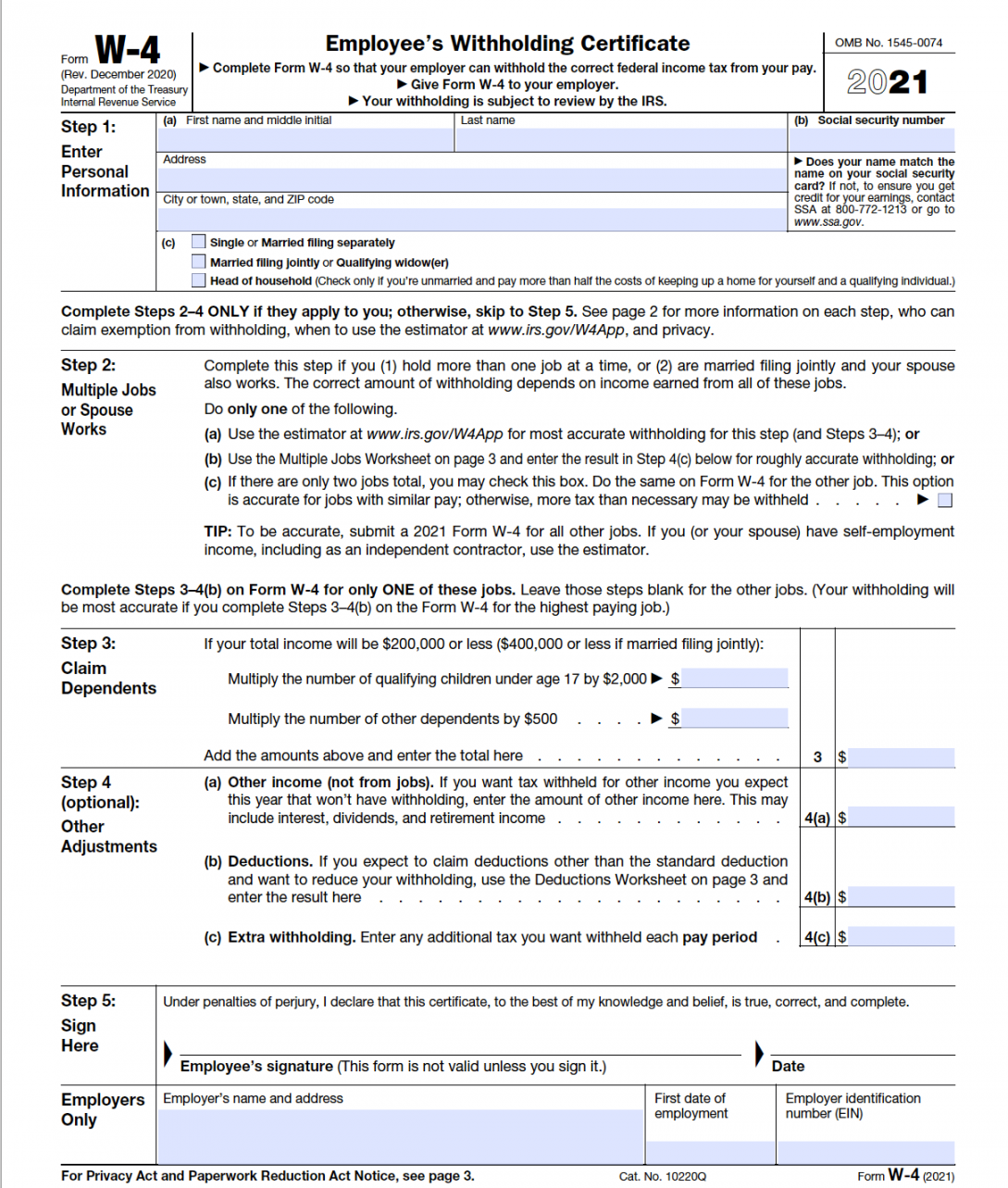

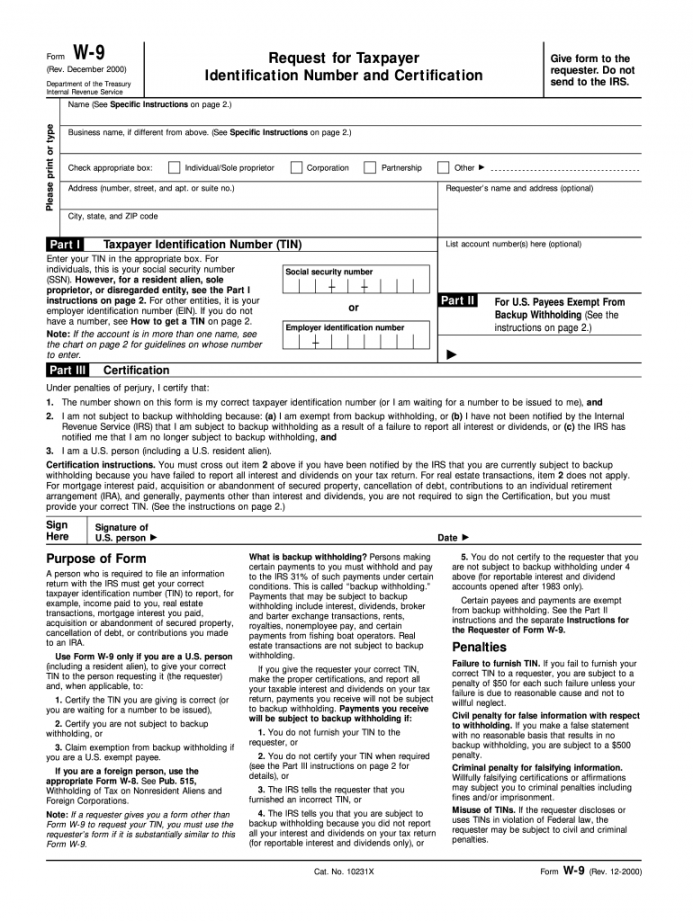

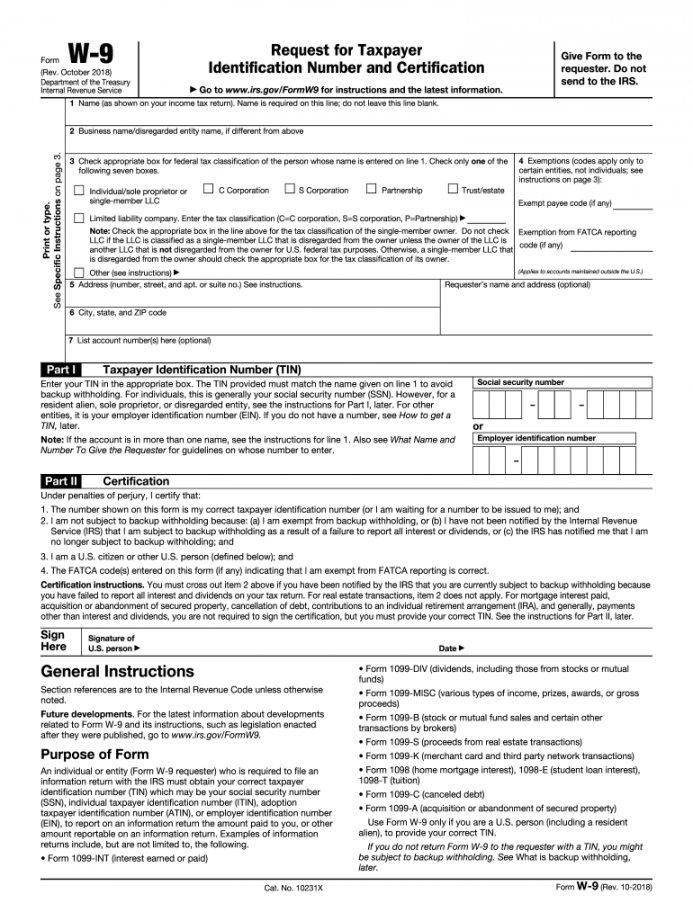

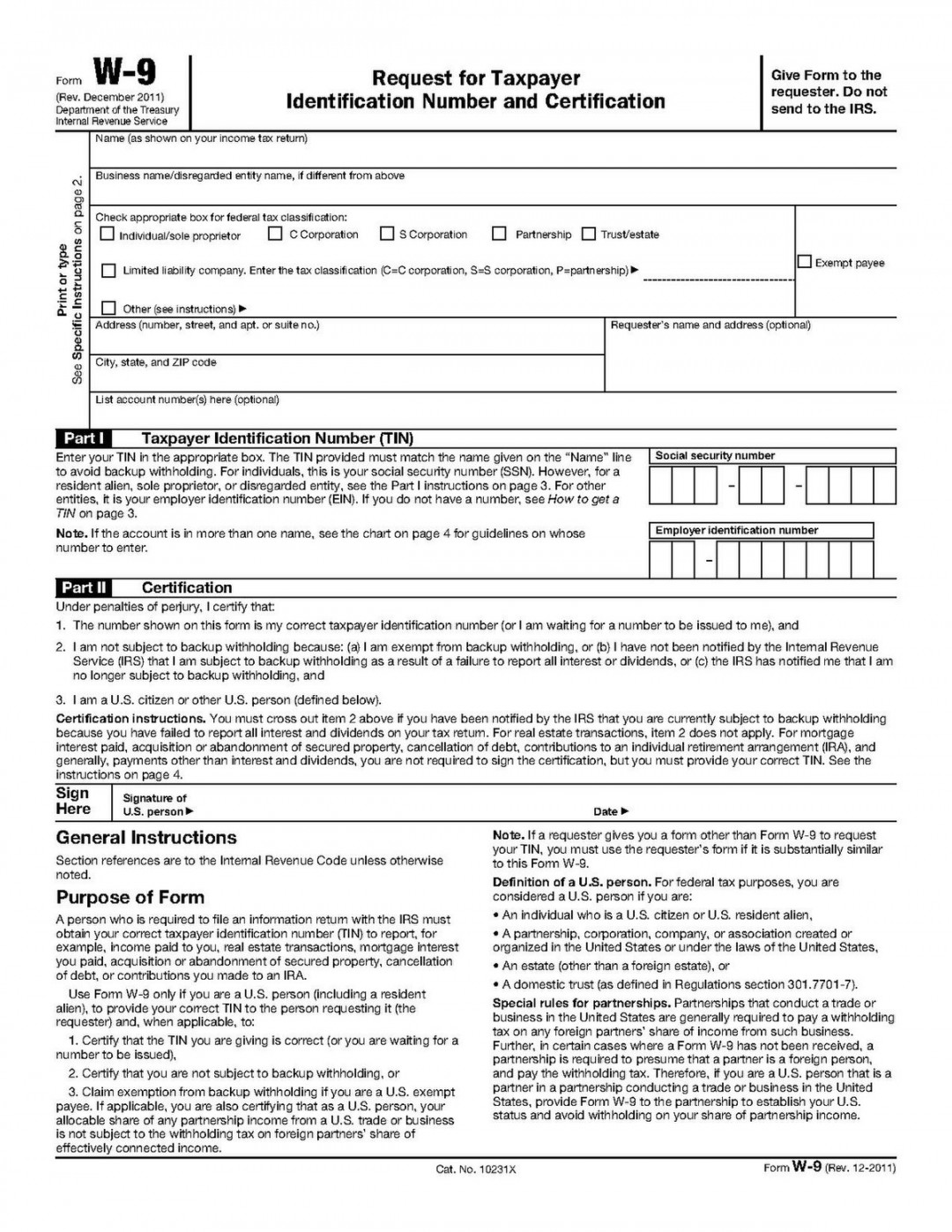

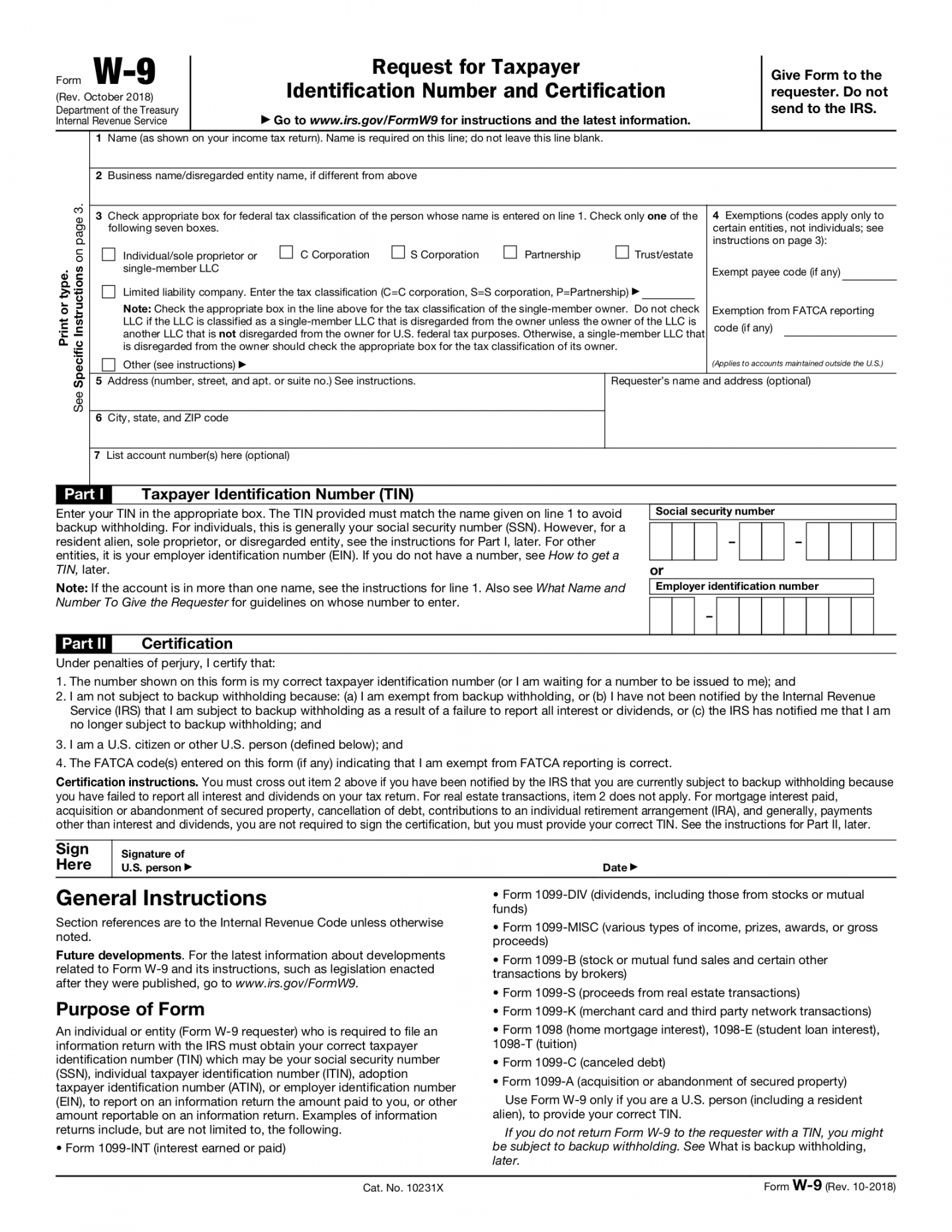

Request for Taxpayer Identification Number and Certification (Form W-9)

IRS Form W-9 is used to provide the University’s Tax Identification Number to those who will pay the university. Please follow the link to obtain the most recent or W&M W-9 Form or VIMS W-9 Form

Virginia Sales and Use Tax Certificate of Exemption (Form ST-12)

As a public institution of the Commonwealth of Virginia, W&M and VIMS qualify for the Virginia retail sales and use tax exemption on purchases of tangible property for use or consumption by W&M or VIMS. This exemption only applies if W&M or VIMS pays the vendor directly. Employees using personal funds will not qualify for the exemption.

Please contact Tax Services for information about university-related tax issues. William & Mary employees, while in their official tax role at W&M, are not allowed to act as tax consultants or provide a personal tax advice. Use of this site does not constitute advisement. For personal tax questions, individuals should consult with a professional tax advisor. Additional Questions?

Any questions not addressed by this website may be directed to the Tax Compliance Office via [email protected].