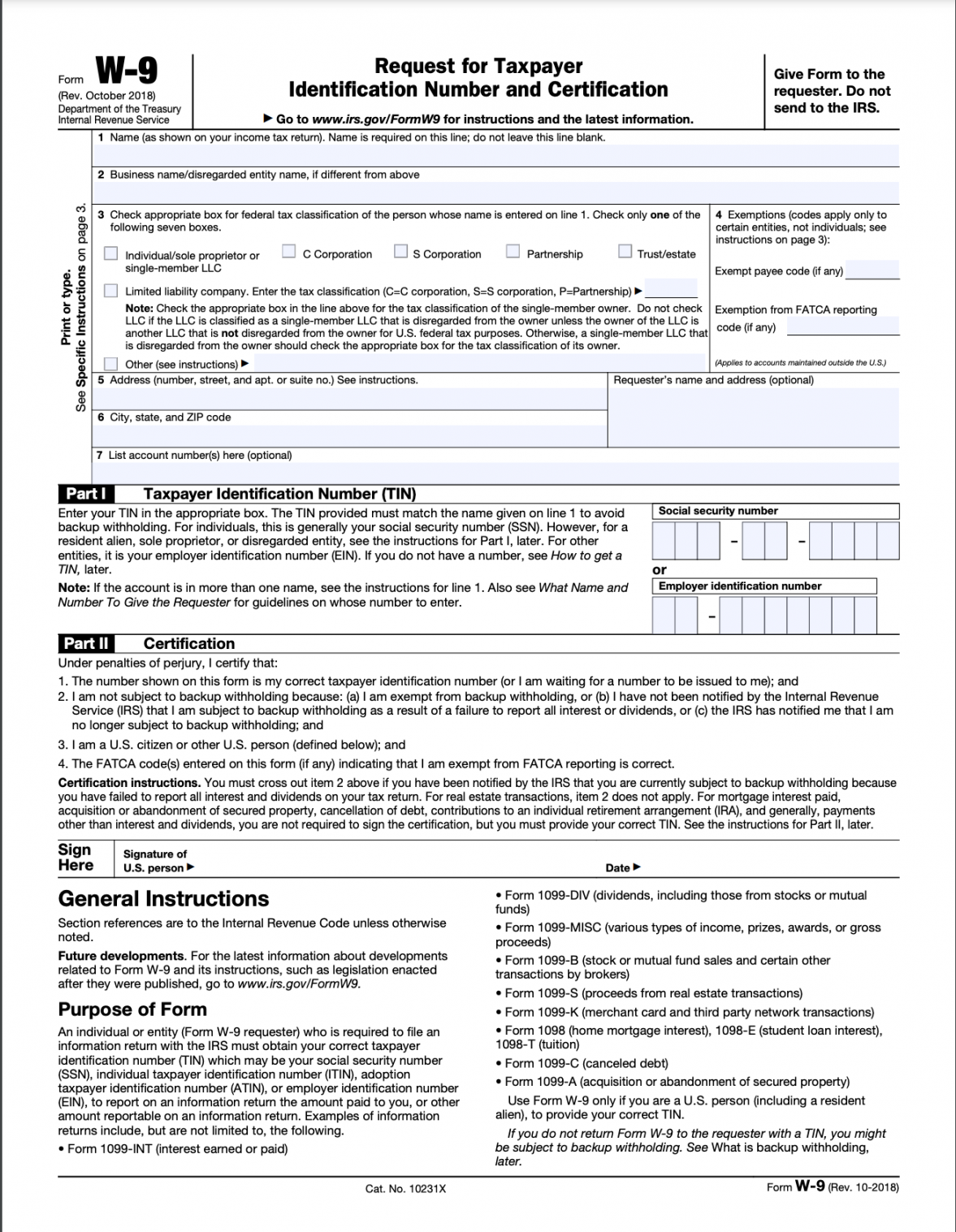

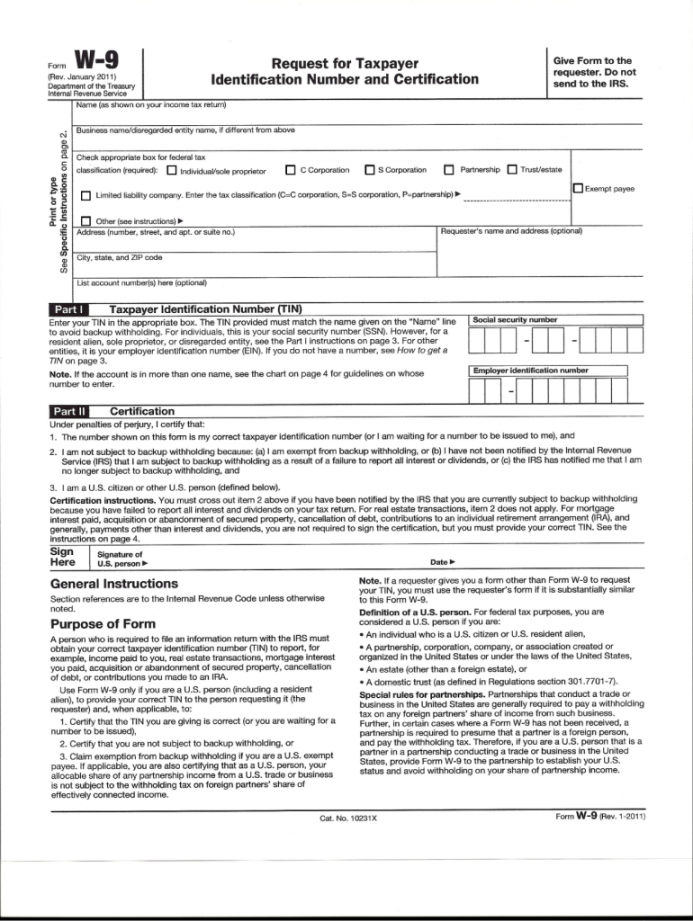

Printable W-9 Irs Form

Top Tax Advantages of Buying a Home

Thinking of buying a home? There are plenty of perks if you purchase one. You can decorate it to suit your taste, you can install a professional home theater system, or you can perfectly customize the walk-in closet to hold everything you have, just the way you want it. But there are other benefits—the financial kind.

If you rented in the past, all of your money went to a landlord, and none of it came back to you as a tax deduction. That changes if you’re a homeowner.

Whether you buy a mobile home, townhouse, condominium, co-operative apartment, or single-family home, several tax breaks can save you money at tax time.

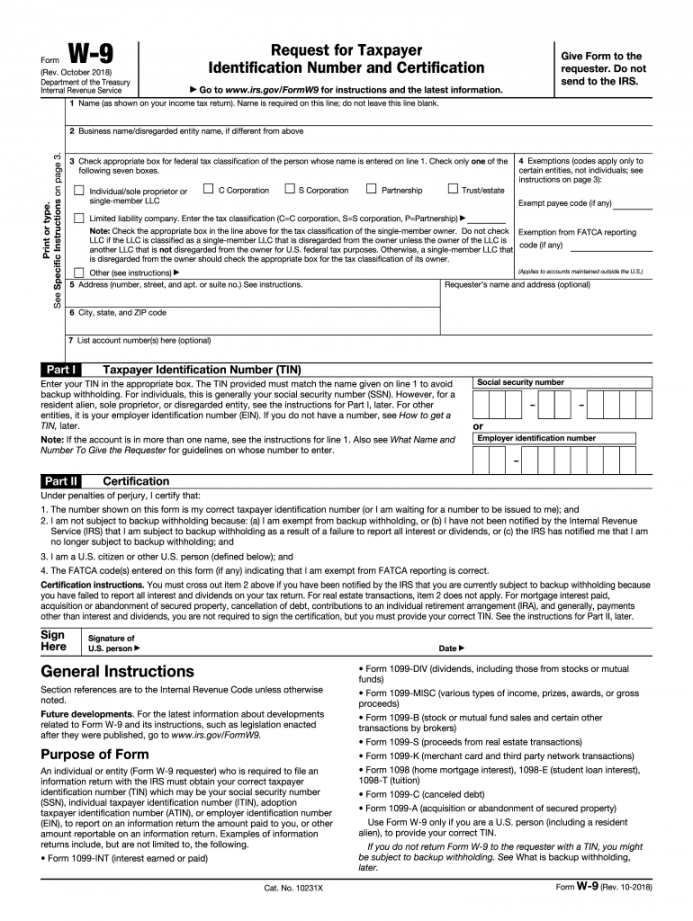

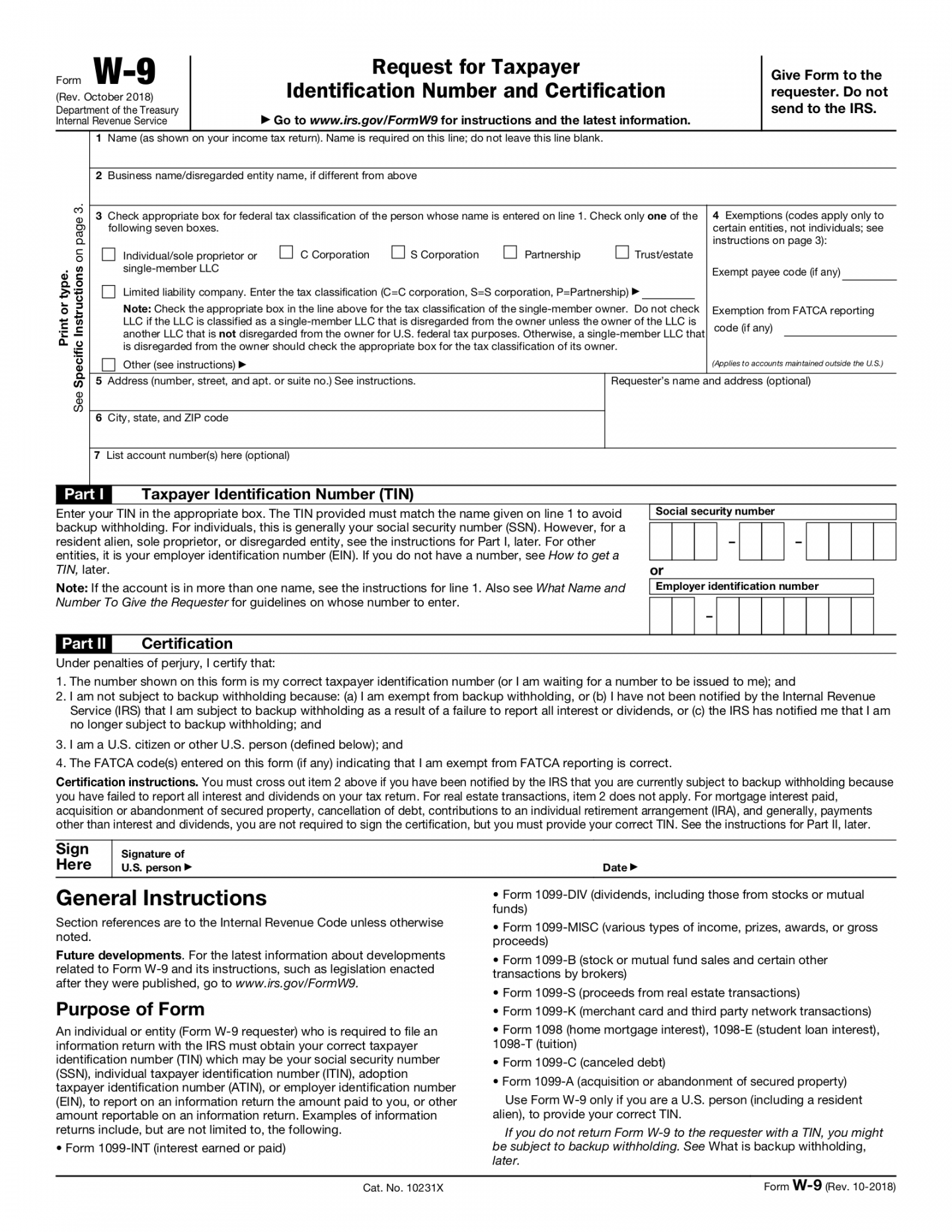

The only downside is that your taxes will get more complicated. You cannot just plug your W-2 information into the 1040EZ form and finish your taxes in 10 minutes. As a homeowner, you can most likely take advantage of itemizing, which can save you a lot of money.

Key Takeaways Buying a home may be the most expensive and important purchase you make in your life.The Internal Revenue Service (IRS) provides several tax breaks to make homeownership more affordable.Common tax deductions include those for mortgage interest, mortgage points, and private mortgage insurance (PMI).To claim the deductions, you have to itemize your taxes (and not take the standard deduction).Tax credits are available for qualified first-time homebuyers and homeowners who invest in energy improvements (e.g., solar panels and energy-efficient windows). Tax Credits vs. Tax Deductions

In the tax world, there are deductions, and there are credits. Credits represent money taken off of your tax bill. Think of them as coupons. If you get a $1,000 tax credit, your tax due will decrease by $1,000. A tax deduction reduces your adjusted gross income (AGI), which in turn reduces your tax liability.

For example, if you’re in the 24% tax bracket, your tax liability will be reduced by 24% of the total claimed deduction. So, if you claim a $1,000 deduction, you can expect your tax liability to drop by $240 ($1,000 × 24%).

Tax Deductions for Homeowners

Most of the favorable tax treatment that comes from owning a home is in the form of deductions. Here are the most common deductions:

Mortgage Interest Deduction

You can deduct your home mortgage interest on the first $750,000 ($375,000 if married filing separately) of mortgage debt. The old limit—$1 million ($500,000 if married filing separately)—applies if you bought your home before Dec. 16, 2017.

You can’t deduct home mortgage interest unless you itemize deductions on Schedule A Form 1040 or 1040-SR, and the mortgage is a secured debt on a home in which you have an ownership interest. You can deduct mortgage interest on a second home as long as the mortgage satisfies the same requirements for deductible interest as on your primary residence.

In January, after the end of the tax year, your lender will send you Internal Revenue Service (IRS) Form 1098, detailing the amount of interest that you paid in the previous year. Be sure to include any interest that you paid as part of your closing. Lenders will include interest for the partial first month of your mortgage as part of your closing. You can find it on the settlement sheet. Ask your lender or mortgage broker to point this out to you. If it’s not included on your 1098, add this to your total mortgage interest when doing your taxes.

Mortgage Points Deduction

You may have paid mortgage points to your lender as part of a new loan or refinancing. Each point that you buy generally costs 1% of the total loan and lowers your interest rate by 0.25%. For example, if you paid $300,000 for your home, each point would equal $3,000 ($300,000 × 1%). And, with a 4% interest rate, for instance, that one point would lower the rate to 3.75% for the life of the loan. As long as you actually gave the lender money for these discount points, you get a deduction.

Like the mortgage interest deduction, discount points are deductible on the first $750,000 of debt.

If you refinanced your loan or took out a home equity line of credit (HELOC), you receive a deduction for points over the life of the loan. Each time you make a mortgage payment, a small percentage of the points is built into the loan. You can deduct that amount for each month that you made payments. So, if $5 of the payment was for points, and you made a year’s worth of payments, your deductible amount would be $60.

Your lender will send you Form 1098, detailing how much you paid in mortgage interest and mortgage points. Using that information, you can claim the deduction on Schedule A of Form 1040 or 1040-SR.

Private Mortgage Insurance (PMI)

Lenders charge private mortgage insurance (PMI) to borrowers who put down less than 20% on a conventional loan. PMI usually costs $30 to $70 a month for each $100,000 borrowed. Like other types of mortgage insurance, PMI protects the lender (not you) if you stop making mortgage payments. Depending on your income and when you bought your home, you might be able to deduct your PMI payments.

Mortgage insurance premiums can now no longer be deducted.

Prior to 2022, the PMI deduction expired and was renewed several times. The PMI deduction expired in 2017 but was renewed in 2019 and retroactively applied to the 2018 tax year. The deduction was available for 2020 and extended through 2021 under the Consolidated Appropriations Act (CAA) of 2021. For 2022 returns, the IRS has let the deduction expire, and taxpayers can currently no longer deduct mortgage insurance premiums.

State and Local Tax (SALT) Deduction

The state and local tax (SALT) deduction lets you deduct certain taxes paid to state and local governments, provided that you itemize on your federal return. The $10,000 cap applies whether you are single or married filing jointly and drops to $5,000 if you’re married filing separately. The deduction limit relates to the combined total deduction of state income, local income, sales, and property taxes.

You must itemize your deductions to claim the mortgage interest deduction, mortgage points deduction, and SALT deduction. You can’t claim these deductions if you take the standard deduction when filing your tax return.

If you pay your property taxes through a lender escrow account, you’ll find the amount on your 1098 form. Alternatively, you will have personal records in the form of a check or automatic transfer if you pay directly to your municipality. Be sure to include payments that you made to the seller for any prepaid real estate taxes (you can find them on your settlement sheet).

State and local income taxes withheld from your paycheck appear on your W-2 form, which your employer(s) should send by the end of January following the tax year. If you elect to deduct state and local sales taxes instead of income taxes (you can’t deduct both), you can use your actual expenses or the optional sales tax tables found in Schedule A (Form 1040).

Home Sale Exclusion

Chances are you won’t have to pay taxes on most of the profit that you might make when you sell your home, thanks to the home sale exclusion.

If you’ve owned and lived in the home for at least two of the five years before the sale, you won’t pay taxes on the first $250,000 of profit (i.e., capital gain). The number doubles to $500,000 if you’re married filing jointly. However, at least one spouse must meet the ownership requirement, and both spouses must meet the residency requirement (i.e., lived in the home for two out of the previous five years). You might be able to meet part of the residency requirement if you had to sell your home early due to a divorce, job change, or something else.

If you have a taxable gain on the sale of your main home that’s greater than the exclusion, report the entire gain on Form 8949: Sales and Other Dispositions of Capital Assets.

Depending on how long you owned the home, any gains will be taxed at either the short-term or long-term capital gains rate:

Short-term capital gains tax rates apply if you owned the home for less than a year. These gains are taxed at your ordinary income tax rate, which 37% and 2023. Long-term capital gains tax rates apply if you owned the home for more than a year. The rate is 0%, 15%, or 20%, depending on your filing status and income. Tax Credits

You might be eligible for a mortgage credit if you were issued a qualified mortgage credit certificate (MCC) by a state or local governmental unit or agency under a qualified mortgage credit certificate program. Also, check energy.gov to find out whether your state offers tax credits, rebates, and other incentives for energy-efficient improvements to your home.

Which Expenses Can I Itemize?

You itemize your deductions on Schedule A Form 1040. Homeowners can generally deduct home mortgage interest, home equity loan or home equity line of credit (HELOC) interest, mortgage points, private mortgage insurance (PMI), and state and local tax (SALT) deductions. You also may be able to deduct charitable donations, casualty and theft losses, some gambling losses, unreimbursed medical and dental expenses, and long-term care premiums.

Who Should Itemize Deductions?

You can either take the standard deduction or itemize your deductions. If the value of expenses that you can itemize is greater than the standard deduction, then it makes financial sense to itemize. Also, you must itemize to claim the mortgage interest, mortgage points, and SALT deductions.

What Are the Standard Deduction Amounts for 2023?

For tax year 2023, the standard deduction is $13,850 for single of married filing separately taxpayers, $20,800 for heads of household, and $27,700 for married filing jointly filers.

The Bottom Line

Let’s keep this in perspective: If you’re in the 24% tax bracket, you’re still paying nearly 75% of your mortgage interest without any deductions. Don’t fall into the trap of thinking that paying interest is beneficial because it reduces your taxes. In many cases, paying off your home as quickly as possible is the best financial move. There’s no prepayment penalty for paying off your mortgage. Of course, talk to your financial planner about the most beneficial way to pay down your debt.