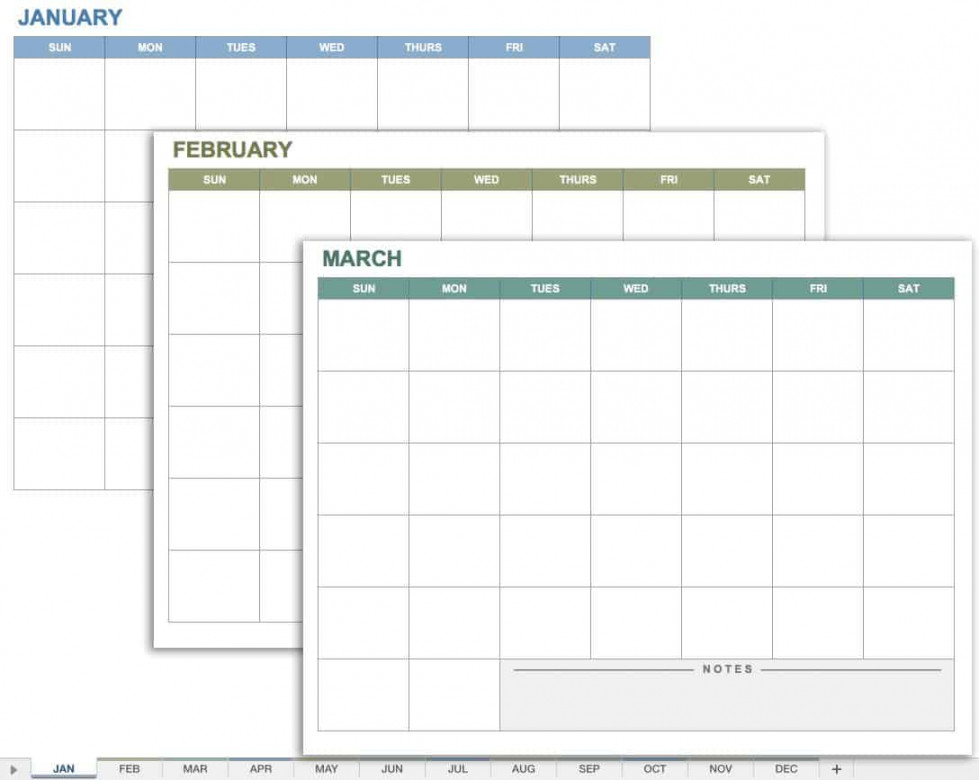

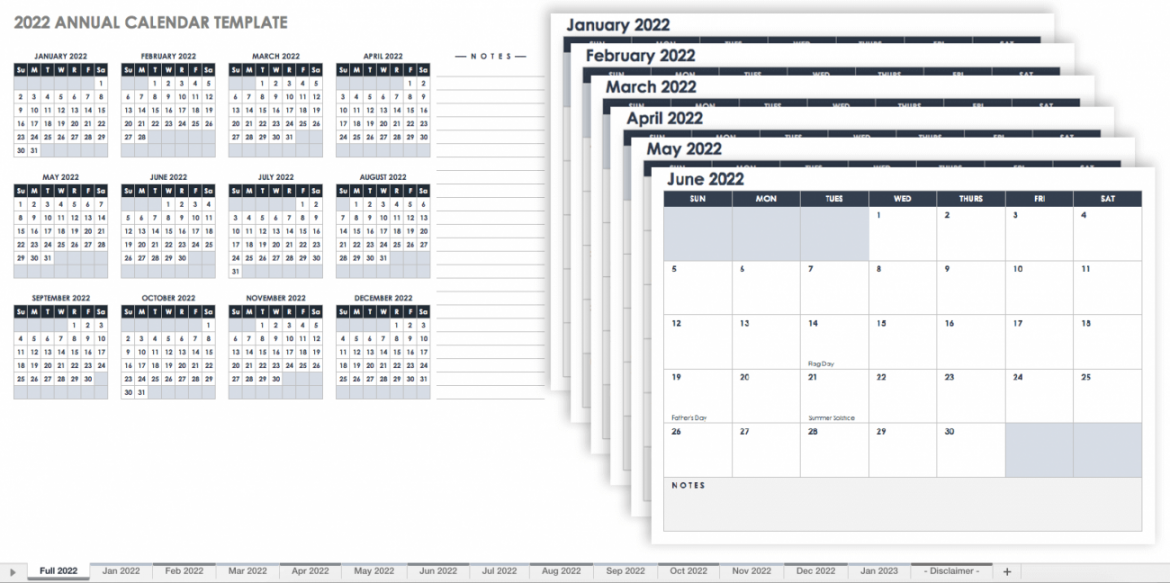

12 Month Calendar Template

What Is the Tax Year? Definition, When It Ends, and Types What Is a Tax Year?

A tax year is the 12-month calendar year covered by a tax return. In the U.S., the tax year for individuals runs from Jan. 1 to Dec. 31 and includes taxes owed on earnings during that period.

For example, taxes withheld or owed for earnings during the calendar year 2023 would be included on the tax return sent to the Internal Revenue Service (IRS) by most taxpayers in 2024.

The 2024 federal income tax filing deadline for individuals is April 15, 2024.

Key Takeaways A tax year refers to the 12-month period that a tax return covers.Individuals are subject to a calendar tax year beginning Jan. 1 and ending Dec. 31.Tax returns in the U.S. for the year are usually due on April 15 of the following year.Business taxes may be filed using a calendar year or a fiscal year. How a Tax Year Works

A tax year is an annual accounting period for paying or withholding taxes, keeping records, and reporting income and expenses.

Wage-earning people pay taxes throughout the calendar tax year. Early in the following year, usually before April 15, they report the wages they paid to the Internal Revenue Service (IRS) and either pay any shortfall in their taxes due or request a refund of taxes overpaid.

Self-employed people and small business owners usually file quarterly to report their incomes and pay an estimate of the taxes they owe for that quarter. They also file annual documents to square the accounts and either pay the difference or request a refund.

Types of Tax Years

Individuals are generally required to use a calendar year if they have kept no records, have no accounting period, do not use a fiscal year, or fall under a provision of the Internal Tax Code tax regulations.

A tax year that follows the calendar year refers to the 12 consecutive months beginning Jan. 1 and ending Dec. 31.

Businesses can use either the calendar year or the fiscal year (FY) for their tax year reporting. However, once a tax year is adopted, the business must continue using it unless it receives permission from the IRS to change. If it changes to a tax year that differs from a calendar year, it is adopting a fiscal year.

A fiscal year is any period of 12 consecutive months that ends on any day of any month except for the last day of December.

Taxpayers who request an extension will have until Oct. 15, 2024, to file their taxes.

State Tax Years

Every state handles taxation independently of the federal system, but most impose income taxes and use April 15 as their required filing date. Virginia is an exception, with a filing deadline of May 1.

Several states do not have income taxes. New Hampshire, which has no income or sales tax, compensates with relatively high property taxes. The New Hampshire property tax year runs from April 1 to March 31 for all property owners.

Short Tax Years

A short tax year is a fiscal or calendar tax year that is less than 12 months long. Short tax years occur either when a business is started or when its accounting period changes.

A short tax year can also occur when a business decides to change its taxable year, which requires the IRS’s approval after the entity files Form 1128. In this case, the short tax period begins on the first day after the close of the old tax year and ends on the day before the first day of the new tax year.

For instance, imagine a business that reports income from June 1 to May 31 every year decides to change its fiscal year to begin in October. As a result, that business must report a short tax year from June 1 to Sep. 30.

History of the Tax Year

In early American history, taxes were a topic of heated debate because colonists were required to pay taxes to a government they no longer wished to answer to. After breaking free of colonial rule and declaring independence, the U.S. spent several decades passing and repealing tax legislation until the early 1900s. The 16th Amendment was finally passed in 1913, granting taxation authority to the federal government.

The first income tax was signed into law by Abraham Lincoln in 1862 to help pay for the Civil War.

When the 16th Amendment was passed, only a small number of very wealthy individuals were expected to pay federal tax—as the country expanded and the population grew, it became necessary to collect more taxes as the government (and expenses) broadened to match the federal programs being implemented.

Congress initially designated March 1 as tax filing day. This date was moved to March 15, 1918, and then April 15, 1954. When the deadline was changed the last time, the IRS claimed that it helped to spread out the workload due to so many returns arriving at once.

What Dates Are in a Tax Year?

Calendar tax years are Jan. 1 to Dec. 31, and fiscal tax years are 12-month periods that end in any month on any day except Dec. 31.

What Is the Tax Year for 2024?

When you file taxes in 2024, you’re filing your 2023 taxes. Taxes are due by April 15, 2024.

Can You Skip Tax Years?

There are civil and criminal penalties for not filing taxes. You can lose your refund, pay fines in interest and late fees, or even be taken to court by the IRS for not filing your taxes.

The Bottom Line

Taxes are an essential part of funding federal programs that benefit everyone. Therefore, it’s vital to ensure all taxes for a period are reported and paid by a specific date so that federal budgets can be created and programs funded.

Tax years allow governments to coordinate the reporting and collecting of taxes, which in modern times is a monumental task—in the U.S. in 2022, there were $2.6 trillion in individual taxes collected, $1.5 trillion in payroll taxes collected, and $425 billion in corporate taxes collected.