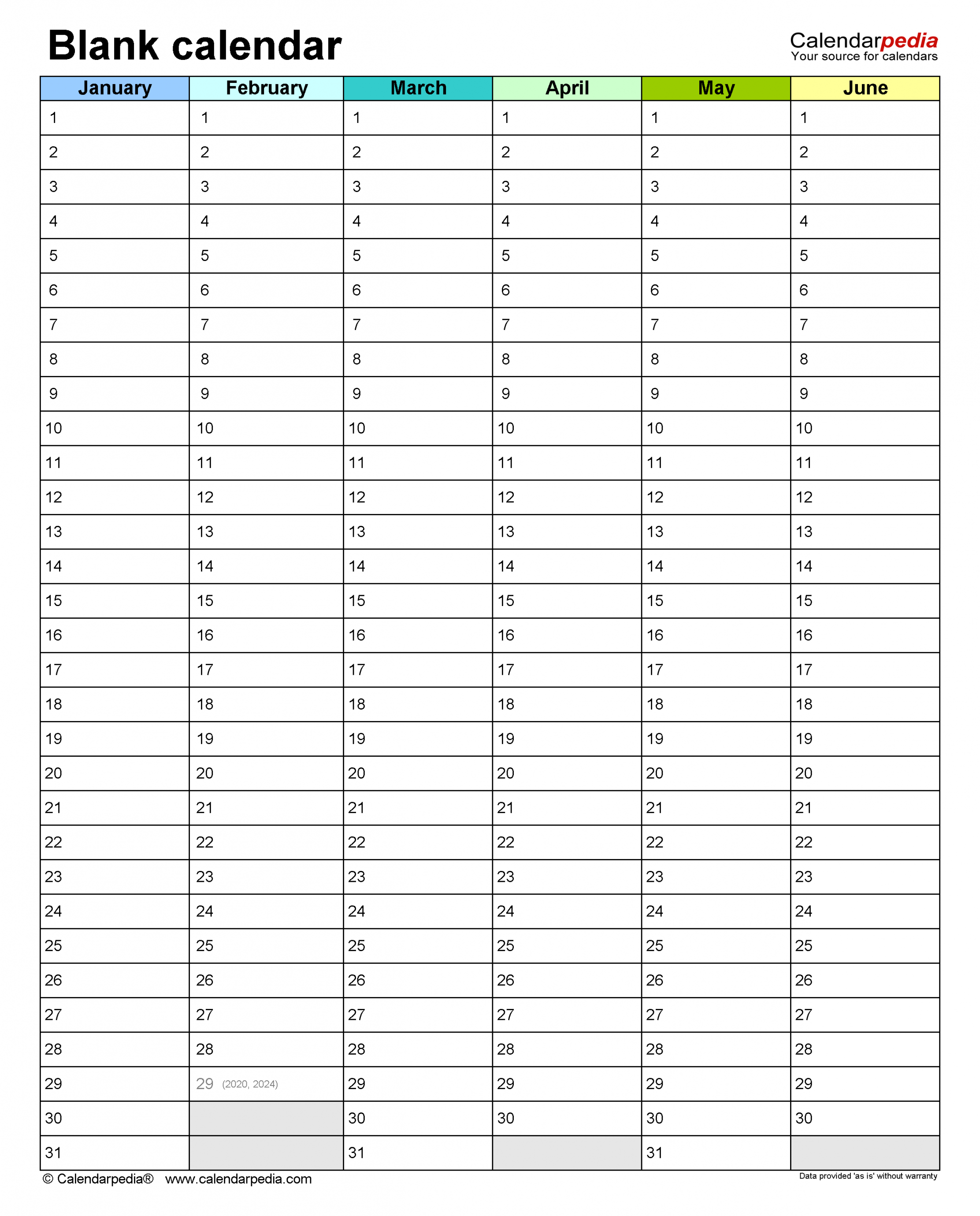

12 Month Calendar Word Template

Best 6-month CD rates for 2023 With a short-term CD you can earn a high rate of interest and withdraw the funds in just a few months. Getty Images

With the Federal Reserve setting its interest rate range at a 22-year high, many banks and credit unions have responded by raising the rates they provide to their own customers to attract deposits. Now, individuals can often find savings vehicles, such as high-yield savings accounts or certificates of deposits (CDs), paying near or even above 5%.

In this environment, many savers are turning to products like 6-month CDs to help grow their savings while retaining some flexibility.

Rather than committing to a long-term CD, one benefit of putting money in 6-month CDs is that you can re-evaluate what to do with your funds in the near future. If rates go up, you might renew your CD at a higher rate. If rates go down, you might look for other investments, such as stocks.

Short-term CDs can also have advantages over high-yield savings accounts by paying slightly higher interest rates. Plus, some people like the idea of separating their savings into another type of account, as you might be less tempted to use this money if it’s tied up in a CD, rather than sitting in your regular bank account.

So, if you’re looking for the best CD rates for 6-month terms, it helps to know which ones offer a strong mix of features such as high rates and broad access. Start searching for a high interest-earning CD here now.

Best 6-month CD rates for 2023

Here are some of the best short-term CDs currently available, listed in descending order by APY.

Merrick Bank: 5.50% APY

Merrick Bank has one of the best 6-month CD rates in the nation with a 5.50% annual percentage yield (APY), along with highly competitive yields on other durations, such as a 5.60% APY on a 12-month CD. Note that the bank requires a $25,000 minimum deposit, but if you have that much to save, then this could be a great place to earn some extra return on your cash. The bank also offers products such as credit cards geared toward those looking to build or repair their credit.

Bank5 Connect: 5.50% APY

Bank5 Connect, the online division of community bank BankFive, offers online access to some of the best CD rates for those living outside of Massachusetts and Rhode Island. The bank’s 6-month CD has a 5.50% APY with a $500 minimum deposit. Bank5 Connect also offers products such as a jumbo savings account, where balances of at least $25,000 can earn a 5.10% APY, with insurance for every dollar, including on amounts that exceed FDIC limits.

Bask Bank: 5.25% APY

Bask Bank is the online division of Texas Capital Bank and has one of the best 6-month CD rates at 5.25% APY with a $1,000 minimum deposit. One advantage of Bask Bank, beyond its competitive CD rates, is that it offers a unique savings account that lets you earn American Airlines reward miles instead of traditional interest.

Find a top interest-earning CD here today!

Prime Alliance Bank: 5.25% APY

Prime Alliance Bank is another community bank that offers some of the best CD rates online. Its 6-month CDs have a 5.25% APY with a $500 minimum. The bank also offers 12-, 18-, 24- and 36-month CDs with competitive APYs, ranging from 4.97%-5.25%. This similarity in rates could be attractive to those looking to build a CD ladder with relatively consistent payouts.

BMO Alto: 5.20% APY

BMO Alto, the online division of BMO, also has attractive CD offers. The bank’s online-only CDs have no minimum deposit, and its 6-month CD has a 5.20% APY. BMO Alto also has a high-yield savings account with no minimum deposit, no account fees and a 4.85% APY.

TAB Bank: 5.02% APY

This online bank specializes in serving truck drivers and trucking companies, but you don’t have to be in the transportation industry to take advantage of TAB Bank’s great CD rates. A 6-month CD at this bank has a 5.02% APY with a $1,000 minimum deposit. It offers this same rate for 9-month and 12-month CDs.

Synchrony Bank: 4.90% APY

Synchrony Bank is another great choice for savers looking for an online bank with some of the best CD rates. Its 6-month CD has a 4.90% APY with no minimum, and it also offers products like step-up CDs and no-penalty CDs for those looking for more flexibility. The bank also offers a 16-month CD—a term that many banks do not offer—that provides a 5.40% APY.

Start earning more money with a top CD rate here now.

The bottom line

Choosing one of these banks for a 6-month CD can be a great way to boost your interest earnings, but keep in mind that your decision might be driven by more than just where to find the best CD rates.

A slightly lower APY might be worth it, for example, if the bank or credit union makes it easy for you to deposit or withdraw money. Or, you might prefer a financial institution that you can work with long term, rather than just for the duration of a short-term CD. So, compare both rates and features of different banks and credit unions, and read reviews to see where you might be comfortable parking your money. Get started here now.

MoneyWatch: Managing Your Money More More