Irs Form W 9 Fillable Pdf

1099-MISC vs. 1099-NEC: Which One Do You Need?

Form 1099 is an IRS form used to report the payment of certain expenses annually to both the recipient and the IRS. Form 1099-MISC is used in the reporting of payments that are not subject to self-employment tax – things like rents and prizes. Form 1099-NEC is used for reporting non-employee compensation that is most likely subject to self-employment tax.

1099-MISC vs. 1099-NEC at a glance 1099-MISC1099-NECSent to recipient✔✔Submitted to IRS✔✔Filing deadlineJan. 31Jan. 31Types of payments recordedRents, prizes, medical payments and other awardsFreelancer/contractor income and other payments likely subject to self-employment tax

Tax code changes often, so stay on top of new tax laws and regulations.

What is Form 1099-MISC?

IRS Form 1099-MISC is a tax form used by businesses and individuals to report the payment of certain qualifying expenses paid over a calendar year. The form serves as a filing for the IRS as well as a receipt of payments for the payee, which they use in filing their own tax returns.

Form 1099-MISC is most often used to report miscellaneous (hence, MISC) payments that aren’t subject to self-employment tax. This includes things like rent, prizes and awards, legal settlements, and other qualifying reimbursements.

Employers issuing 1099-MISCs are required to have them prepared and filed no later than Jan. 31 for any payee that they pay over $600 in deductible expenses during a calendar year. Employers are also required to send a copy to the individual or business they pay so that the payee can use the 1099 to declare relevant income when filing their taxes.

Who uses Form 1099-MISC?

IRS Form 1099-MISC is very common, especially for individuals and businesses who own investment real estate or regularly buy supplies for clients. This form is used by rental property management companies and companies that award cash prizes or reimburse businesses or individuals for client-related expenses.

These are some common payments reported on Form 1099-MISC:

Rent: Tenants or property management companies issue a 1099-MISC to landlords to report rent paid in a calendar year.Prizes and awards: If you receive a large cash payment, including from casino winnings, you’ll receive a 1099-MISC to report your winnings.Legal settlements: Payments such as legal settlements are also reported on a 1099-MISC.Some reimbursements: If you’re a contractor who is regularly reimbursed for supplies or other items you purchase for clients, these payments aren’t subject to self-employment tax and may be reported on Form 1099-MISC.

While a 1099-MISC is frequently used to record certain tax-deductible payments made by businesses or individuals, it’s not used for everything. Most notably, Form 1099-MISC isn’t used when reporting non-employee compensation that is subject to self-employment tax for the payee. For that, you need Form 1099-NEC.

Form 1099-MISC is used to report business-related payments that are not subject to self-employment tax.

What is Form 1099-NEC?

Form 1099-NEC is also an IRS form used for the reporting of certain tax-deductible payments by businesses and individuals. “NEC” stands for non-employee compensation, which is what the form is used to report. Specifically, Form 1099-NEC is used by businesses and individuals to report compensation paid to independent contractors that’s subject to self-employment tax.

Like Form 1099-MISC, Form 1099-NEC is also required for any payees whom businesses or individuals pay more than $600 in qualifying payments during a calendar year. And, like Form 1099-MISC, the deadline for preparing and filing Form 1099-NEC is Jan. 31, and a copy must be sent to the payee once it’s filed.

Even if payments are for non-employment compensation, a 1099 may not be required in certain cases, such as if the recipient is a corporation.

Who uses Form 1099-NEC?

IRS Form 1099-NEC is extremely common among freelancers, independent contractors and other independent service providers – really anyone who does more than $600 worth of work for a business client in a year without being employed by that business or individual as a full-time W-2 employee or through a temp agency.

Form 1099-NEC is common in self-employment situations.

Freelance work: Writers, editors, designers and other freelancers, whether operating as LLCs or sole proprietors, will receive a 1099-NEC for compensation received during a calendar year.Contract work: Any contractors who aren’t paid as W-2 employees through a staffing firm (or otherwise have employment taxes withheld) will receive Form 1099-NEC.Independent services: Any small businesses doing things like web design, legal or accounting work, or network administration services will likely be subject to this type of reporting.

Form 1099-NEC is much more common than Form 1099-MISC among the self-employed and for service businesses. It’s important to note, though, that a 1099 (MISC or NEC) is not required in all circumstances. For example, if the company providing the service (the payee) is registered as a corporation, the business or individual employing that service provider does not need to issue a 1099. [Related article: Self-Employed? Everything You Need to Know About Taxes]

Similarly, if the service provider is paid by credit card, the individual or business paying for the service does not need to issue a 1099 because payment is technically being made by the payer’s credit card company.

Information required for Form 1099-MISC and Form 1099-NEC

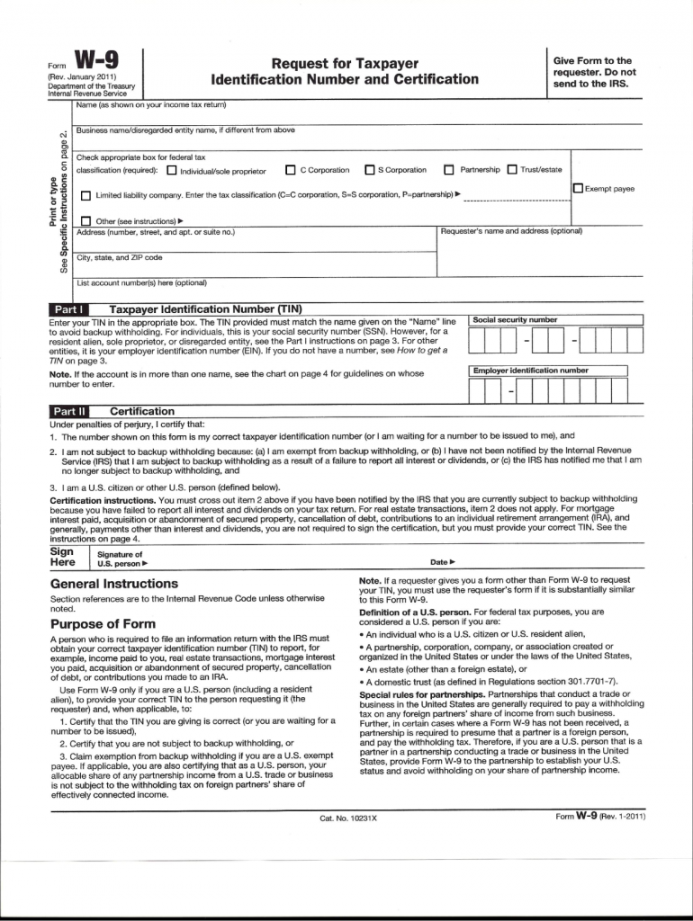

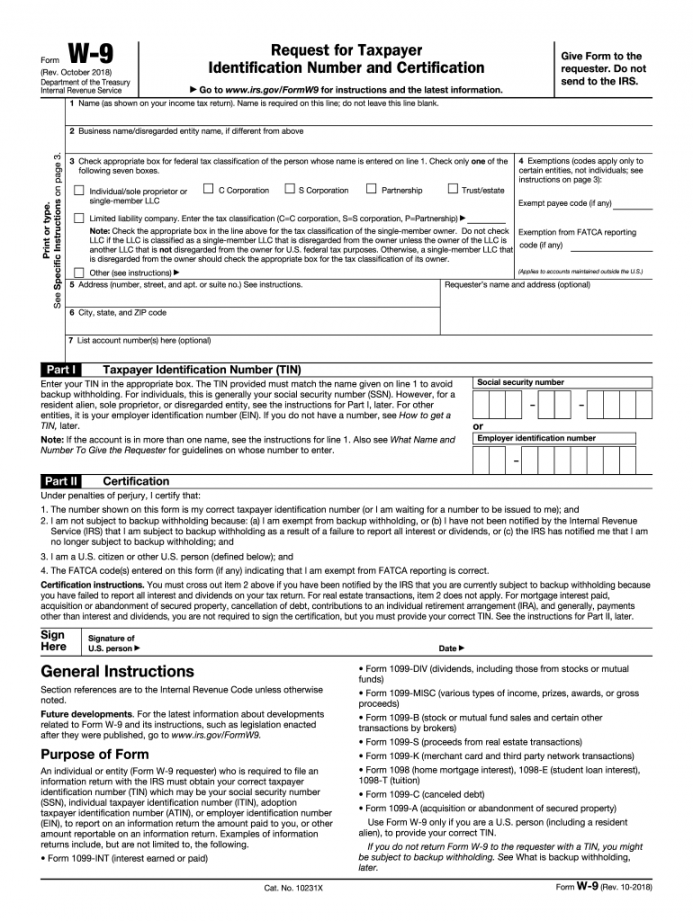

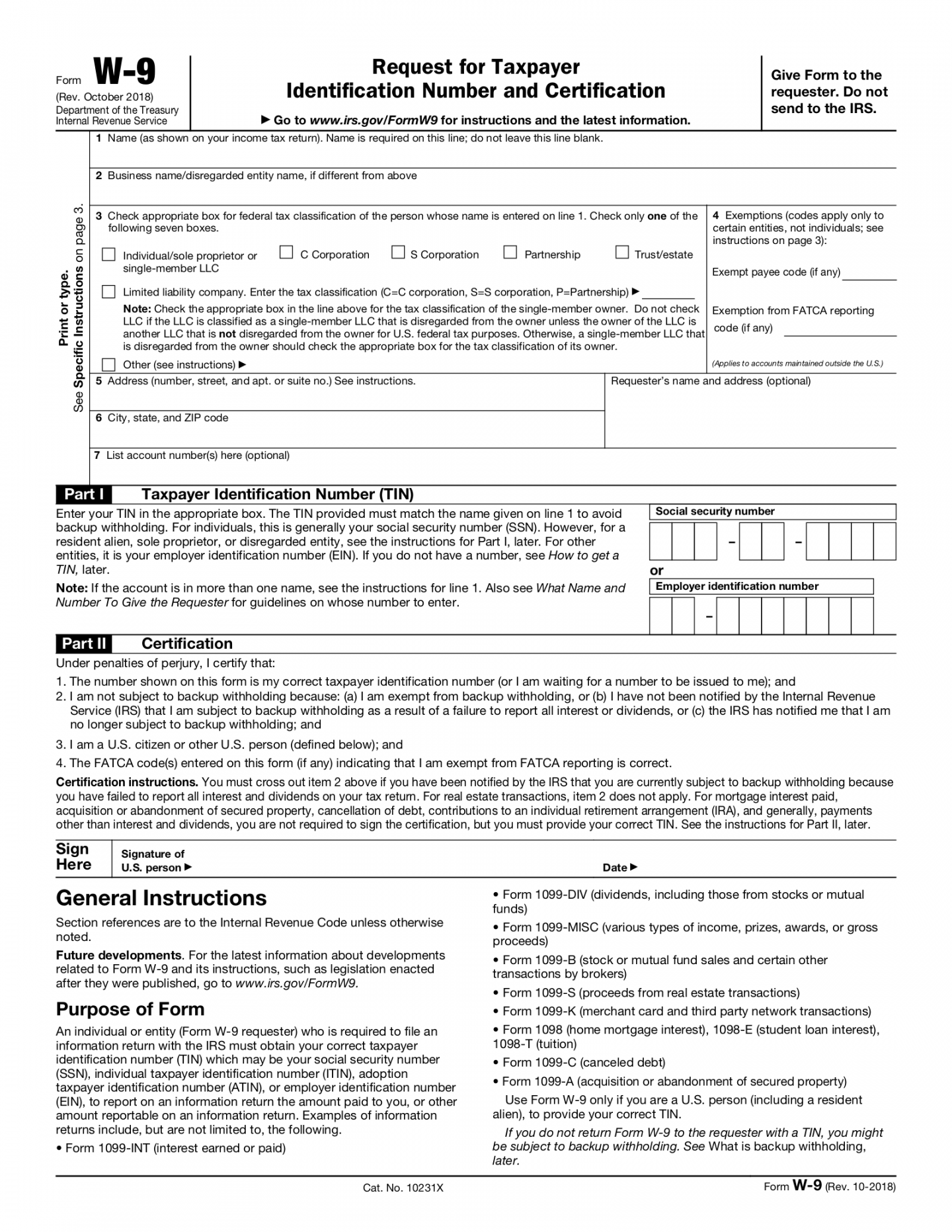

When completing a 1099, employers are required to include several pieces of information about the payee. This information typically comes from the payee’s Form W-9, which the employer is required to collect from an independent contractor when they start working together.

Payee name: The form must include the name of the payee, whether they’re an individual or company.Payee type: The form also reflects the payee entity type, whether it’s an individual, partnership, corporation, etc.Address: The payee’s mailing address goes on the form.Tax ID: The tax ID associated with the payee also goes on the form.Instructions for Form 1099-NEC and Form 1099-MISC

In the case of both Form 1099-NEC and Form 1099-MISC, there is a process for qualifying to have income reported via 1099, providing the requisite information for the form, having the form prepared and filed, and providing a copy to the payee for use in preparing their own taxes.

Follow these five steps to report income on Form 1099-NEC or 1099-MISC:

Qualify. The first step in using a 1099-NEC or 1099-MISC is to qualify. This may mean winning some sort of prize or getting hired by a company as an independent contractor.Complete a W-9. When you get hired or win a prize, the first thing you’ll be asked to do is complete Form W-9, which provides certain information to the individual or company that will be paying you that they’ll need later when completing your 1099.Perform and get paid. Once you’ve provided your information to the company that will be paying you, you’ll need to actually receive the payment. If you’re an independent contractor, this will also require rendering whatever service you were hired to perform.Prepare a 1099. It’s generally easy for the individual or company that issued at least $600 in qualifying payments to prepare a 1099-MISC or 1099-NEC. This has to be done by Jan. 31, with one copy going to the IRS and another to the payee.File taxes. Once the payee receives their 1099, they use the form to report their income on their tax return before the tax filing deadline (April 15, or Oct. 15 if they file an extension).

If you want to learn more about tracking 1099 income or completing 1099s for qualifying contractors, visit our best accounting software guide. Most accounting software makes it easy to prepare and issue 1099s using information gathered from contractors on their W-9s.