Irs Forms W 9

W9 vs. W2: Everything you need to know W9 vs. W2: Differences overview What is a W2?

Also called a ‘wage and tax statement,’ a W2 form is an annual tax form employees receive from their employers around January 31 of each calendar year. This form must be supplied if the employee earned more than $600 from that employer throughout the year. Employers use the information employees filled in on their W4 forms to file the W2 form.

The form outlines the compensation an employee has received from their employer in the previous calendar year, such as:

Salary, wages and tips. Nonmonetary compensation that’s considered taxable. Federal taxes withheld and paid on the employee’s behalf, such as income, Medicare and Social Security taxes. State taxes withheld and paid for on the employee’s behalf, if applicable.

For example, if you worked for your employer from February to December 2023, you can expect to receive your W2 around January 2024. Employees don’t need to do anything — the form will be sent automatically by the employer.

“Employers are required to provide W2 Forms to employees with copies also sent to the IRS and relevant state tax agencies,” says Riley Adams, a CPA licensed in Louisiana. “For many taxpayers, this is the most important tax form needed to prepare their annual tax returns.”

Featured Payroll Software Offers

Monthly fee

Starting at $40 plus $6 per month per employee

Monthly fee

$99 plus $5 per month per employee

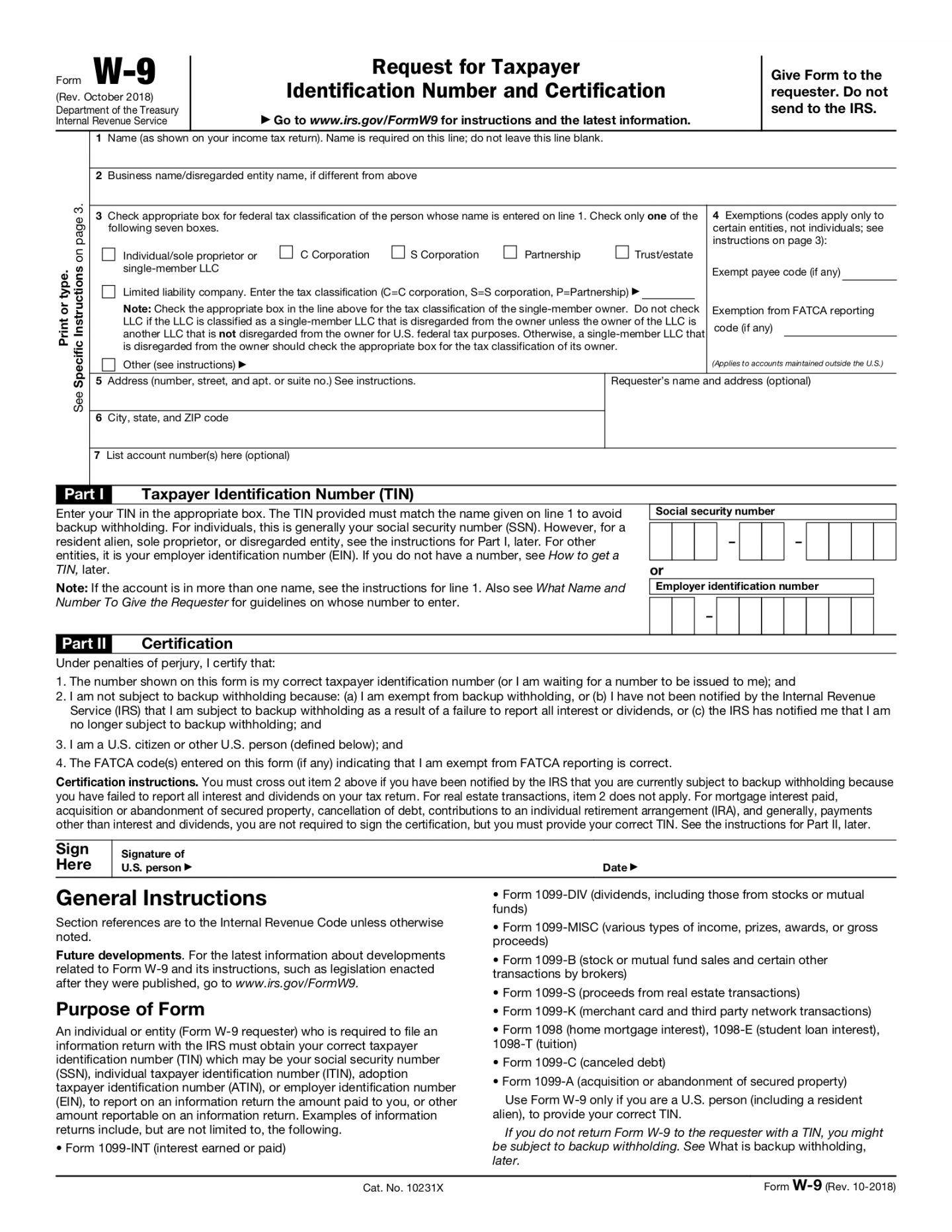

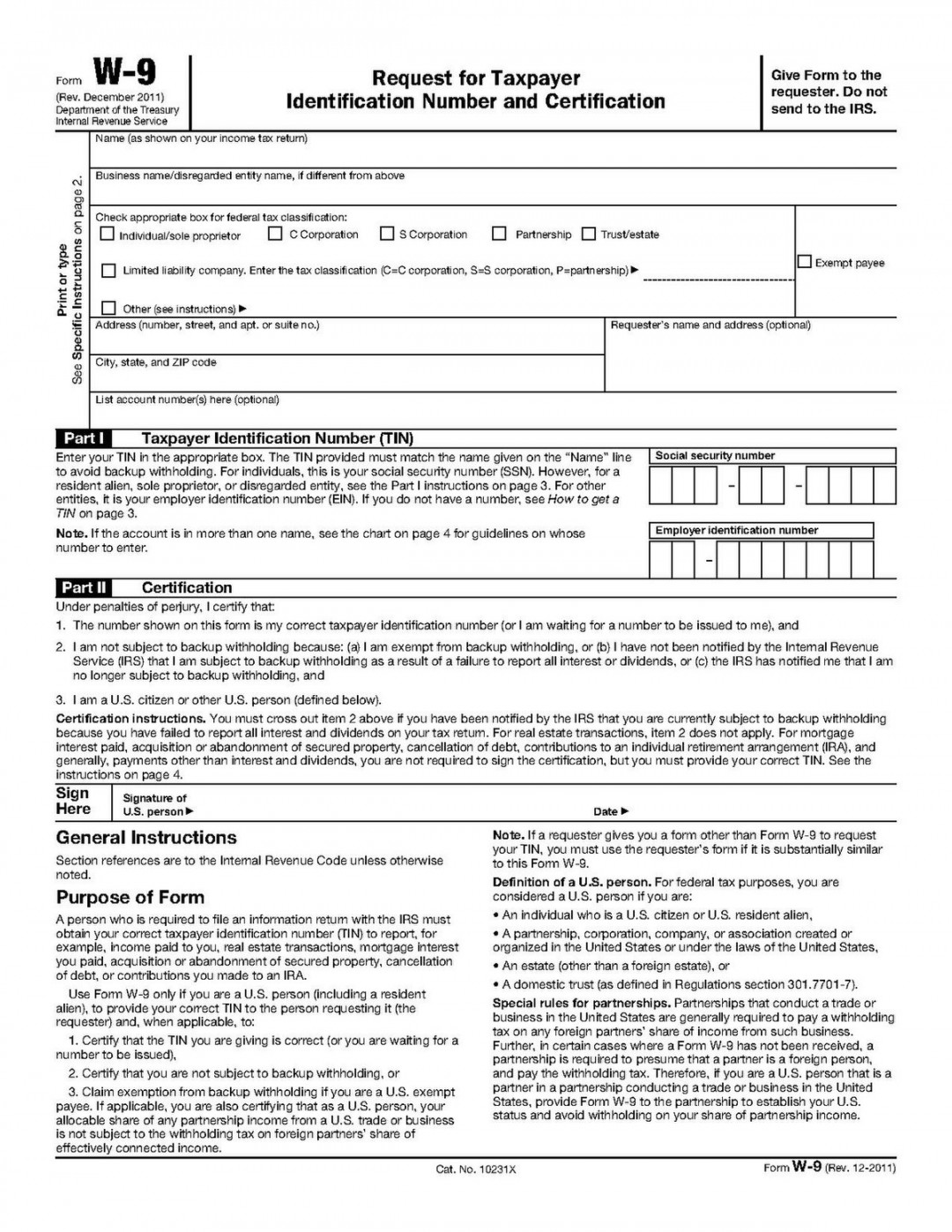

What is a W9?

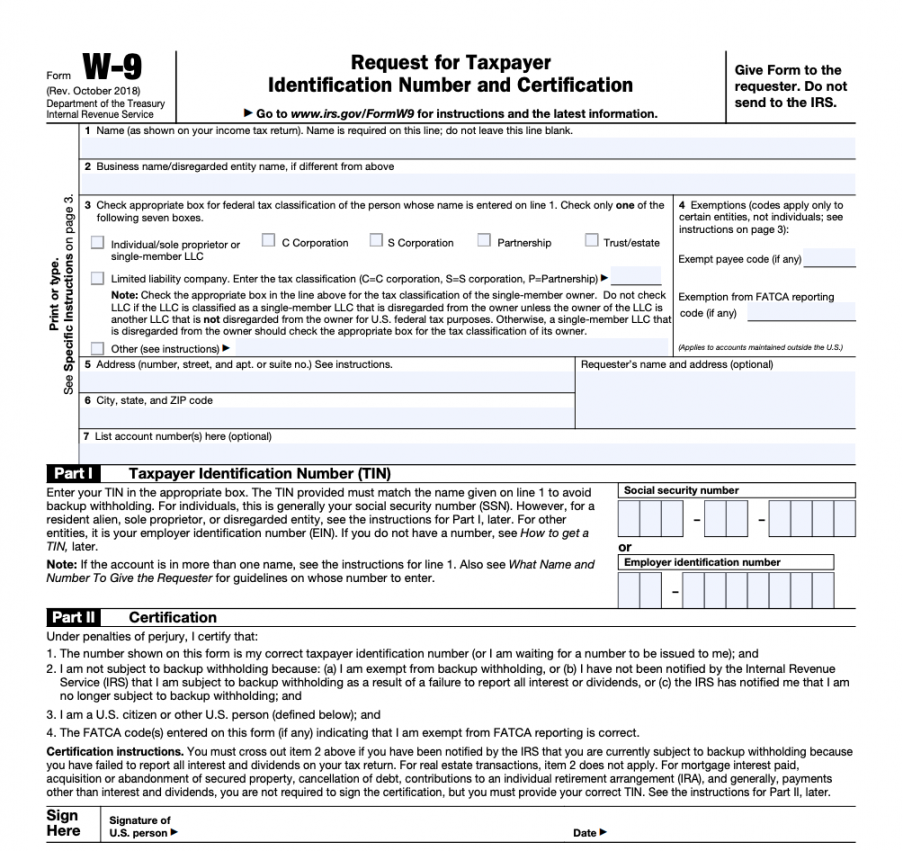

A W9 form is used by employers to collect tax information for independent contractors or an income earner not considered an employee. Think of this form as an official request for information in order for a company to confirm a contractor’s taxpayer identification number (TIN) — whether that’s their Social Security number or employer identification number (EIN) — and identifying information needed to report earned income, including:

The contractor’s full name. The company name that the contractor works under (if applicable). The type of business entity the contractor has set up to sell their services (such as a limited liability company, or LLC, an S Corp or a sole proprietorship).

Companies can request that contractors submit a W9 electronically or by filling out a paper form. This form is only supplied to the IRS upon request.

The information on the W9 is used by companies to prepare form 1099, which shows all income a contractor received in a given year. Unlike a W2 form, this form will show no tax withholdings because the contractor is responsible for withholding and paying income, Social Security and Medicare taxes.

If the contractor earns more than $600 throughout the year, the 1099 form is sent to the contractor at the beginning of each calendar year and reports the income paid the previous year. Not all contractors receive a 1099 even though they submitted a W9, so it’s best to contact the company for which services were rendered if you don’t receive one as expected.

W2 and W9 exemptions W2 exemptions

In certain circumstances, some employees require less or no tax withholdings from their earnings. For example, a married employee or one with dependents needs less withholding throughout the year than a single person with no dependents. Employees need to indicate if they qualify for any exemptions when filling out the W4 and update this form each year. However, exemptions here will only apply to income taxes, not withholdings for Medicare and Social Security taxes.

Then, throughout the year and when preparing a W2, an employer must refer to an employee’s withholding data to determine withholding amounts from wages earned and accurately report them for tax purposes.

W9 exemptions

Contractors who fill out a W9 form need to enter a code in the correct part of the form if they’re exempt from any backup withholdings. Examples of when a contractor may be exempt from backup withholdings include in the case of:

Broker transactions. Barter exchange transactions. Dividends. Interest payments. Distributions from a medical or health savings account. Distributions from qualified tuition programs. Certain real estate transactions. Certain cancelled debts. Some fish purchases for cash.

In addition, any entities or individuals that are exempt from reporting any taxes under the Foreign Account Tax Compliance Act, or FATCA — an act that impacts foreign financial entities with foreign-held assets — will most likely need to enter another code in the correct box on the W9.

“These number or letter codes are found on page three from the W9 instructions,” says Adams.

Where to find the correct tax forms

The IRS website is the best source to find the correct tax forms needed to remain in compliance as a business. For example, the IRS provides the following blank W2 and W9 forms for employer, employee or contractor use:

If you’re an employee looking for your W2, your employer may mail you a paper copy or send one electronically through their payroll system each January in preparation for your filing of your yearly income tax return.

However, as a contractor, instead of sending you a W9 form, your client will use your W9 form to fill out and send you a 1099 form each year for your yearly income reporting needs. As such, you will not receive a copy of your W9 form automatically from a client.

Employers can also look for the correct tax form through their payroll software. “Payroll software will typically automate the distribution and collection of these two forms to keep the company in compliance with tax laws,” says Adams. “They are a good source to find the correct tax forms.”

Frequently asked questions (FAQs)

Is it better to be a W2 or W9 employee?

There isn’t a one-size-fits-all way to tell if it’s better to be a full-time employee or work as a contractor. The amount of taxes you ultimately pay for either type of employment will depend on factors such as your income and available deductions. There are benefits and drawbacks to both.

Do W9 employees pay more taxes?

Those who are considered self-employed (and so use W9 forms) typically pay more taxes than employees because they’re required to pay income and self-employment taxes. Self-employment taxes include Medicare and Social Security taxes. If employed, an employer covers half of these taxes. However, if self-employed, the contractor must pay all of these taxes.