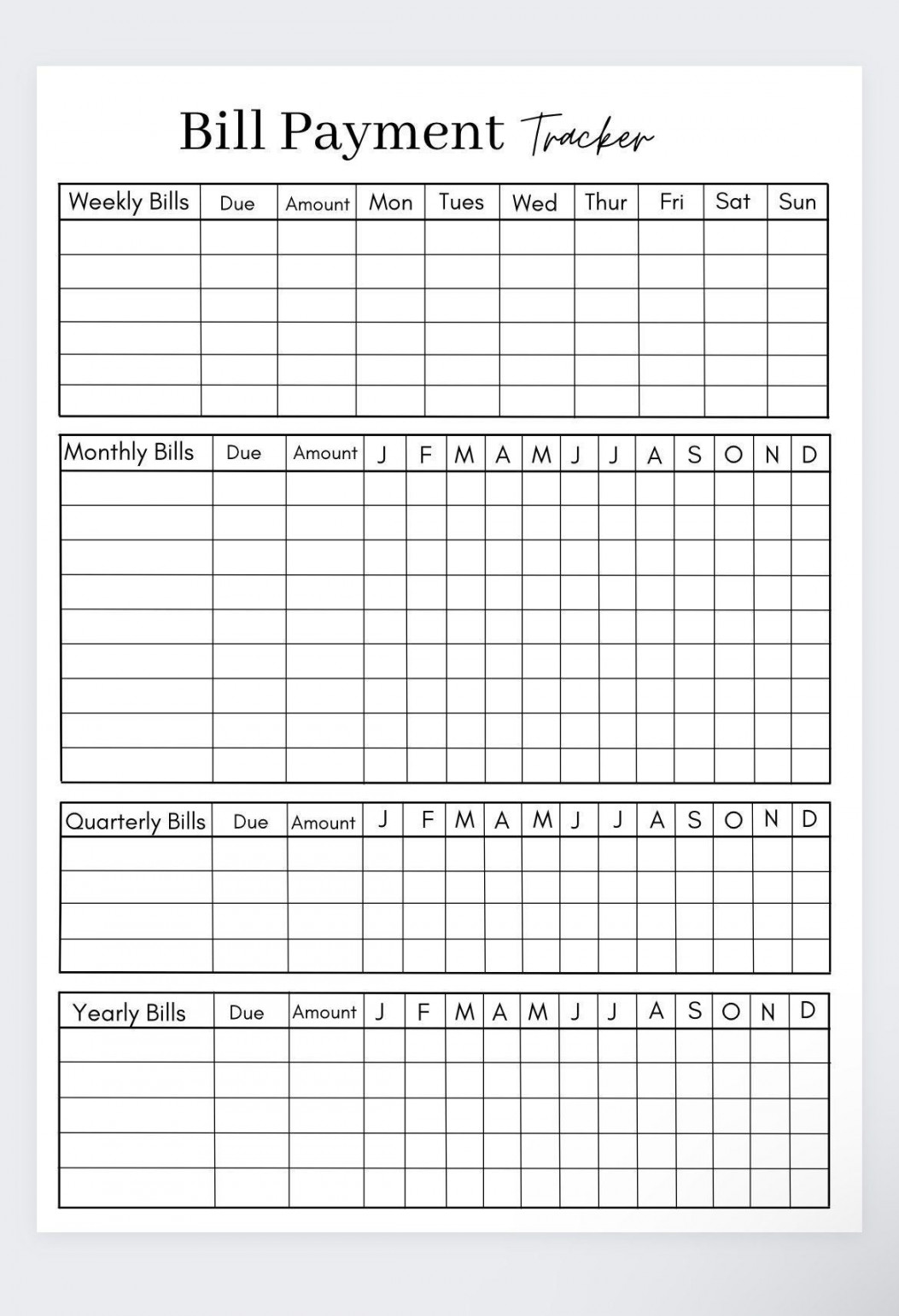

Free Weekly Bill Payment Template

Intuit introduces QuickBooks Bill Pay

Today, Intuit Inc. (Nasdaq: INTU), the global financial technology platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and Mailchimp, announced a new solution fully integrated within Intuit QuickBooks that transforms bill pay for businesses and delivers accounts payable (AP) automation – QuickBooks Bill Pay.

“Across the QuickBooks platform, we’re revolutionizing money movement to improve the number-one problem small businesses face – cash flow – which impacts their success rates,” said David Talach, Senior Vice President of the QuickBooks Money Platform at Intuit. “QuickBooks Bill Pay is a key addition to our ecosystem as we aim to deliver a singular, end-to-end financial solution for small businesses to manage their money. Integrating Bill Pay with our other money offerings enables our customers to leverage game-changing automation capabilities and have the visibility and clarity they need when it comes to their finances.”

For many business owners, managing bill payments to vendors and contractors means piecing together disparate solutions, creating a complex and time-consuming web that can lead to late or missed payments, potentially impacting cash flow management and vendor relations. QuickBooks Bill Pay solves this problem head on, with tracking and paying bills now seamlessly integrated within the QuickBooks platform – a suite of powerful financial and accounting tools, delivering unparalleled benefits of simplicity, speed, and accuracy that can help businesses manage their money more effectively. And with QuickBooks’ integrated AP automation capabilities, small businesses save valuable time with manual entry reduced by 48%¹.

QuickBooks Bill Pay provides small and mid-sized businesses with time-saving automation, digitized record-keeping, seamless payments, advanced controls with roles and permissions for their team, and simplified vendor and contractor management. Businesses can:

Create bills automatically: Import vendor invoices and QuickBooks will automatically create a bill. All businesses have to do is review and save.Assign ownership roles to employees: QuickBooks Bill Pay Elite customers can share roles and permissions to decide who can create, approve, and pay bills.** Setting rules helps to customize the bill approval process and automate work, while limiting access to other QuickBooks functionality.Effortlessly organize their books: When paying vendors and contractors through QuickBooks, the transaction will automatically be recorded and matched for the business in their books using QuickBooks integrated AP automation capabilities.Go paperless and stay tax ready: Keep digital records of bills and payments in one place, rather than across multiple platforms, spreadsheets, or folders.Choose how to pay vendors or contractors: Send electronic payments or paper checks with the help of QuickBooks. Even if your vendor prefers paper checks, you don’t have to spend extra time issuing and mailing them.Stay on top of 1099s: With vendor information in one place, businesses can see everyone who needs a 1099 at a glance, allowing them to stay compliant. With QuickBooks Bill Pay Premium or Elite, businesses can also file unlimited 1099s for no additional fee.

QuickBooks Bill Pay also enhances the Intuit QuickBooks Business Network, one of the largest business-to-business (B2B) networks aimed at accelerating and automating B2B payments and improving overall cash flow. Now, when a small business sends a payment through QuickBooks Bill Pay, vendors who are not part of the QuickBooks Business Network will receive an invite to join. If they choose to sign up, the vendor can save their payment details securely to their network profile for future payments, saving time and reducing errors often associated with manual entry and eliminating the need to share this information with multiple parties. Once part of the network, vendors can also track the status of their incoming QuickBooks Bill Pay payments.

QuickBooks Bill Pay has a plan to meet the needs of businesses of any size. Eligible QuickBooks Online customers in the U.S. can choose between three flexible QuickBooks Bill Pay pricing plans, all of which include expert support. The QuickBooks Bill Pay Basic plan, which has no subscription fee, includes five free standard ACH payments per month, and two additional paid plan options (Premium or Elite) provide small businesses with additional standard ACH payments per month**, custom bill approval workflows, unlimited 1099s issued to contractors or vendors, and predefined roles and permissions to empower a small business’s team.

For a limited time, QuickBooks is also giving businesses 50% off the monthly base price for QuickBooks Bill Pay (Premium or Elite) for the first three months of service, starting from the date of enrollment. To be eligible for this offer, you must be an existing QuickBooks Online customer and a new Bill Pay customer and sign up for the Premium or Elite monthly plan.*

1. Reduce manual entry by 48%: Based on U.S. QuickBooks customers who record bills in QuickBooks using automation tools on the Apps/Bills page compared to customers not using these tools, from November 2022 to March 2023.