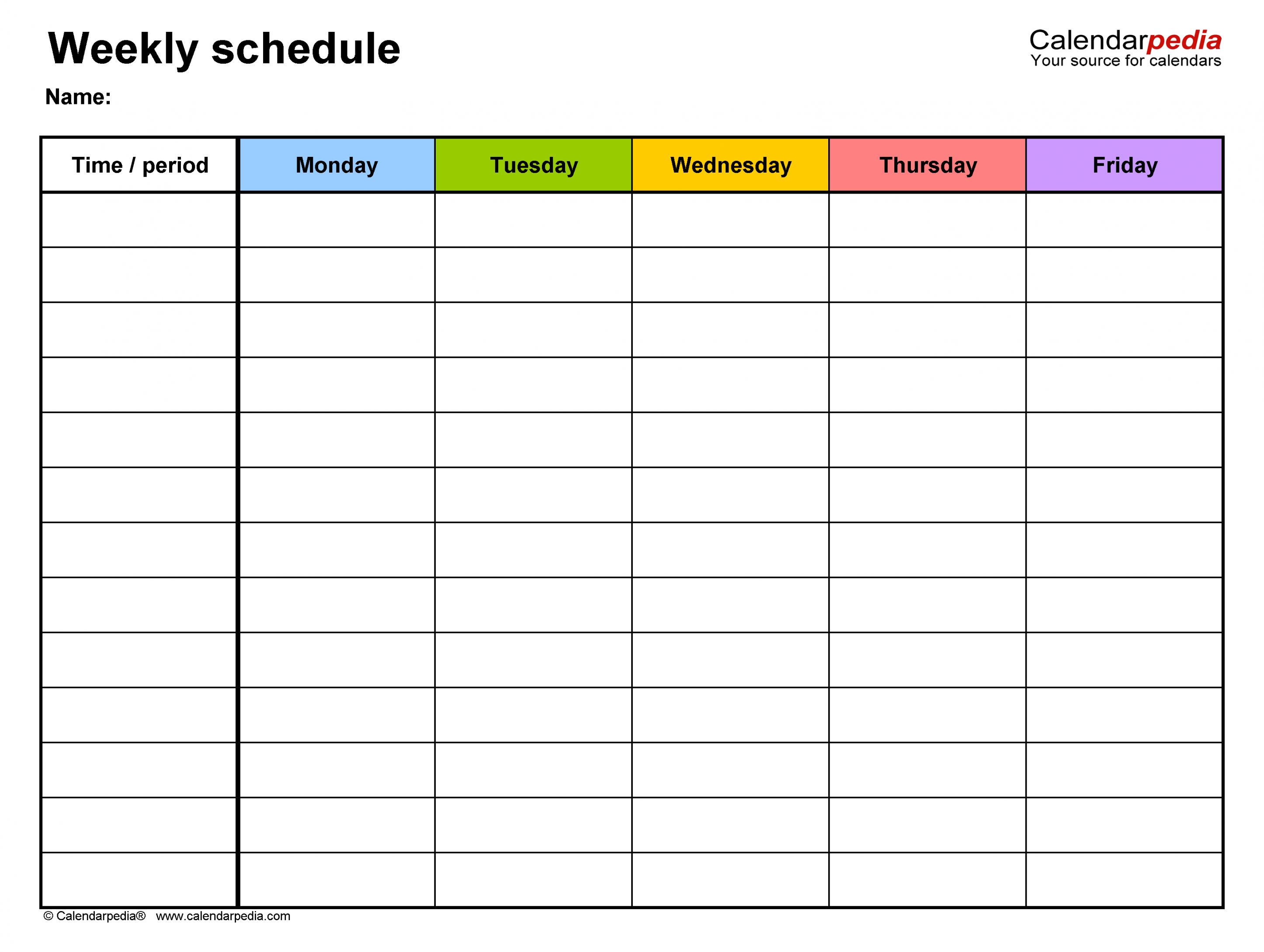

Monday To Friday Timetable Template

How to start an LLC in Maine in 2023

Forming a limited liability company (LLC) can reduce your personal liability and offer a number of benefits and protections. However, every state has different LLC formation requirements. In this guide, we break down the steps to start an LLC in Maine and offer resources to help you along the way.

Here are the 8 steps to start an LLC in Maine.

8 steps to start an LLC in Maine 1. Select a business name

Your first step is to select a name. When done correctly, you can protect your brand from potential legal entanglements and help ensure its successful marketing. Consider brainstorming two or three acceptable names. There is no guarantee your name is available for use and brainstorming more than one can save you headaches later in this step. As you select names, incorporate Maine’s naming guidelines.

Once you have brianstormed at least one name that complies with the above guidelines, you must search for the business name using Maine’s corporate name search tool. If your name shows up in the results of your search, it is already in use by another business in the state and cannot be used by your LLC.

If your chosen name is already in use, you can either choose a completely different name or “distinguish” it. Distinguishing a name means changing letters or words to make it different from the already-used name. Return to Maine’s naming guidelines to learn acceptable ways to distinguish your name.

Once you have a distinguished and available LLC name, ensure the name is not already taken on a national level. To do so, look up the LLC name in the United States Patent and Trademark Office’s trademark electronic search system (TESS).

If you are not yet ready to formally establish your LLC but have chosen a name, you can reserve the name for up to 120 days. To do so, submit form MLLC-1 — application for reservation of name and the required $20 filing fee. Note that once the 120 days have expired, you cannot renew the reservation. So, to keep the name, you must file your articles of organization within this time frame (see step three).

To learn more about how to name a business and how to protect the name you’ve chosen, read our business naming guide.

Our Partners

Free version available

Yes

Lowest published package price

$199

Free version available

Yes

Lowest published package price

$249

Free version available

Yes

Lowest published package price

$199

2. Designate a registered agent

When submitting formation documents for your Maine LLC, you’re required to list a registered agent. A registered agent’s primary responsibility is to accept legal documents and correspondence on your LLC’s behalf and ensure the LLC receives those materials. For example, they may accept reminder documents from the state telling you to file your annual report soon or a notification that your LLC has been named in a lawsuit.

You can appoint an individual registered agent or work with a registered agent service to handle everything for you. The state of Maine also offers a commercial registered agents list, which comprises the registered agents that have requested to be listed with the state.

Or, you can choose your own registered agent (a noncommercial registered agent), which can offer advantages like the ability to expand to other states, better pricing and complementary features to help you remain in good standing with the state of Maine. To find the best registered agent service provider, read our best registered agent services guide.

For more information on your LLC’s registered agent requirement, your options to fulfill this requirement and the benefits of each, read our registered agent guide.

3. Draft an operating agreement

To start an LLC in Maine, you’re required to have an operating agreement, which Maine refers to as a limited liability company agreement. In Maine, this operating agreement must be filed at or around the time you file your LLC certificate of formation (see step four). Because it takes effect when you file your certificate of formation, we advise you to already have it in place so you are following its legal contents when it takes effect.

An operating agreement serves your LLC in many ways. First, it gives you control over how your LLC will operate, even if your wishes contradict state rules. It also enhances your limited liability protection if your LLC is ever sued or must file for bankruptcy. In addition, its clear operating guidelines help to prevent and resolve member disputes.

You can begin drafting your Maine operating agreement by using a free template. For example, Rocket Lawyer and Northwest Registered Agent offer a template for a Maine limited liability company agreement.

However, these templates are often quite generic and may not address the LLC’s unique needs. Since this is an important legal document for your business and one that is required in Maine, once you’ve filled out the template, consider hiring a business attorney to make sure you have an agreement that is adapted to your operational needs. Rocket Lawyer and LegalZoom both offer business legal consultation services.

To learn more about the benefits of an operating agreement and how to create one, read our LLC operating agreement guide.

4. Submit a certificate of formation

Once you’ve chosen a name and a registered agent for your LLC, register your entity with the Maine Secretary of State. To do so, most states require you to either fill out an articles of organization or an articles of formation form. In Maine, you must fill out and submit a certificate of formation (form MLLC-6) and pay the $175 filing fee.

Beyond providing basic information about your LLC, such as its name and registered agent, you need to indicate if the following items apply to your LLC, which is likely not the case:

You’re considered a low-profit LLC: This type of LLC must officially qualify as a low-profit limited liability company by, in part, significantly furthering the accomplishment of a charitable or educational purpose and by not prioritizing the production of income or accomplishing a political or legislative purpose. You’re a professional LLC: A professional LLC must be designated as such by, in part, being made up of all licensed, certified or legally authorized professionals that are offering services within their industry. For example, it may be a firm with several attorneys or certified public accountants (CPAs) or a veterinarian practice with several practicing veterinarians.

Once completed, unlike in other states that allow you to file LLC formation paperwork online, Maine requires you to mail the certificate of formation to the Maine Department of the Secretary of State. The accompanying filing fee can be paid by a money order or check payable to the “Maine Secretary of State” or by filling out Maine’s pay by credit card form. The address where you should send your form and payment is located on the bottom of the form.

To learn more about filling out and submitting this form, read our LLC articles of organization guide.

5. Apply for an employer identification number (EIN)

An employer identification number (EIN) is issued by the IRS and identifies your business for tax administration purposes. In addition, it is required to complete key business tasks, such as opening a company bank account, hiring employees, obtaining business licenses and permits and accessing some forms of business funding.

Applying for an EIN is free and only takes a few minutes. To complete the application, visit the IRS’s apply for an employer identification number (EIN) online page between 7 a.m. and 10 p.m. Eastern Standard Time, Monday through Friday. Fill out the application as prompted. This application must be completed in a single session, as there’s no option to save and submit it later.

After you submit the application, you’ll receive your EIN immediately in a confirmation document. Print the form and keep it with your other important LLC documentation, such as your operating agreement.

For more information about what to expect as you fill out this form, read our employer identification number (EIN) guide.

6. Apply for business licenses and permits (as necessary)

While the state of Maine does not require a general business license to operate, you may need to apply for a business or professional license or permit at the city level. Research city-specific requirements by visiting your town office or municipal website. Here you can identify the appropriate person and their contact information to learn more.

Some professions also require a license, such as counselors, physicians and insurance providers. To cover your bases, visit Maine’s resources by profession page and select your profession. When you do, you will be presented with licensing information, applications, regulations and resources related to your profession and its operating requirements.

7. Register with Maine’s revenue services

Register your business with Maine Revenue Services to pay any taxes that apply to your business. Here are some relevant tax examples new LLCs can pay using this portal:

Withholding tax: This tax must be paid when you withhold taxes from LLC employees’ wages. The rate depends on many factors, including employees’ marital statuses and preferences. Sales and use tax: This 5% tax is paid on the retail sales of tangible personal property and taxable services in Maine, including telephone services, automobile rental or leasing companies and hotel rental companies. A different tax rate applies to some industries, such as food or liquor retailers. Service provider tax: This 6% tax is imposed on the value of some services sold in Maine, such as home support services, community support services and video media rental services. Pass-through entity withholding: This 7.15% withholding tax is imposed on businesses with non-Maine-resident members. Health care provider tax: If your LLC is a nursing home, you must pay 6% of the LLC’s annual gross patient services revenue.

To register your LLC with Maine Revenue Services, go to the Maine Revenue Services tax portal page and click “create a username” to begin your account setup. Follow the prompts to register your LLC. Once you’ve completed the application, you will be guided through the account confirmation process.

8. File an annual report

An annual report updates the state on important information about your business, such as your current members’ names and confirmation that your registered agent has not changed. This document is important for keeping your LLC active. Not filing by the due date puts your LLC at risk for automatic dissolution.

After setting up an LLC in Maine, you’re required to submit an annual report (form MLLC-13) by June 1 of each year and pay an $85 filing fee. If you are filing as a foreign LLC, the filing fee is $150.

To simplify the filing process, you can create a username and password on Maine’s annual reports online page by clicking “file a single annual report.” Follow the prompts to go through the filing process, pay your filing fee and submit your annual report.

Find the best LLC services for Maine: Best LLC services of 2023

Our top recommended LLC service for Maine

Best LLC service

Rocket Lawyer

Frequently asked questions (FAQs)

Can I set up an LLC for free in Maine?

To start an LLC in Maine, you must pay a $175 filing fee to submit the certificate of formation. An annual report must also be filed each year with a domestic filing fee of $85 or a foreign filing fee of $150. Learn more about potential fees by reading our cost to start an LLC guide.

Do Maine LLCs pay taxes?

In most cases, Maine LLCs don’t directly pay taxes. LLCs are generally considered pass-through entities. This means that the responsibility to pay taxes passes through the business and to the member(s). However, there are some taxes that may apply, such as withholding taxes if you’ve hired employees or sales tax on the retail sales of some products or services. If you’ve opted for a different tax treatment, your LLC may pay corporate taxes. It’s best to reach out to a tax professional for tax advice regarding your business.

Do I need a registered agent in Maine?

As part of setting up an LLC in Maine, you are required to appoint a registered agent. To learn more about this requirement, read our registered agent guide. To learn more about your option to hire a registered agent, read our best registered agent services guide.

Do Maine LLCs need to file an annual report?

Maine LLCs must submit an annual report either online or by mail by June 1 of each year. The filing fee is $85 for domestic LLCs and $150 for foreign LLCs. Not filing your annual report could result in your LLC’s administrative dissolution.

How do I dissolve an LLC in Maine?

To dissolve an LLC in Maine, follow the dissolution instructions in your operating agreement. Then, fill out and submit Maine’s certificate of cancellation form and pay a $75 fee. You can mail the form to the Maine Department of the Secretary of State. In the form, you’ll need to include the LLC’s start date, dissolution date and the date you wish the cancellation to take effect. The form must also be signed and dated.