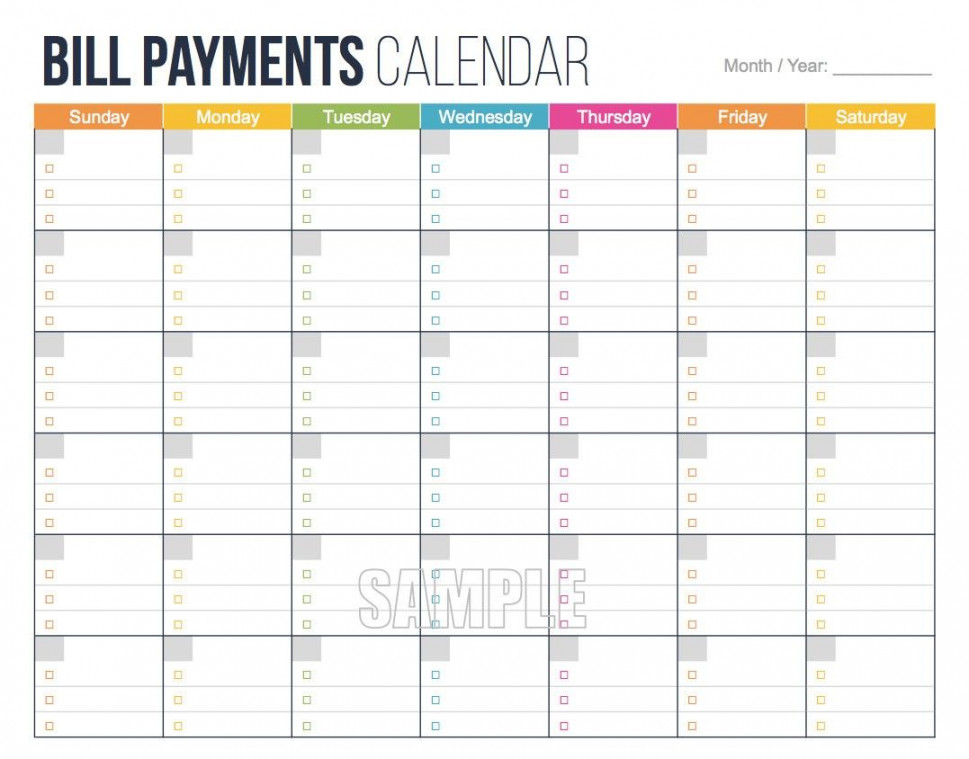

Monthly Bill Payment Calendar Template

Conquering Cash Chaos: Your Guide to Monthly Bill Payment Calendar Templates

Juggling bills can feel like a high-wire act without a net. Between rent, utilities, subscriptions, and a million other recurring expenses, it’s easy to get lost in the financial shuffle. But fear not, fellow budget warriors! Enter the monthly bill payment calendar template, your secret weapon for slaying due date dragons and achieving financial zen.

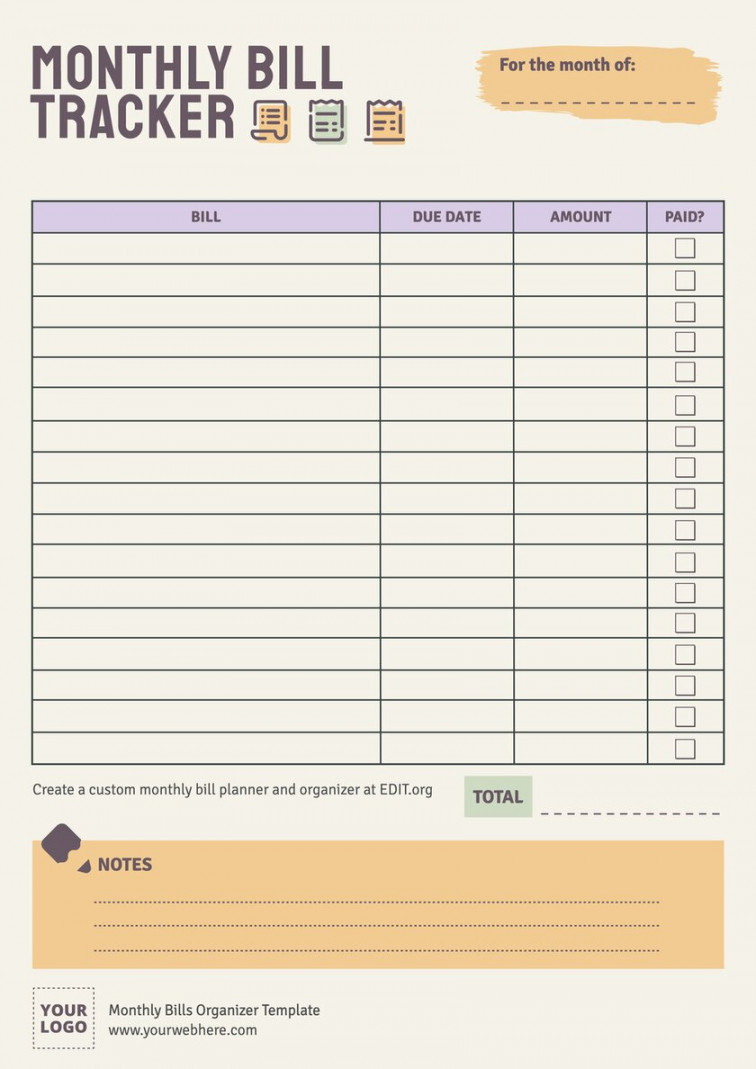

1. Gather your bill information: Scour your emails, bank statements, and any other financial nooks and crannies. List out all your recurring bills, including due dates, amounts, and payment methods.

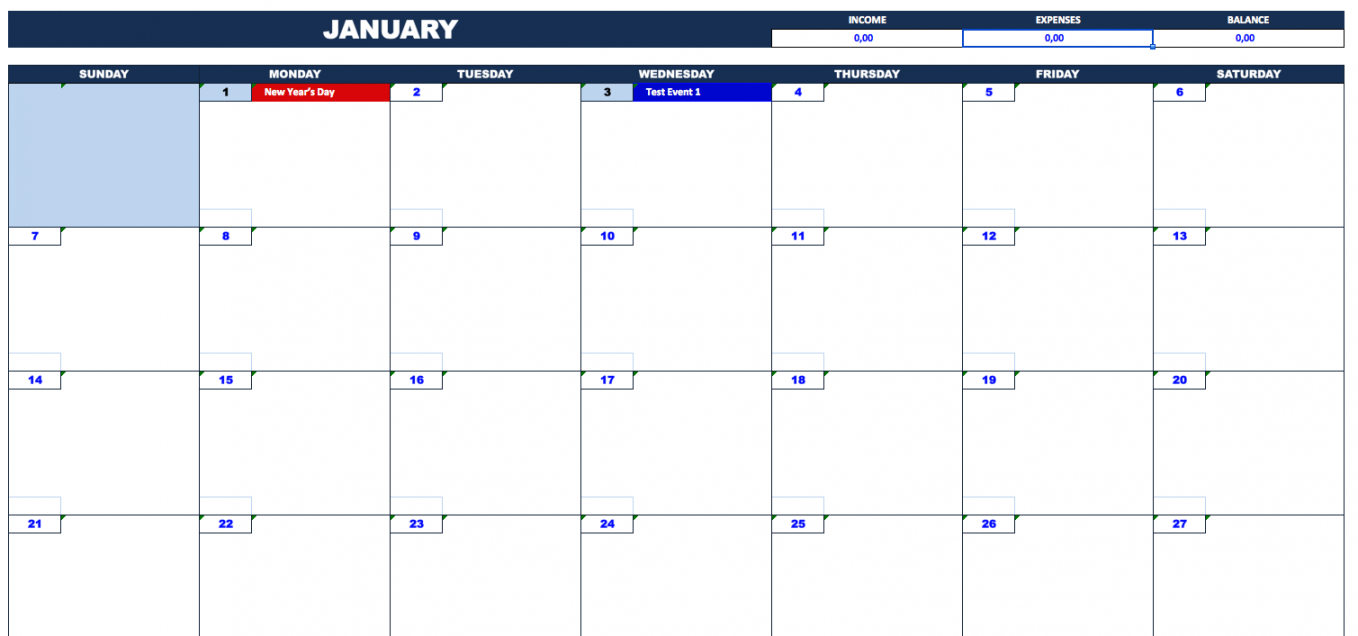

2. Choose your template: Head online or dive into your favorite spreadsheet software. There are countless free and paid templates available, so find one that fits your style and needs.

3. Populate your calendar: Plug your bill information into the template, ensuring each bill has its designated spot. Color-code categories, highlight important dates, and make it your own!

4. Schedule your payments: Once your calendar is complete, schedule your bill payments in advance. Set reminders, automate recurring payments, and savor the sweet freedom of knowing you’re never late again.

5. Stay consistent: Treat your calendar like your financial gospel. Update it regularly, track your spending, and celebrate your budgeting victories!

Identify spending patterns: Tracking your bills over time reveals where your money goes, allowing you to identify areas for potential savings or adjustments.

1. Q: Which template platform is best? A: The best platform depends on your personal preferences and technical skills. Try out different options like Google Sheets, Excel, or even printable templates to find your perfect fit.

2. Q: Can I include non-bill expenses? A: Absolutely! Add recurring expenses like groceries, gas, or gym memberships to gain a holistic view of your financial landscape.

3. Q: What if I have irregular bills? No problem! Most templates allow you to add custom rows or sections for sporadic expenses.

4. Q: How can I automate my bill payments? Many banks and bill providers offer automated payment options. Link your accounts to your calendar and enjoy the ultimate hands-free budgeting experience.

5. Q: I’m overwhelmed with debt. Can this calendar help? Absolutely! Tracking your debt payments alongside your bills can help you develop a strategic debt repayment plan. Remember, even small steps can lead to significant financial progress.

So, what are you waiting for? Embrace the power of the monthly bill payment calendar template and watch your financial worries melt away!