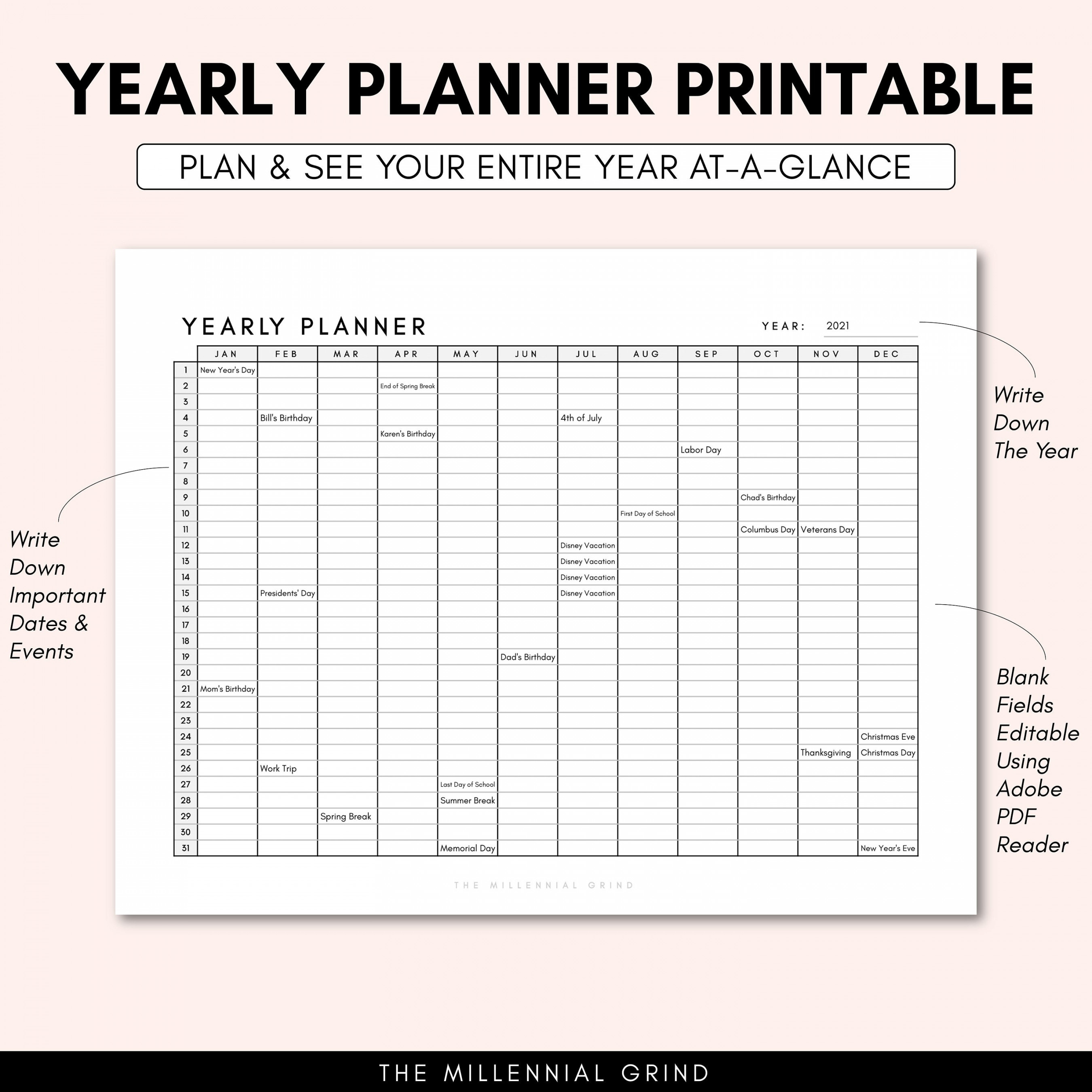

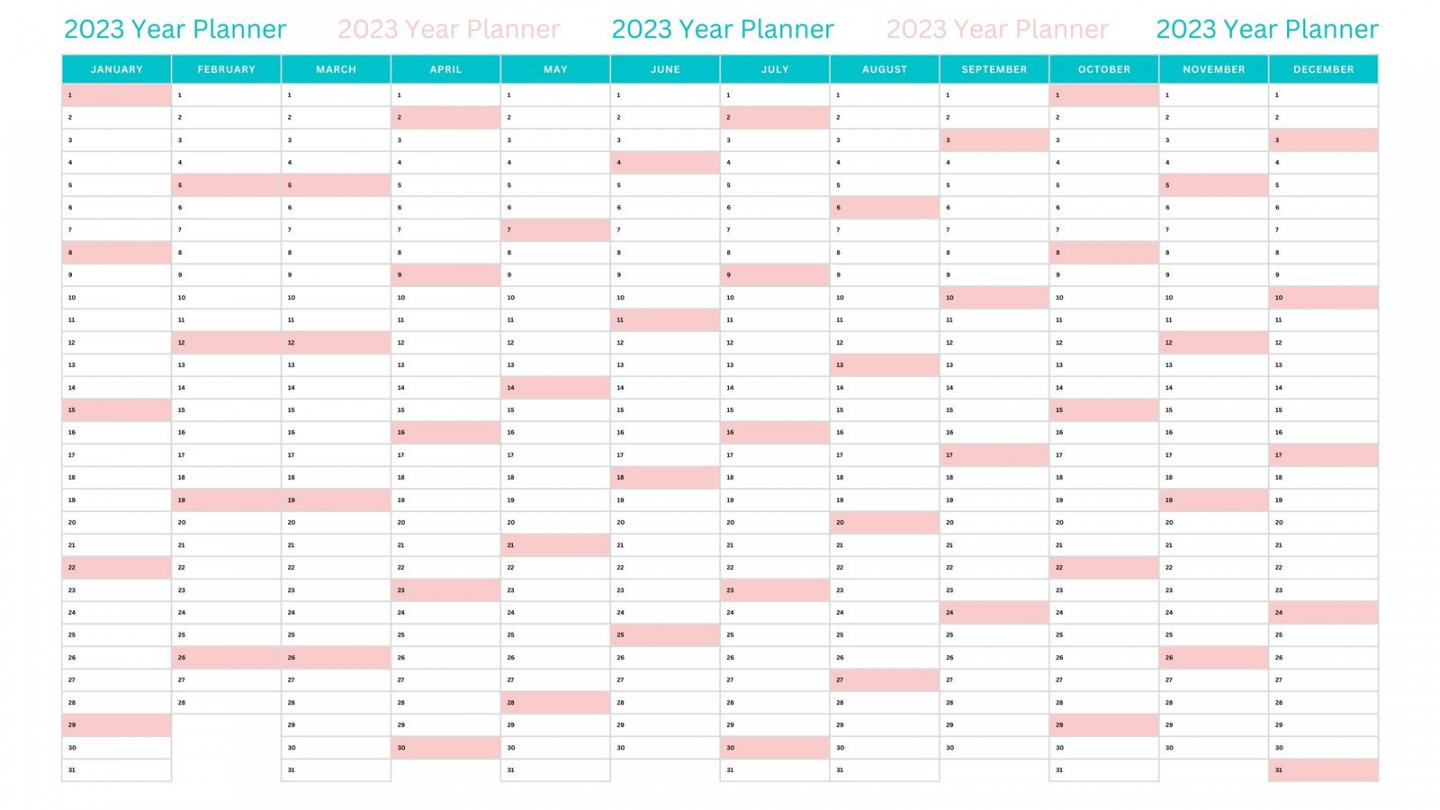

Yearly Planning Calendar Template For -2019

New Year’s Planning for Business Owners

At the beginning of every new year, it’s a good idea for business owners to take time to sit down and do a little planning, to make sure they can keep their company afloat and on the right course going forward.

Doing so can help ensure that your business has the necessary tools to meet its financial and operational goals and that your valued employees will be content with their working environment and unlikely to jump ship.

Read on for some tips on a smooth planning process for your digital presence, vendors, equipment, employees, insurance, and retirement plans.

Key Takeaways If you own a business, do some financial housekeeping at the beginning of each year to prevent unexpected money needs where possible.To avoid unpleasant surprises, make sure that your insurance policies and employee benefits program are on track and not set to lapse.Evaluate your staffing, vendor, and marketing efforts to keep up with your competitors.Consider the broader economy and determine whether factors such as labor market conditions or the pace of inflation require any changes on your part. 1. Consider Your Digital Footprint Set up a Business Website

If you want to compete, especially with the big names, you need a presence online and in social media. Begin by planning a website for your business, if you don’t already have one. How complex it has to be and how much traffic you need to generate will determine whether you can set it up yourself or should hire a professional to do it for you.

Here’s a basic checklist for this task:

Select and purchase a recognizable domain name that customers can connect easily with your business.Determine whether you should share a host with other small websites, employ a managed hosting service for larger businesses, or set up your own dedicated server.For your budget, remember to build in costs for website maintenance and marketing.Develop a marketing plan to ensure that—once you have your website up and running—it will draw visitors. Develop a Social Media Presence

These days a social media presence for your business is essential. If you’re not already, become familiar with platforms such as Facebook, Instagram, X (formerly Twitter), Snapchat, LinkedIn, Pinterest, YouTube, and TikTok.

Try to define the audiences that they serve and select those that match your customer profile. For example, certain age groups may focus on Facebook while others may prefer TikTok. Most platforms will offer advertising kits, demographic data, and more to those interested in using their sites for sales and marketing purposes.

If you’re unsure of how or where to start building your social media presence, there are services that can assist you. You can also hire individuals or firms to help you maintain that presence if that’s not your strong suit or you simply don’t have the time to devote to the effort.

If you decide to be hands-on, create a social media team within your company to plot your online strategy for reaching potential patrons. This team should define your audience and its interests and how to reach it with existing content or newly created content. Blogging, vlogging (video blogging), and podcasts are just some of the ways to market your business and reach prospects and customers.

2. Vendors

Every business owner should periodically review their vendors and suppliers to make certain that they are receiving the competitive prices and quality service that they need. The beginning of the year may be the best time for such a review.

In many cases, vendors will be working on their own budgets for the year, looking to pin down business, and open to cutting deals to ensure that they achieve their quarterly and annual financial objectives.

With that in mind, business owners should ask themselves the following questions:

Do current vendors charge reasonable rates?Do they provide excellent service and adapt to the changing needs of my business?Should I establish relationships with any new vendors or suppliers?Does it make sense to try out a new vendor with a small order?Would trying out a new vendor provide my business with leverage over an existing vendor?

Business owners with an eye on their bottom line want to know whether they’re getting the best possible products and services at the lowest possible prices. The first few months of the year are an opportune time to take stock of this.

3. Equipment

Manufacturing companies and many service-related businesses depend on machinery, supplies, and a variety of other equipment to operate. However, many business owners are so focused on day-to-day activities that they forget to make sure they have what they need to operate smoothly and grow their enterprise.

Early in the first quarter is a good time to evaluate equipment needs and to determine whether any new capital investments are in order. This type of planning can ensure that your company is always properly equipped to capitalize on business opportunities. It can also help you allocate needed cash or arrange for borrowing.

Here are some questions to consider for equipment needs:

Does the business have the equipment necessary to succeed and profit over the long haul? If not, can existing equipment last another year, and can the business sustain itself using it? What will new equipment cost and where can you obtain quotes for it? Does the company have the cash on hand or the ability to finance such purchases, or will the money need to come from future operational cash flow? Are there any expenses that could be cut in order to offset and help justify such expenditures? 4. Employees

Your planning should also consider your staffing needs. It’s advantageous to uncover any deficiencies early on in the year, so that you can make the appropriate adjustments.

Also, bear in mind that finding, hiring, and training the right person can take a lot of time. So it helps to get started as soon as possible. That can be especially true when a low unemployment rate and hot job market mean that potential employees may receive multiple job offers.

Finally, it’s important to realize that many employees ponder their own futures at the end of the year. They may start thinking about whether they intend to stay with your company or move on. If they choose the latter, you’ll want to be ready to deal with the consequences.

5. Insurance

Though the old adage says that the best defense is a good offense, sometimes the best offense is a good defense. Simply put, insurance coverage is a business necessity.

At the beginning of the year, new rates for health insurance, business liability insurance, automobile insurance, umbrella policies, and other types of insurance tend to go into effect, so it’s an opportune time to go quote shopping.

Be sure to consider the following questions about your insurance:

Is the company adequately covered by liability insurance and does it have adequate fire and health insurance? Are insurance companies running multiple policy bundling deals at the beginning of the year in order to win your business? Are there any new insurance carriers that might be able to provide competitive quotes? Has your company taken on any new assets or business interests that haven’t been accounted for and protected by existing policies? 6. Retirement Plans

Businesses that want to set up a 401(k), simplified employee pension (SEP), or other retirement plan should do so as early as possible during the year. Setting up a plan early can permit employees to take full advantage of their annual allowed pretax contributions and the tax advantage offered by qualified retirement plans. The longer their money can grow on a tax-deferred basis, the larger the nest egg they can potentially accumulate.

Reviewing the various plans, selecting an investment firm, and actually setting up a plan doesn’t happen overnight. Getting an early jump on these efforts makes sense.

Here are some questions that can assist your planning:

What will it cost to administer the plan?How many employees might benefit from and want to take advantage of the plan?How much, if anything, will the company need to contribute to the plan?Are there any advantages to setting up one type of plan over another based on costs, the firm’s size, and employees’ retirement needs?Which type of plan or combination of plans will best meet your own retirement needs? Why Is Planning at the Start of a New Year a Good Idea?

Fiscal years often begin with the new year, so reevaluating and making any necessary changes at that point gives you the maximum benefit across the next 12 months. It also gives participants in retirement plans the opportunity to maximize their savings.

Which Areas of My Business Should I Look at?

Six important areas to consider are your online and social media presence, vendors, equipment, staffing needs, insurance, and retirement plans.

How Will Rising Inflation Affect My Business Outlook?

No one knows for sure whether inflation will rise or fall. But you’ll want to factor it into your financial planning. Among other things, inflation could affect your borrowing costs, the prices you pay for supplies, and the salary expectations of your employees. You’ll also need to weigh whether to raise your own prices and by how much, as well as the potential impact that might have on the demand for your products or services.

The Bottom Line

Business owners should continually evaluate their businesses and make adjustments accordingly. However, from a number of angles—such as insurance, retirement plans, staffing, vendors, and equipment needs—the beginning of a new year is a particularly opportune time to examine aspects of your business and plan decisively.