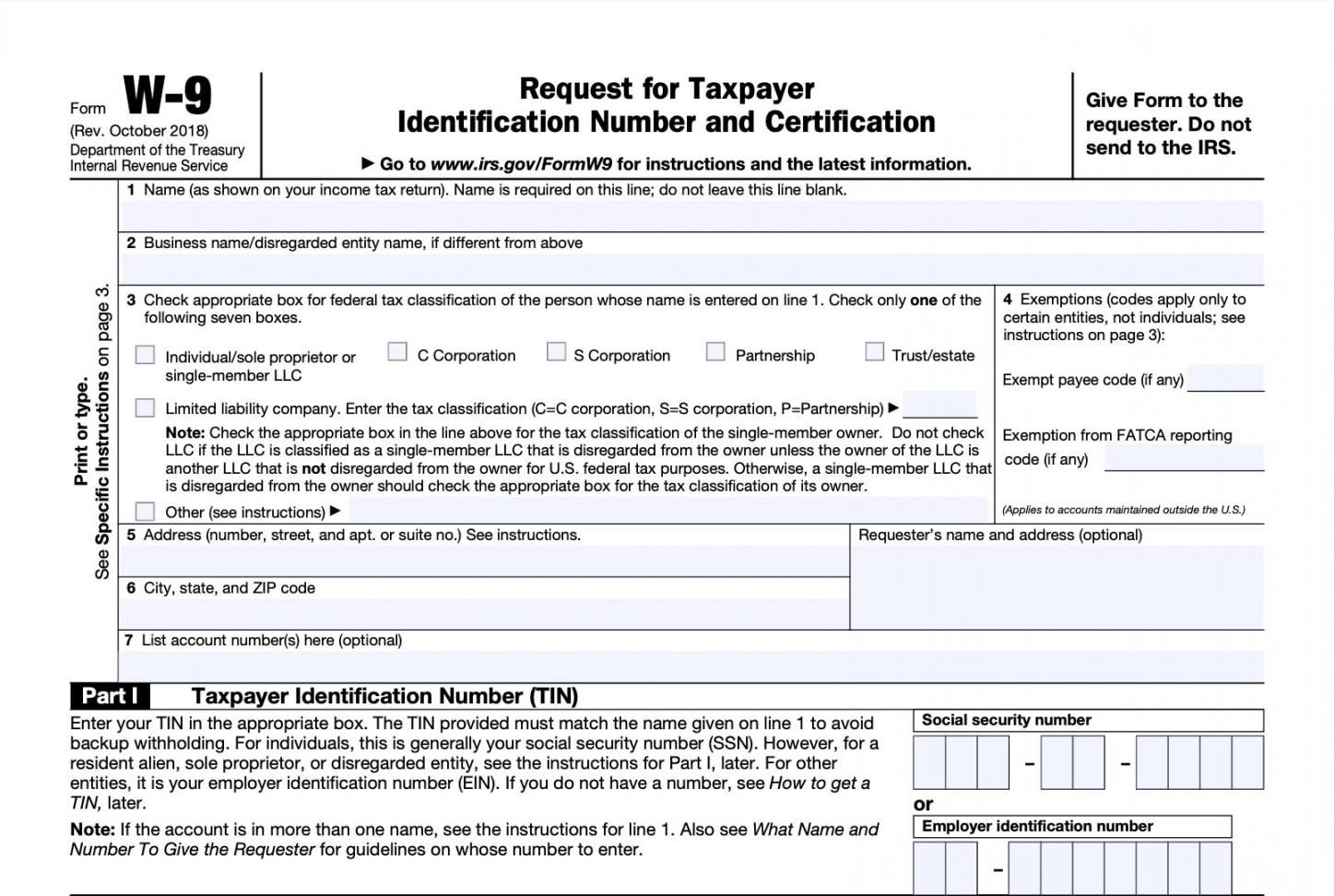

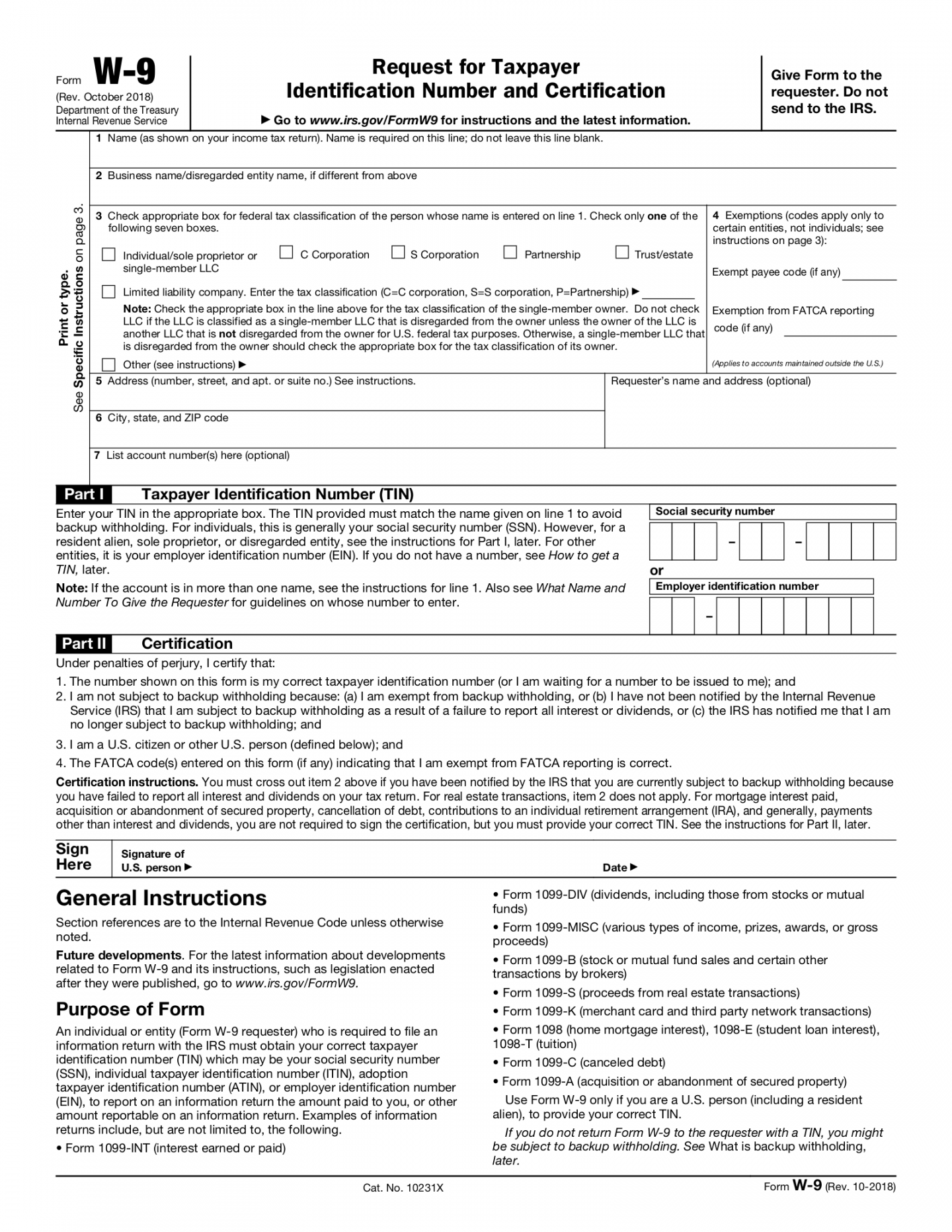

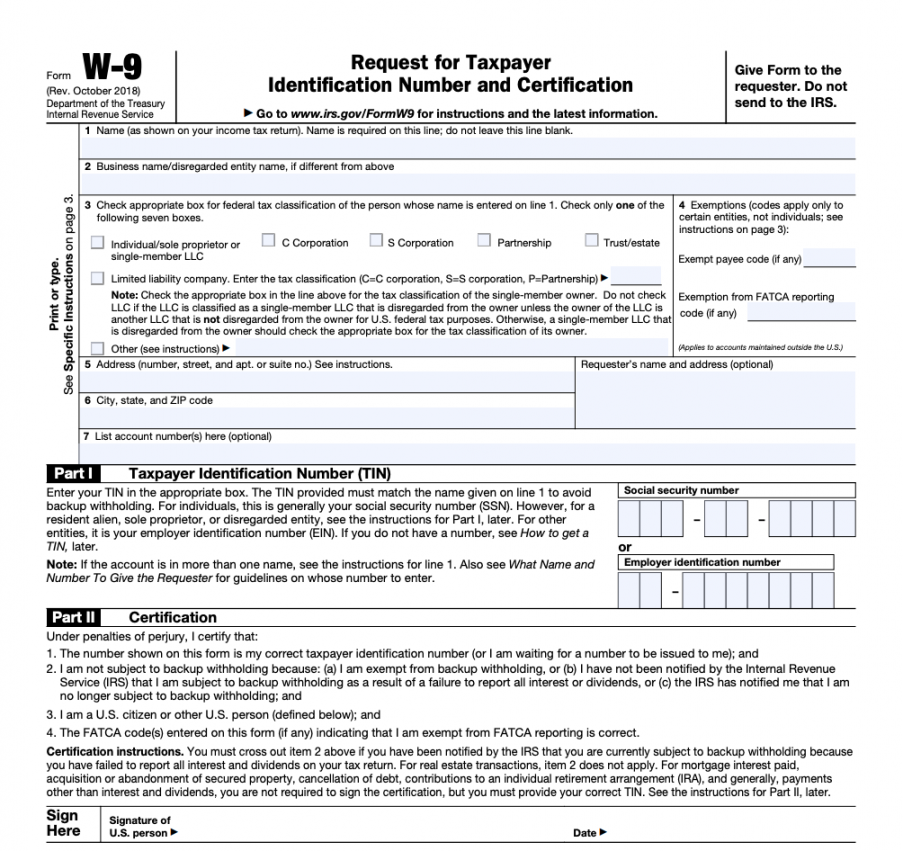

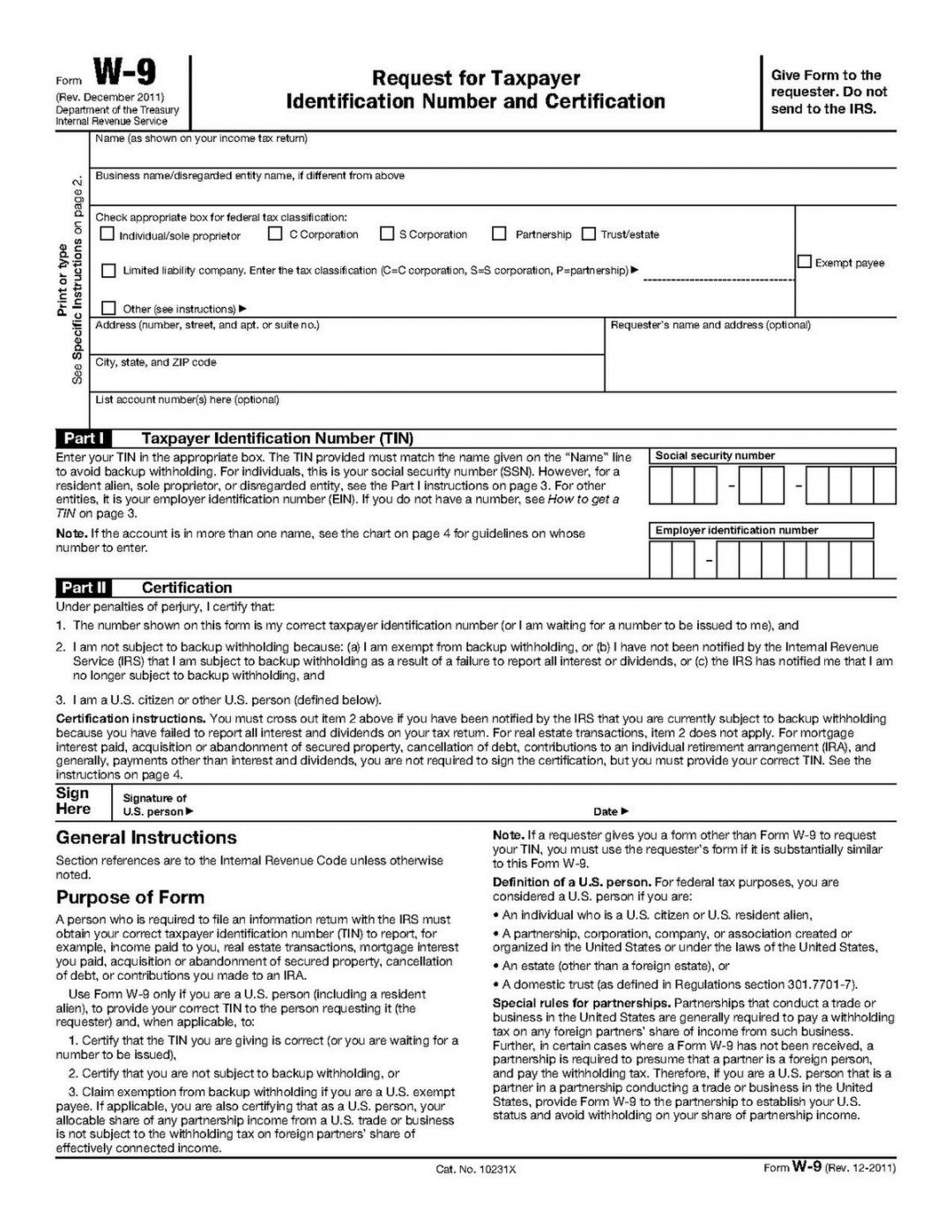

Form Irs W 9

How Are W-9 and 1099-Misc Related?

Cam Merritt is a writer and editor specializing in business, personal finance and home design. He has contributed to USA Today, The Des Moines Register and Better Homes and Gardens”publications. Merritt has a journalism degree from Drake University and is pursuing an MBA from the University of Iowa.